Welcome to the March issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

The number of completed merger reviews through the end of March (59) is 16 per cent higher than the number of completed reviews through the same period in 2020 (51) and 31 per cent higher than the number of completed reviews through the same period in 2019 (45), suggesting that merger activity (in terms of the number of reviews completed by the Bureau) continues to increase following the significant reduction in merger activity resulting from COVID-19 observed in 2020 (particularly in the second quarter and through the summer months).

Competition Bureau to review the proposed acquisition of Shaw by Rogers.

New fee remission policy and 2021 adjustment to filing fees for Competition Bureau merger reviews come into effect.

The Government of Canada updated its Guidelines on the National Security Review of Investments under the Investment Canada Act.

Merger Monitor

March 2021 Highlights

27 merger reviews completed

Primary industries: manufacturing (37 per cent); mining, quarrying and oil and gas extraction (19 per cent)

Zero consent agreements (remedies) filed

19 transactions received an Advance Ruling Certificate (70 per cent), while eight transactions received a No Action Letter (30 per cent)

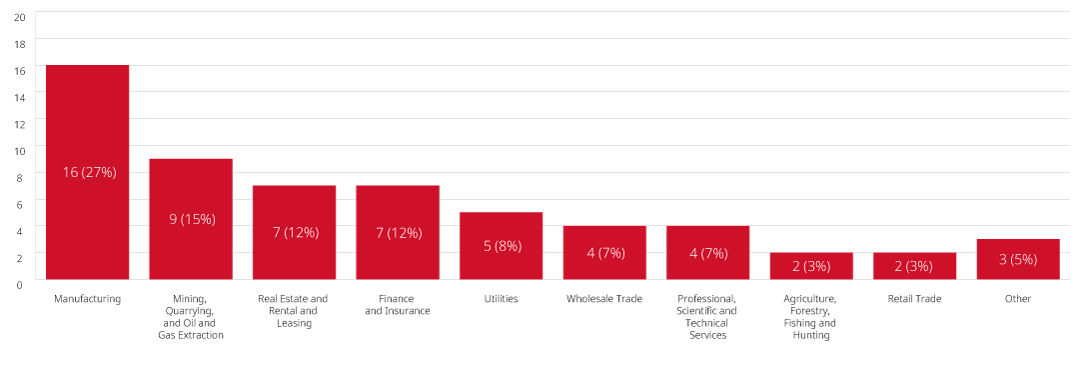

January – March 2021 Highlights

59 merger reviews completed

Primary industries: manufacturing (27 per cent); mining, quarrying and oil and gas extraction (15 per cent); real estate and rental and leasing (12 per cent); finance and insurance (12 per cent); and utilities (eight per cent)

Zero consent agreements (remedies) required

38 transactions received an Advance Ruling Certificate (64 per cent), while 21 transactions received a No Action Letter (36 per cent)

.jpg)

Merger Enforcement

Competition Bureau to review the proposed acquisition of Shaw by Rogers

On March 15, 2021, Rogers announced that it has signed a deal to acquire Shaw Communications in a transaction valued at C$26-billion. In a news release on the same day, the Bureau said that it will review the proposed transaction.

Parties file written submissions on the 1991 MEGs following a direction to counsel in the Parrish & Heimbecker Case

On April 7, 2021, the parties filed their written submissions on the 1991 Merger Enforcement Guidelines (MEGs). The Competition Tribunal’s Panel issued a direction to counsel last month inviting both parties to provide submissions they may have on the 1991 MEGs. The Panel had examined the 1991 MEGs and noted that one of the issues in dispute in the present matter (the “value-added” approach to determining the price of a product) was the subject of a specific reference in the 1991 MEGs.

Misleading Advertising Enforcement

Certification criteria met in Bergen v. WestJet Airlines Ltd. class action

- On March 3, 2021 the British Columbia Supreme Court published additional reasons to its January 6, 2021 decision where the court found that the plaintiff had not met the requirement that the pleadings disclose a cause of action with respect to a violation of section 54 of the Competition Act (double ticketing). In its January decision, the court provided the plaintiff leave to propose new amendments in order to address deficiencies in her pleadings, which the plaintiff has since provided along with brief written submissions. Thus, the court is now satisfied that the proposed amendments will move the litigation forward as they all now relate to a section 54 offence and a cause of action under section 36.

Bid-Rigging Enforcement

Multiple companies and their owners charged with conspiracy to commit fraud and rig bids for condo refurbishment contracts in the GTA

- On March 29, 2021 the Bureau announced that it has laid multiple charges under the Criminal Code and the Competition Act against four companies and three individuals in connection with an alleged conspiracy to commit fraud and rig bids for condominium refurbishment services in the Greater Toronto Area (GTA). The Bureau alleges that the accused conspired to commit fraud and rig bids for refurbishment contracts issued by private condominium corporations in the GTA between 2009 and 2014.

Non-Enforcement Activity

Competition Bureau joins multilateral working group on analysis of pharmaceutical mergers

- On March 16, 2021, the Bureau announced that is has joined its counterparts in the United States, the United Kingdom and the European Union in launching an international working group to develop updated approaches for analyzing the effects of pharmaceutical mergers. The working group will examine a variety of issues related to mergers in the pharmaceutical industry, including potential updates and expansion of current theories of harm, the evaluation of the full range of effects of a merger on innovation, as well as potential remedies to resolve emerging concerns.

New fee remission policy and 2021 adjustment to filing fees for Competition Bureau merger reviews come into effect

The Bureau has announced two important updates related to its filing fees for merger reviews which take effect as of April 1, 2021, in accordance with the Service Fees Act. First, the Bureau’s filing fee for merger reviews has decreased to $74,905.57. Second, Innovation, Science and Economic Development Canada’s new Remission Policy, which applies to filing fees for pre-merger notifications and/or ARC requests, also comes into effect.

Competition Bureau sets scope for digital health care market study

On April 8, 2021, the Bureau issued a market study notice (Notice) in relation to its ongoing study (Study) of the health care sector. The Notice presents three broad topics of study: data and information, products and services and health care providers. The Study examines existing or potential impediments to innovation and choice, and possible opportunities for change.

Investment Canada Act

ICA National Security Review Guidelines updated

On March 24, 2021, the Government of Canada (Government) updated its Guidelines on the National Security Review of Investments (Guidelines) under the Investment Canada Act. These Guidelines have been updated to adopt several national security-related measures the Government put in place at the start of COVID-19, explain what may constitute a “sensitive technology”, and add two new relevant factors for national security reviews: critical minerals (including their supply chains) and personal data. For more information, see our April 2021 Blakes Bulletin: New National Security Review Guidelines and Other Important Updates on the Investment Canada Act.

Standing Committee on Industry, Science and Technology issued a report on the ICA

On March 26, 2021, the Standing Committee on Industry, Science and Technology (INDU) issued a report entitled The Investment Canada Act: Responding to the COVID-19 pandemic and facilitating Canada’s recovery (Report). The Report makes nine recommendations to the federal government for a “more cautious, responsive, and transparent approach to regulating foreign investments” through the ICA’s national security and net benefit review provisions. For more information, see our April 2021 Blakes Bulletin: New National Security Review Guidelines and Other Important Updates on the Investment Canada Act.

UK is (again) a trade agreement investor under the ICA

As announced on the Investment Canada website, with the Canada-United Kingdom Trade Continuity Agreement coming into force on April 1, 2021, UK private sector investors will once again benefit from the higher trade agreement investor threshold of C$1.565-billion in enterprise value for net benefit review under the Investment Canada Act.

January 2021 Highlights

Information regarding Investment Canada Act decisions for January 2021 have not yet been published and will instead be included in next month’s Competitive Edge newsletter.

Blakes Notes

For more information on current trends in competition law and the restaurant industry, view the Blakes Competition, Antitrust & Foreign Investment group’s online publication, published on April 5, 2021.

To read more thought leadership insights from the Competition, Antitrust & Foreign Investment group, please click here.

For the latest legal and business updates regarding COVID-19, visit our Resource Centre.

Contact Us

If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2024 Blake, Cassels & Graydon LLP