Welcome to the July issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition and foreign investment law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- Merger review activity in 2025 is up compared to the last two years, with the Bureau completing 102 merger reviews through the end of June, a 10% increase from the 92 completed through June 2024 and a 14% increase from the 88 completed through June 2023. Merger reviews resulting in No Action Letters have also risen to 62%, compared to 57% through June 2024 and 53% through December 2024.

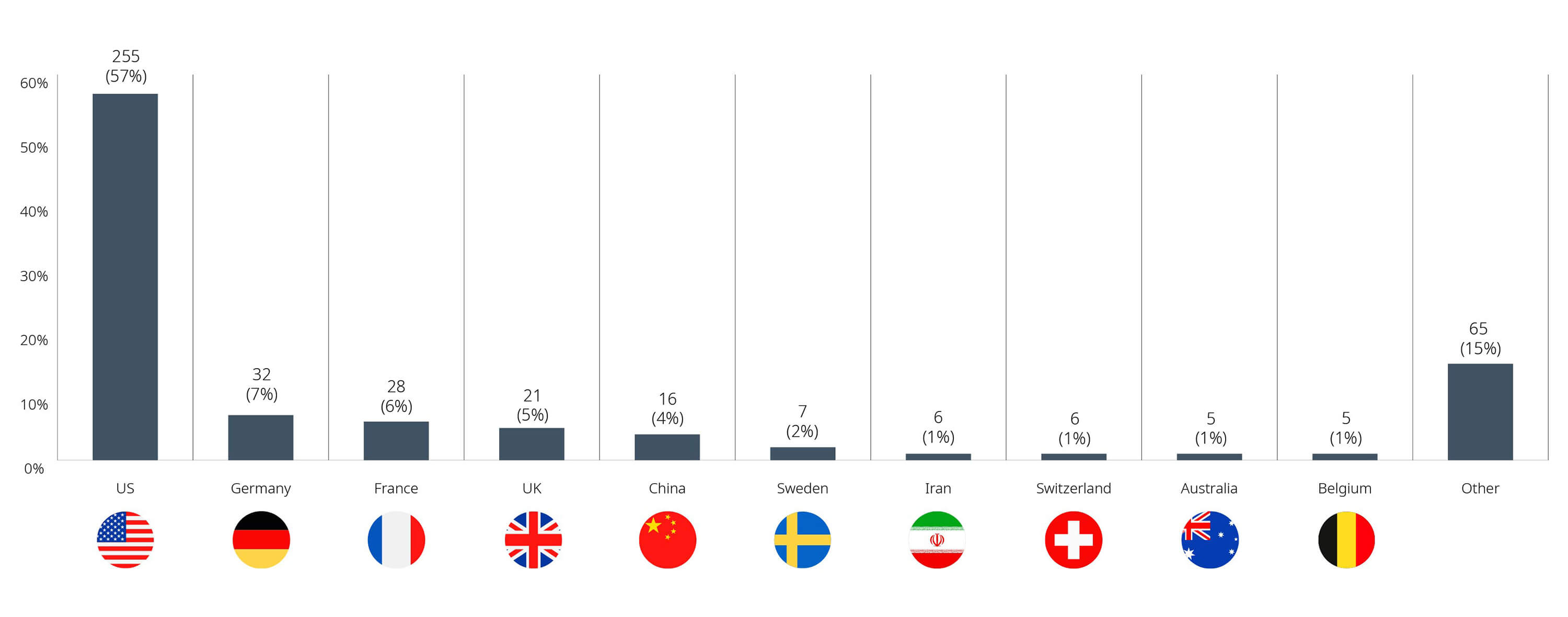

- The United States remains the most common investor country of ultimate control for non-cultural investments, representing 57% of all Investment Canada Act notifications and approved net benefit applications through May 2025. Germany has the second-highest proportion of notifications and approved net benefit applications through May 2025 at 7%, a one-percentage point decrease from 8% through April 2025.

- Canada’s Wonderland responds to the Bureau’s misleading advertising application.

- The Bureau publishes a market study on Canada’s domestic airline industry.

Competition Act

Merger Monitor

June 1 – June 30, 2025 Highlights

- 20 merger reviews announced, 19 merger reviews completed

- Primary industries of completed reviews: mining, quarrying, and oil and gas extraction (37%); real estate and rental and leasing (16%); manufacturing (16%); finance and insurance (11%)

- Thirteen transactions received a No Action Letter (68%), six transactions received an Advanced Ruling Certificate (32%)

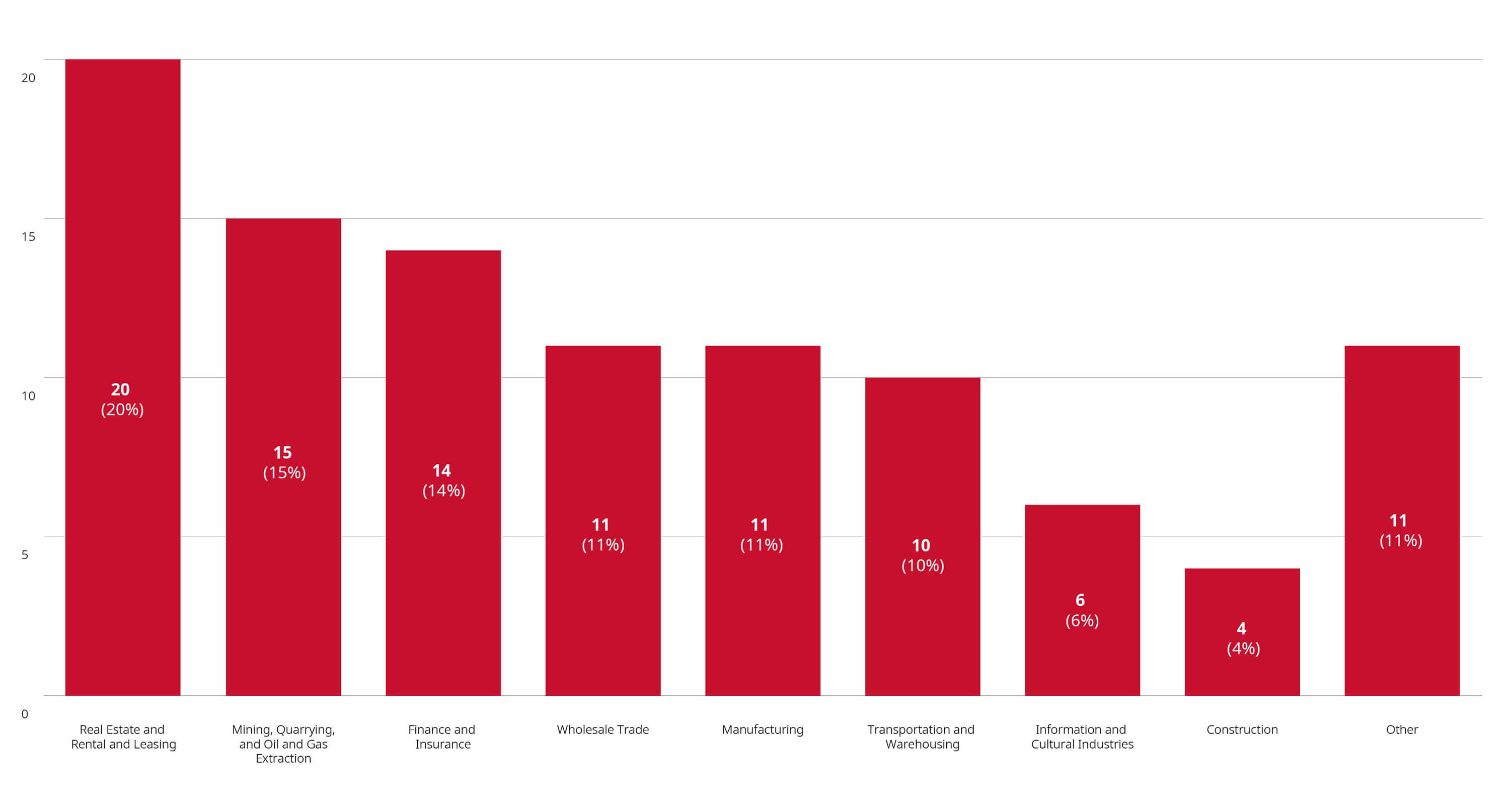

January – June 30, 2025 Highlights

- 104 merger reviews announced, 102 merger reviews completed

- Primary industries of completed reviews: real estate and rental and leasing (20%); mining, quarrying, and oil and gas extraction (15%); finance and insurance (14%); wholesale trade (11%); manufacturing (11%); transportation and warehousing (10%)

- 63 transactions received a No Action Letter (62%); 34 transactions received an Advance Ruling Certificate (33%); four transactions were resolved through other means; one transaction was abandoned by the merging parties

Merger Reviews Completed Year to Date Through June 30, 2025, by Primary Industry

Enforcement Activity

Bureau Obtains Court Order to Advance Investigation Into Amazon’s Marketplace Fair Pricing Policy

- On July 8, 2025, the Bureau announced that it had obtained a court order to advance its ongoing investigation into Amazon’s pricing policies used on its online Canadian marketplace, Amazon.ca, to determine if they constitute an abuse of dominance. The Bureau is investigating Amazon’s Marketplace Fair Pricing Policy, which it alleges allows Amazon to penalize sellers for certain conduct, such as setting prices for a product on Amazon.ca that are significantly higher than recent prices offered on Amazon or elsewhere. In particular, the Bureau is examining whether the Marketplace Fair Pricing Policy (1) allows Amazon to charge higher fees to sellers, and whether this results in higher retail prices; (2) prevents the entry or expansion of existing or potential rivals by preventing sellers from offering lower prices elsewhere than they do on Amazon; or (3) lessens price competition among online marketplaces or retail channels. The court order requires Amazon to produce records and information relevant to the Bureau’s investigation. More information regarding the launch of the Bureau’s investigation into Amazon is available in the Blakes Competitive EdgeTM: September 2020 Update.

Proposed Private Action Against Apple and Google Filed at Competition Tribunal

- On June 20, 2025, Alexander Martin, an independent video game developer filed a notice of application and a memorandum of fact and law at the Competition Tribunal (Tribunal), against Alphabet Inc., Google LLC and Google Canada Corporation (collectively, Google), along with Apple Inc., and Apple Canada Corporation (collectively, Apple) under the abuse of dominance and civil agreement provisions of the Act. Martin alleges that Google’s revenue-sharing agreements (including with Apple) had the effect of entrenching Google’s dominant position within the Canadian search engine market and creating significant barriers to entry for competitors and potential new entrants. On June 30, 2025, the Bureau certified that the subject matter contained in Martin’s application for leave was not the subject of an ongoing inquiry, nor was it the subject of a past inquiry that was discontinued due to a settlement. This is the first private application for leave to be brought to the Tribunal since the Competition Act’s (Act) expanded private access regime came into force. For more information regarding the recent changes to the private access regime, see our June 2025 Blakes Bulletin Canada Expands Private Litigation Regime Under Competition Act: Expanded Scope and New Monetary Compensation.

Bureau Reaches Consent Agreement With Canadian Natural Resources Limited

- On June 20, 2025, the Bureau announced that it had reached a consent agreement with Canadian Natural Resources Limited (CNRL), related to its proposed acquisition of Schlumberger N.V.’s (SLB) interest in the Palliser Block joint venture, through which SLB had interests in 16 natural gas processing plants in southeastern Alberta. The Bureau found that the proposed transaction would likely result in a significant increase in market concentration in the area surrounding three natural gas processing plants located approximately 130 kilometres east of Calgary. To resolve the Bureau’s concerns, CNRL agreed to divest 75% of its interest in the Seiu Lake natural gas processing plant to North 40 Resources Inc.

Canada’s Wonderland Responds to Commissioner of Competition’s Notice of Application

- On June 19, 2025, Canada’s Wonderland (Wonderland) filed a response to the Commissioner of Competition’s (Commissioner) May 5, 2025, notice of application, alleging that Wonderland engaged in drip pricing by improperly disclosing processing fees for online purchases. In its response, Wonderland contended that its price representations were transparent, pro-consumer and compliant with the Act. Among other things, Wonderland argues that (1) the Commissioner misconstrued the drip pricing provisions of the Act to require that a single, all-inclusive price be displayed at the outset of any purchasing process; (2) the processing fee at the core of the proceeding is not fixed, and varies depending on the nature and volume of products purchased; and (3) if found to constitute drip pricing, the representation would not be properly classified as false or misleading, given that the processing fee was repeatedly disclosed to customers throughout the purchasing process. On July 3, 2025, the Commissioner filed a reply to Wonderland’s response that reiterates the allegations made in its notice of application, and asserts that Wonderland has continued to make unattainable price representations since the notice of application’s filing. More information about the Commissioner’s notice of application is available in the Blakes Competitive EdgeTM: May 2025 Update.

Goshen Professional Care Inc. Discontinues Its Application Against the Saskatchewan Health Authority and the Ministry of Health

- On June 20, 2025, the Tribunal issued a direction, noting that Goshen Professional Care Inc. (Goshen), intended to terminate its application seeking leave to bring an application against the Saskatchewan Health Authority (SHA) and the Ministry of Health of Saskatchewan under the refusal to deal and abuse of dominance provisions of the Act. In its notice of application, Goshen alleged that the SHA wrongfully terminated its agreement with Goshen to house individuals in need of long-term care at Goshen’s private care home, which resulted in Goshen being forced into receivership and prohibited from housing new care home residents.

Non-Enforcement Activity

Bureau Publishes Market Study Report on Canada’s Airline Industry

- On June 19, 2025, the Bureau published the results of a market study of Canada’s domestic airline industry. The study describes the state of competition in the industry, including (1) how passengers choose between travel options; (2) how concentration has evolved and how it affects the market; (3) how competition impacts prices; (4) how the dynamics between major carriers are changing; and (5) how new entrants are shaping competition. The study found that despite the recent entry and expansion of new airlines, the domestic market is highly concentrated, with new entrants being unable to effectively compete against industry leaders. The study concludes with recommendations to increase competition in Canada’s domestic airline industry, including through (1) the prioritization of competition in Canada’s aviation policy, including through the review of airline mergers and collaborations; (2) leveraging international capital and experience to strengthen domestic competition, by reducing barriers to foreign ownership; and (3) supporting northern and remote market access to airlines. For more information about the Bureau’s market study powers, see the Blakes Market Studies Toolkit.

Bureau Publishes Revised Bulletin on Private Access to the Competition Tribunal

- On June 20, 2025, the Bureau published a revised draft information bulletin regarding the expanded private access rights to the Competition Tribunal (Tribunal). The expanded private access rights include (1) a broader range of conduct that a private access application can be made for (civil deceptive marketing and collaboration provisions of the Act); (2) a lowered leave threshold; and (3) a new disgorgement remedy for successful private applicants in non-misleading advertising cases. The bulletin provides an overview of how the private access regime works and insight into when the Bureau may become involved in private litigation, namely, if it is in the “public interest.” Additionally, the bulletin sets forth the instances in which the Bureau, in rare cases, may attempt to usurp a private access application, including when in the Bureau’s view (1) the matter would be better handled through public enforcement; (2) the application’s scope is too narrow; (3) the case is better suited to enforcement pursuant to a provision under the Act for which private access is not available; and (4) the plaintiff fails to move expediently. The public is invited to submit feedback on the bulletin by August 19, 2025. For more information regarding the recent changes to the private access regime, see our June 2025 Blakes Bulletin Canada Expands Private Litigation Regime Under Competition Act: Expanded Scope and New Monetary Compensation.

Bureau Publishes Statement Regarding Rental Price Agreements Between Landlords and Property Managers

- On June 25, 2025, the Bureau published a statement indicating that it “is aware that some landlords and property managers may be engaging with their competitors, including through discussion groups on social media.” In its statement, the Bureau notes that agreements between competitors with respect to rental prices (including increases and surcharges), terms of leases (including amenities and services), and restrictions on housing supply by artificially reducing the availability of rental units constitute illegal agreements under the Act. The Bureau suggests that to avoid breaking the law, landlords and property managers should decide on prices, price increases, surcharges and terms of leases independently and that they should explain and negotiate terms of leases exclusively with their tenants.

Investment Canada Act

Foreign Investment Monitor

Cultural Investments

Q1 2025 Highlights

- One reviewable investment approval and two notifications filed (one filed for an acquisition, one for the establishment of a new Canadian business)

- Country of ultimate control: United States (100%)

Non-Cultural Investments

May 2025 Highlights

- 82 notifications filed (64 filed for an acquisition, 18 for the establishment of a new Canadian business)

- Country of ultimate control: United States (67%); United Kingdom (7%); France (6%); Germany (4%); Italy (2%); South Africa (2%); Switzerland (2%)

January – May 2025 Highlights

- One reviewable investment approval and 445 notifications filed (336 filed for an acquisition, 109 for the establishment of a new Canadian business)

- Country of ultimate control: United States (57%); Germany (7%); France (6%); United Kingdom (5%); China (4%)

Investment Canada Act Non-Cultural Investment Filings and Approvals, January – May 2025

Enforcement Activity

Government of Canada Orders Wind-Up of Hikvision Canada Inc.’s Canadian Operations

- On June 27, 2025, the Honourable Mélanie Joly, Minister of Innovation, Science and Industry, announced that the Government of Canada ordered Hikvision Canada Inc. (Hikvision), a Chinese manufacturer of surveillance equipment, to cease all operations in Canada and close its Canadian business. The decision resulted from a multi-step national security review process under the Investment Canada Act. The Government of Canada also prohibited the purchase or use of Hikvision’s products in all government departments, agencies and crown corporations, and announced measures to ensure that legacy Hikvision products are not used by the government moving forward. Hikvision has since announced that it has sought judicial review of the government’s decision.

Blakes Notes

- Browse our thought-leadership insights from the Competition, Antitrust & Foreign Investment group to learn more.

Contact Us

If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Related Insights

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2026 Blake, Cassels & Graydon LLP