Welcome to the June issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- Merger review activity continues to be strong, with the number of completed merger reviews through the end of May (92) being 23 per cent higher than the number of completed reviews through the same period two years ago in 2019 (75). When compared to 2020, which saw a reduction in merger activity resulting from the pandemic, completed merger reviews through the first five months of 2021 are 35 per cent higher than the number of completed reviews through the same period in 2020 (68).

- Competition Bureau holds Competition and Growth Summit

Merger Monitor

May 2021 Highlights

- 13 merger reviews completed

- Primary industries: manufacturing (31 per cent); mining, quarrying and oil and gas extraction (31 per cent); and retail trade (23 per cent)

- Zero consent agreements (remedies) filed

- 11 transactions received an Advance Ruling Certificate (85 per cent), while two transactions received a No Action Letter (15 per cent)

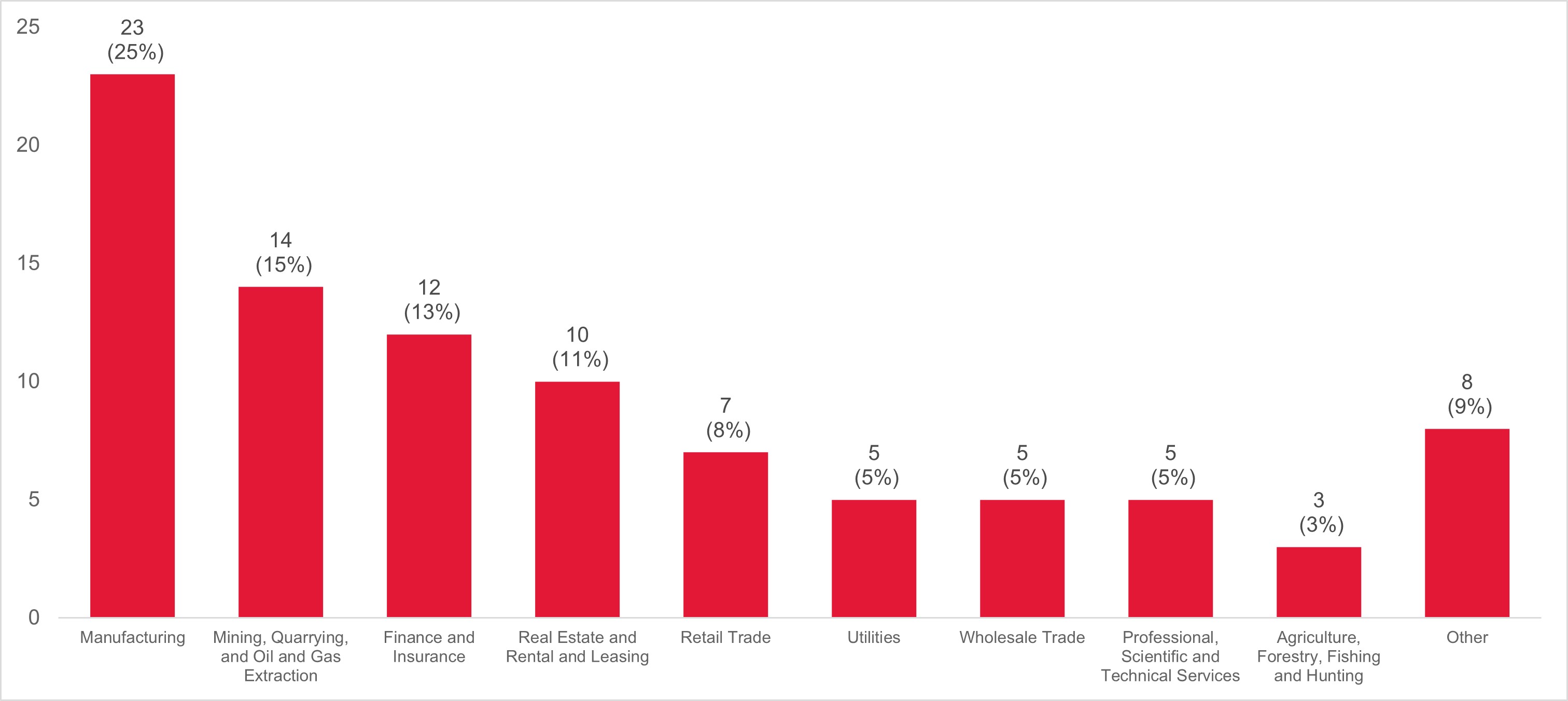

January – May 2021 Highlights

- 92 merger reviews completed

- Primary industries: manufacturing (25 per cent); mining, quarrying and oil and gas extraction (15 per cent); finance and insurance (13 per cent); and real estate and rental and leasing (11 per cent)

- Zero consent agreements (remedies) filed

- 64 transactions received an Advance Ruling Certificate (70 per cent), while 28 transactions received a No Action Letter (30 per cent)

.jpg)

Speeches/Events

Competition Bureau holds Competition and Growth Summit

- From June 1 to June 3, 2021, the Competition Bureau held its virtual Competition and Growth Summit featuring domestic and international experts, including the Honourable François-Philippe Champagne, Minister of Science, Innovation and Industry, Senator Colin Deacon and U.S. senator Amy Klobuchar, among others. Panelists highlighted the importance of antitrust enforcement, increasing the availability of private actions, and promoting competition among small and medium businesses as a driver of Canada’s economic recovery from COVID-19. Senator Klobuchar also discussed her Competition Antitrust Law Enforcement Reform Act which is currently being reviewed in Congress and which proposes broad changes to U.S. antitrust law.

Investment Canada Act

February/March 2021 Highlights

- For non-cultural investments: zero reviewable investment approvals and 157 notifications filed (121 for acquisitions and 36 for the establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (57 percent), UK (seven per cent), France (six percent), and Germany (six percent)

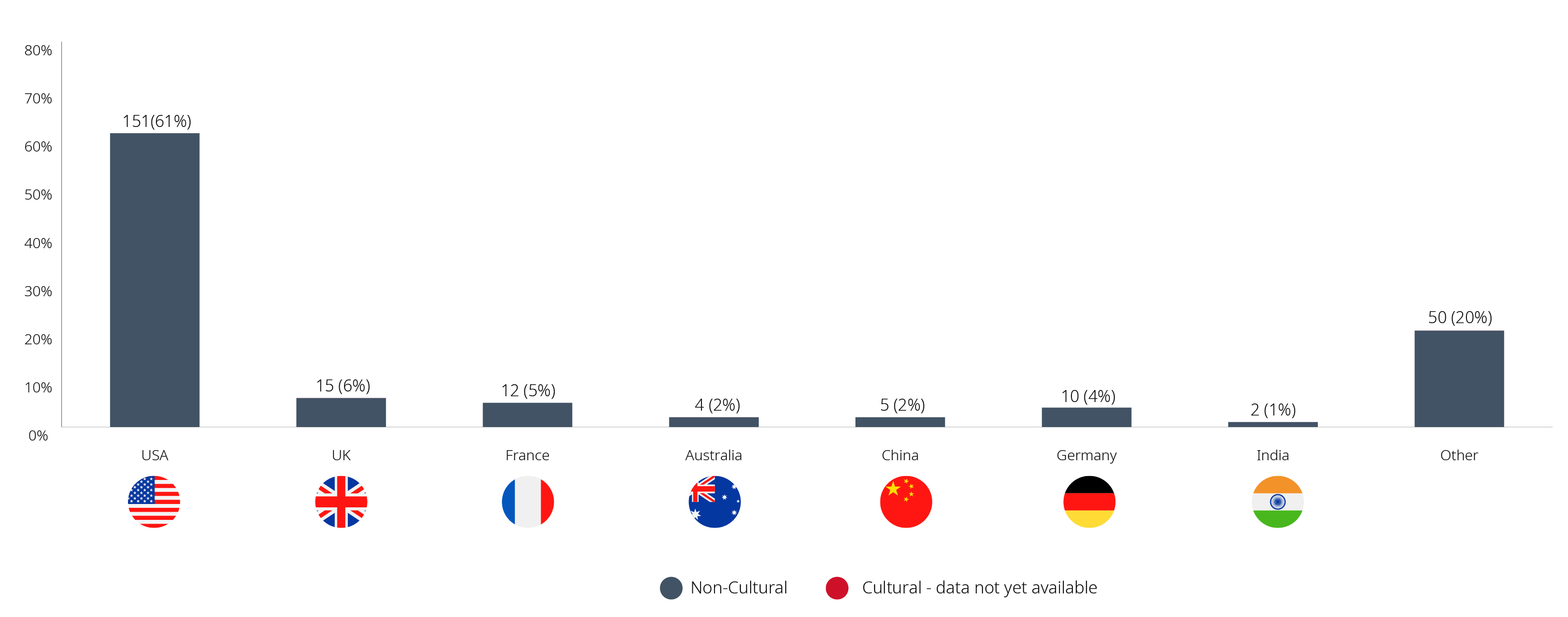

January – March 2021 Highlights

- For non-cultural investments: zero reviewable investment approvals and 249 notifications filed (191 for acquisitions and 58 for the establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (61 percent), UK (six per cent), France (five per cent), and Germany (four per cent)

Blakes Notes

- To read more thought leadership insights from the Competition, Antitrust & Foreign Investment group, please click here.

- For the latest legal and business updates regarding COVID-19, visit our Resource Centre.

Contact Us

If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2024 Blake, Cassels & Graydon LLP