Welcome to the March issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

Merger review activity in 2022 has been slower than in the past two years; the number of completed reviews through the end of February (22) was 31 per cent lower than the number of completed reviews through the same period in 2021 (32) and 39 per cent lower than the number of completed reviews through the same period in 2020 (36).

The Competition Bureau has published its draft Information Bulletin on Transparency, which sets out the Bureau’s approach to communicating with interested parties during an investigation.

The Canadian government has issued a policy statement indicating that it will only permit investments by direct or indirect Russian investors and investments determined to have ties to an individual or entity connected to the Russian state in exceptional circumstances.

Merger Monitor

February 2022 Highlights

13 merger reviews completed

Primary industries real estate and rental and leasing (23 per cent); manufacturing (23 per cent); retail trade (15 per cent); and finance and insurance (15 per cent)

Zero consent agreements (remedies) filed

Nine transactions received an Advance Ruling Certificate (69 per cent), four transactions received a No Action Letter (31 per cent)

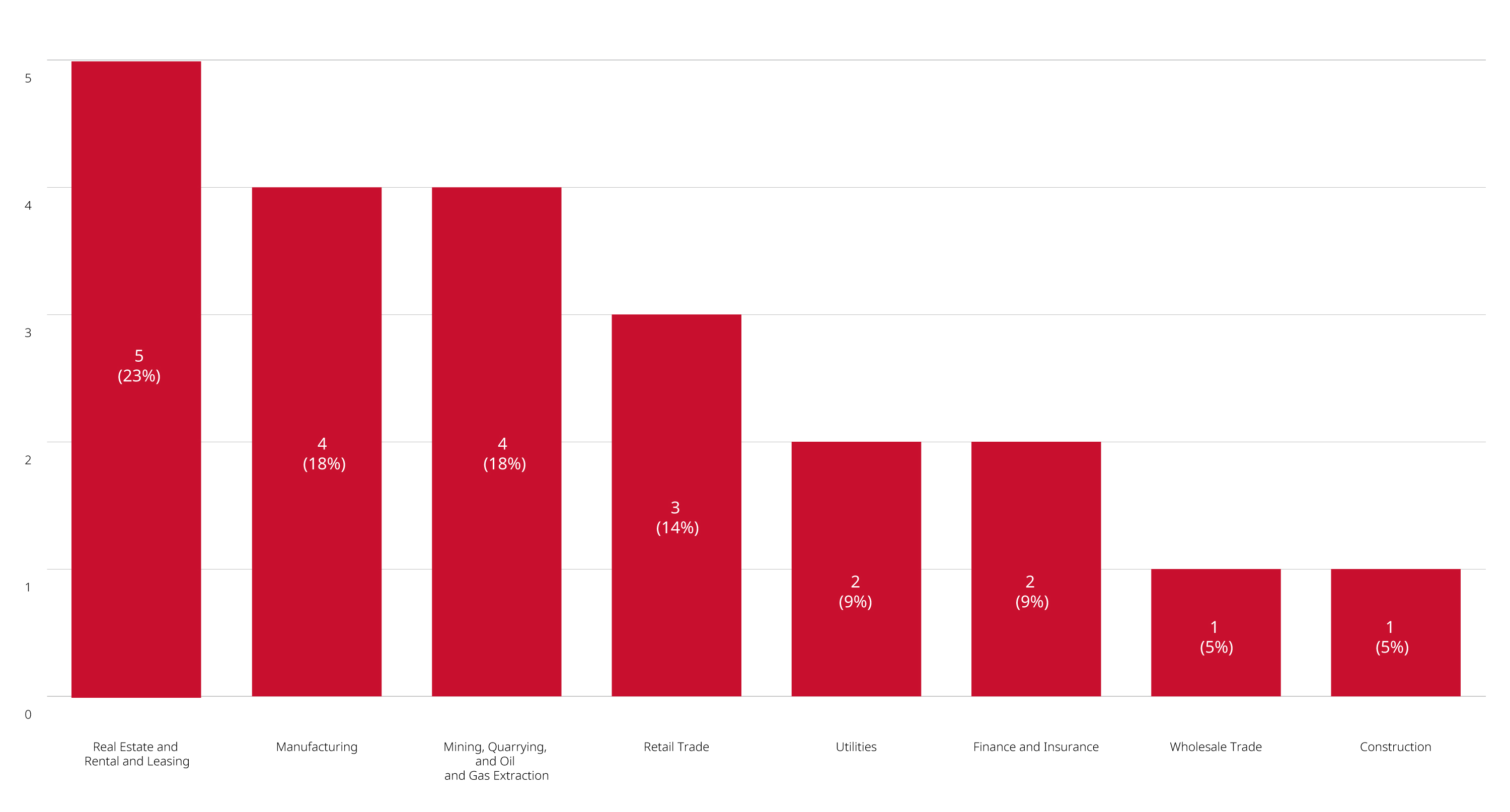

January – February 2022 Highlights

22 merger reviews completed

Primary industries real estate and rental and leasing (23 per cent); manufacturing (18 per cent); mining, quarrying and oil and gas (18 per cent); and retail trade (14 per cent)

Zero consent agreements (remedies) filed

13 transactions received an Advance Ruling Certificate (59 per cent) and nine transactions received a No Action Letter (41 per cent)

Non-Enforcement Activity

Competition Bureau publishes draft Information Bulletin on Transparency

On March 8, 2022, the Competition Bureau published a draft Information Bulletin on Transparency and invited feedback from interested parties. The draft bulletin, which is intended to reflect the evolution in the Bureau’s practices since 2014, highlights differences in the Bureau’s approaches to communicating with persons subject to a merger review or civil investigation, persons subject to a criminal investigation and persons subject to a dual-track investigation. It also explains how the Bureau communicates with lawyers involved in an investigation, complainants, industry participants and the general public. Once finalized, the bulletin will replace the Bureau’s Information Bulletin on Communication during Inquiries, which was published in 2014.

Competition Bureau joins working group targeting collusion in supply and distribution of goods

On February 17, 2022, the Competition Bureau announced that it had joined an international working group focused on sharing information to identify and prevent potentially anticompetitive conduct in the global supply and distribution of goods. The group, which includes the Bureau, the United States Department of Justice, the Australian Competition and Consumer Commission, the New Zealand Commerce Commission and the United Kingdom Competition and Markets Authority, aims to help identify attempts by businesses to use supply chain disruptions as a cover for price-fixing or other collusive activities, in light of pandemic related disruptions to global markets.

Investment Canada Act

Canadian Government issues Policy Statement on Foreign Investment Review and the Ukraine Crisis

On March 8, 2022, the Canadian Government issued the Policy Statement on Foreign Investment Review and the Ukraine Crisis, establishing a new policy for net benefit and national security reviews under the Investment Canada Act for investments by direct or indirect Russian investors or entities associated with the Russian state. Under this new policy, the fact that an investment of any value has direct or indirect ties to an individual or entity associated with, controlled by or subject to influence by the Russian state will support a finding by the Minister of Innovation, Science and Industry that there are reasonable grounds to believe that the investment could be injurious to Canada’s national security and refer the investment under review to the Governor in Council, as set out in Part IV.1 of the Investment Canada Act. Additionally, for the purposes of reviewing foreign investments by direct or indirect Russian investors, the Minister of Industry and the Minister of Canadian Heritage will only find the acquisition of control of a Canadian business to be of net benefit to Canada (and therefore permissible under the Investment Canada Act) in exceptional circumstances. This policy will remain in place until further notice.

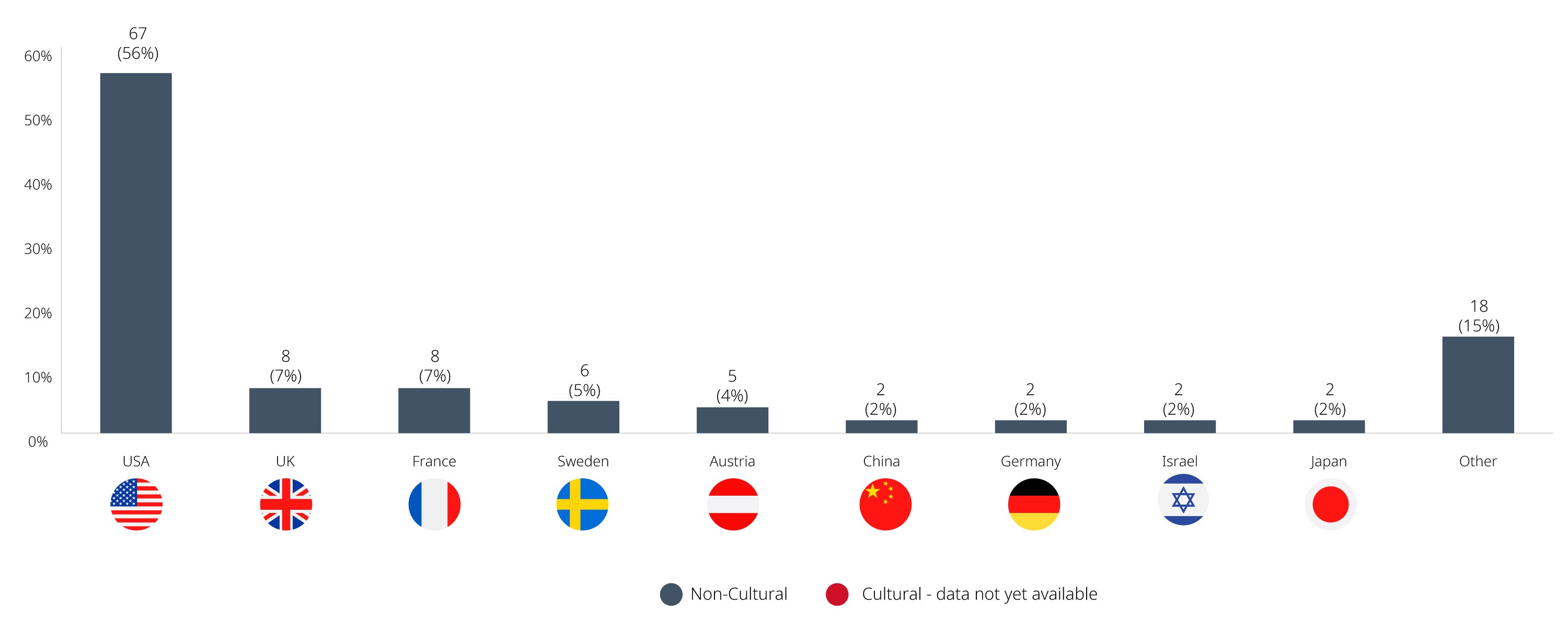

Non-Cultural Investments

January 2022 Highlights

For non-cultural investments: zero reviewable investment approvals and 120 notifications filed (91 for acquisitions and 29 for establishment of a new Canadian business)

Country of origin of investor (non-cultural): U.S. (56 per cent); UK (seven per cent); France (seven per cent); Sweden (five per cent); Austria (four per cent)

Government of Canada confirms thresholds for Investment Canada Act reviews

On February 26, 2022, the Government of Canada published the updated 2022 thresholds for pre-closing review of investments by non-Canadian investors to acquire control of Canadian businesses in the Canada Gazette, confirming the anticipated thresholds released earlier this year.

Blakes Notes

To read more thought leadership insights from the Competition, Antitrust & Foreign Investment group, please click here.

For the latest legal and business updates regarding COVID-19, visit our Resource Centre.

Contact Us

If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2024 Blake, Cassels & Graydon LLP