Welcome to the October issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition and foreign investment law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- The Bureau has completed more merger reviews year-to-date in 2025 (162) compared to the same period in 2024 (149) and 2023 (138), despite an apparent decline in foreign investment into Canada (with 703 reported filings in 2025, compared to 797 through the same period in 2024). The average length of reviews year-to-date in 2025 was 40 calendar days, up from 36 days in the same period in 2024.

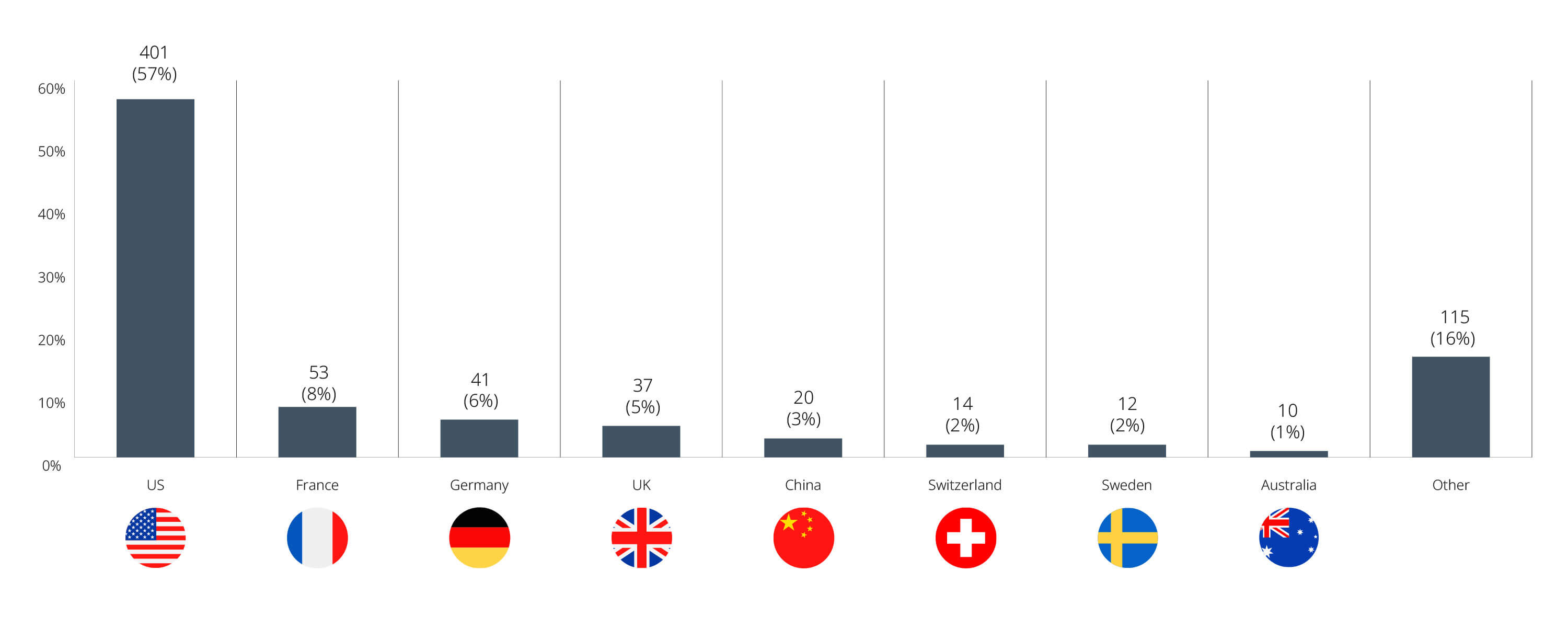

- The United States continues to lead foreign investment into Canada, representing 57% of all reported filings for non-cultural investments through August 2025 (significantly more than second-place France, representing 8% of reported filings).

- The Commissioner of Competition (Commissioner) responds to Google’s constitutional challenge of administrative monetary penalties in abuse of dominance proceedings at the Competition Tribunal (Tribunal).

Competition Act

Merger Monitor

September 1 – September 30, 2025 Highlights

- 24 merger reviews announced; 20 merger reviews completed, with reviews taking 35 calendar days on average

- Primary industries of completed reviews: finance and insurance (15%); manufacturing (15%); construction (10%); mining, quarrying, and oil and gas extraction (10%); utilities (10%); real estate and rental and leasing (10%); wholesale trade (10%)

- Six transactions received an Advanced Ruling Certificate (30%); fourteen transactions received a No Action Letter (70%)

January – September 30, 2025 Highlights

- 171 merger reviews announced, 162 merger reviews completed, with reviews taking 40 calendar days on average

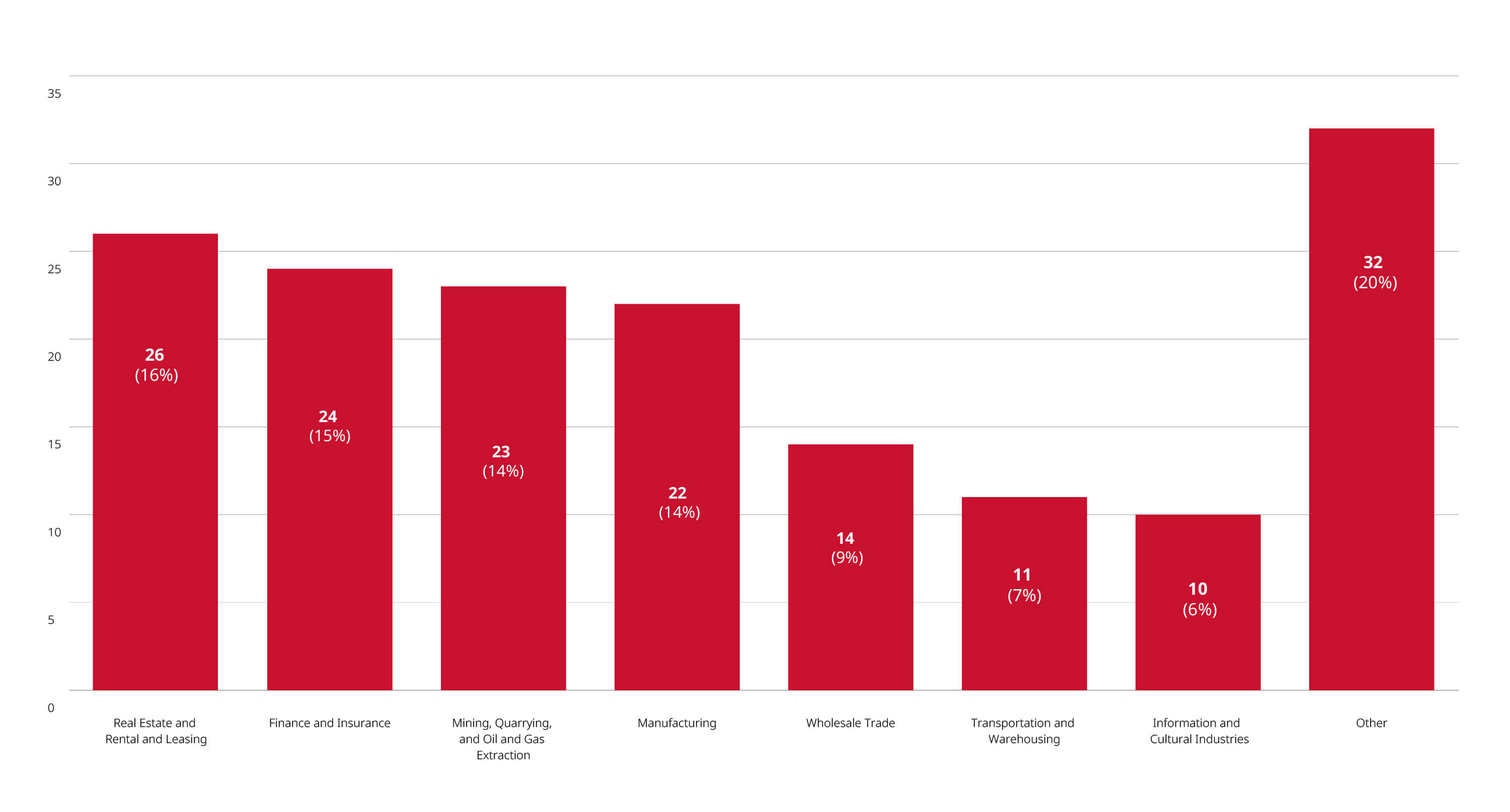

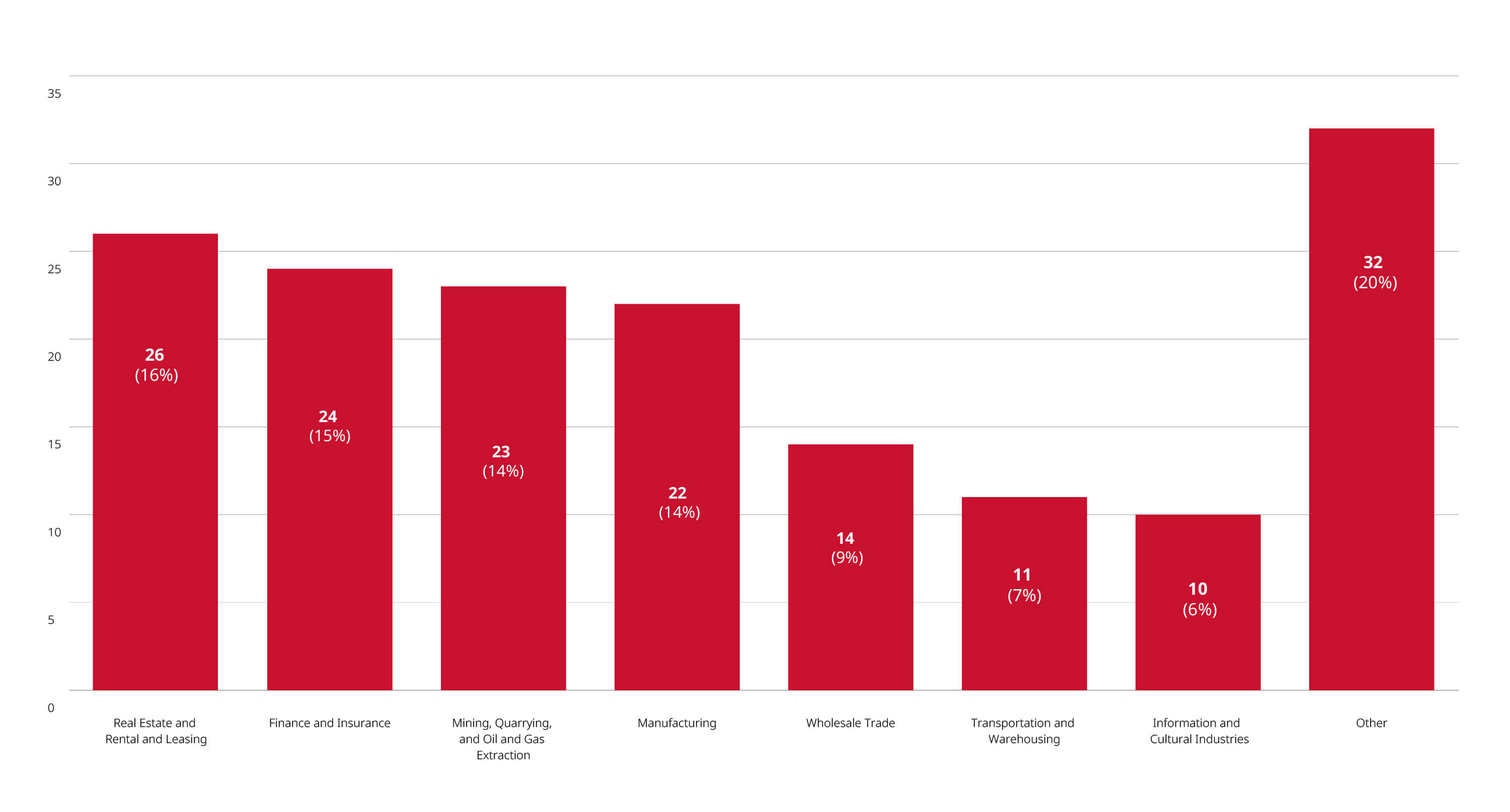

- Primary industries of completed reviews: real estate and rental and leasing (16%); finance and insurance (15%); mining, quarrying, and oil and gas extraction (14%); manufacturing (14%); wholesale trade (9%)

- 96 transactions received a No Action Letter (59%); 59 transactions received an Advance Ruling Certificate (36%); four transactions were resolved through other means; two transactions were resolved via consent agreement; and one transaction was abandoned by the merging parties

Merger Reviews Completed Year to Date Through September 30, 2025, by Primary Industry

Reviews and Enforcement Activity

Reviews and Enforcement Activity

Commissioner Responds to Google’s Constitutional Challenge in Abuse of Dominance Proceedings

- On September 16, 2025, the Commissioner filed a revised memorandum of fact and law with the Tribunal responding to Google LLC and Google Canada Corporation’s (Google) August 22, 2025 memorandum challenging the constitutional validity of certain provisions of the Competition Act (Act) pertaining to the quantum of administrative monetary penalties (AMPs) which Google has alleged constitute a “true penal consequence.” In his submission, the Commissioner asserted that (i) AMPs are issued to promote conformity with the Act, not to punish; (ii) the Tribunal lacks jurisdiction to order an AMP that would constitute a “true penal consequence”; (iii) the test established by the Supreme Court of Canada for whether an AMP constitutes a “true penal consequence” is not met in this case; (iv) the Tribunal’s process meets or exceeds the fairness requirements of the Bill of Rights; and (v) Google’s Charter rights have not been infringed. On September 19, 2025, Google filed a reply memorandum of fact and law rejecting the Commissioner’s arguments and reiterating its previous arguments that the impugned provisions constitute a “true penal consequence.” The constitutional challenge was argued before the Tribunal during the week of September 29, 2025, and the Tribunal has not yet issued its decision. For more information on the abuse of dominance proceedings against Google, see the Blakes Competitive Edge™: September 2025 Update.

Non-Enforcement Activity

Bureau Publishes its Annual Report

- On October 2, 2025, the Bureau published its annual report detailing the Bureau’s enforcement and advocacy activities throughout the 2024–2025 fiscal year ended March 31, 2025. Among other items, the report highlighted the activities of the Bureau’s Behavioural Insights Unit which was established in March 2024 to help the Bureau better understand how individuals and businesses make decisions. Since the unit’s launch, it has supported 25 of the Bureau’s cases and projects, including the launch of a working group at the Organisation for Economic Co-operation and Development (OECD). In addition, the report summarizes key statistics from the Bureau’s Performance Measurement & Statistics Report for the 2024-2025 fiscal year (April 1, 2024 – March 31, 2025), including the following:

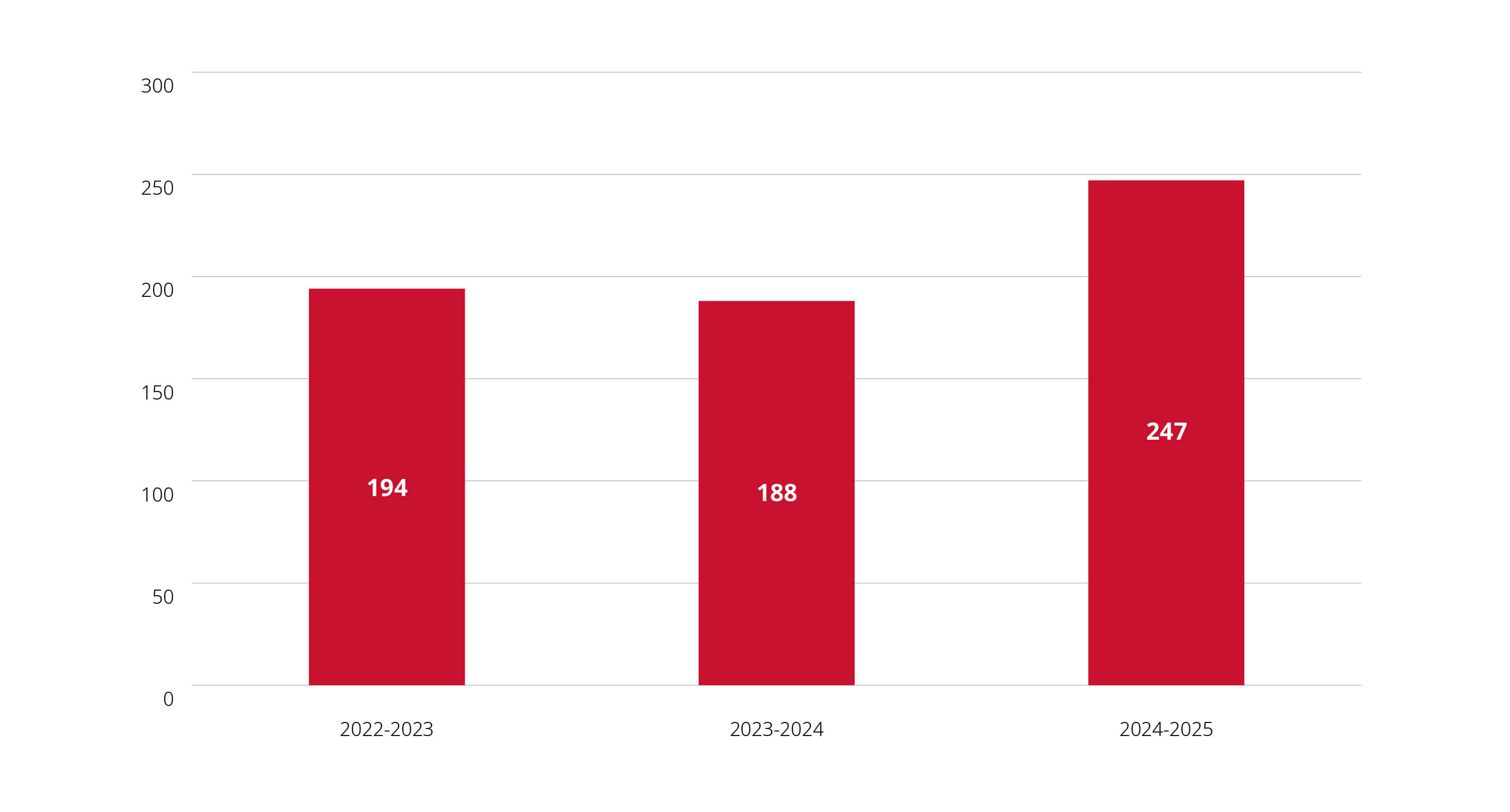

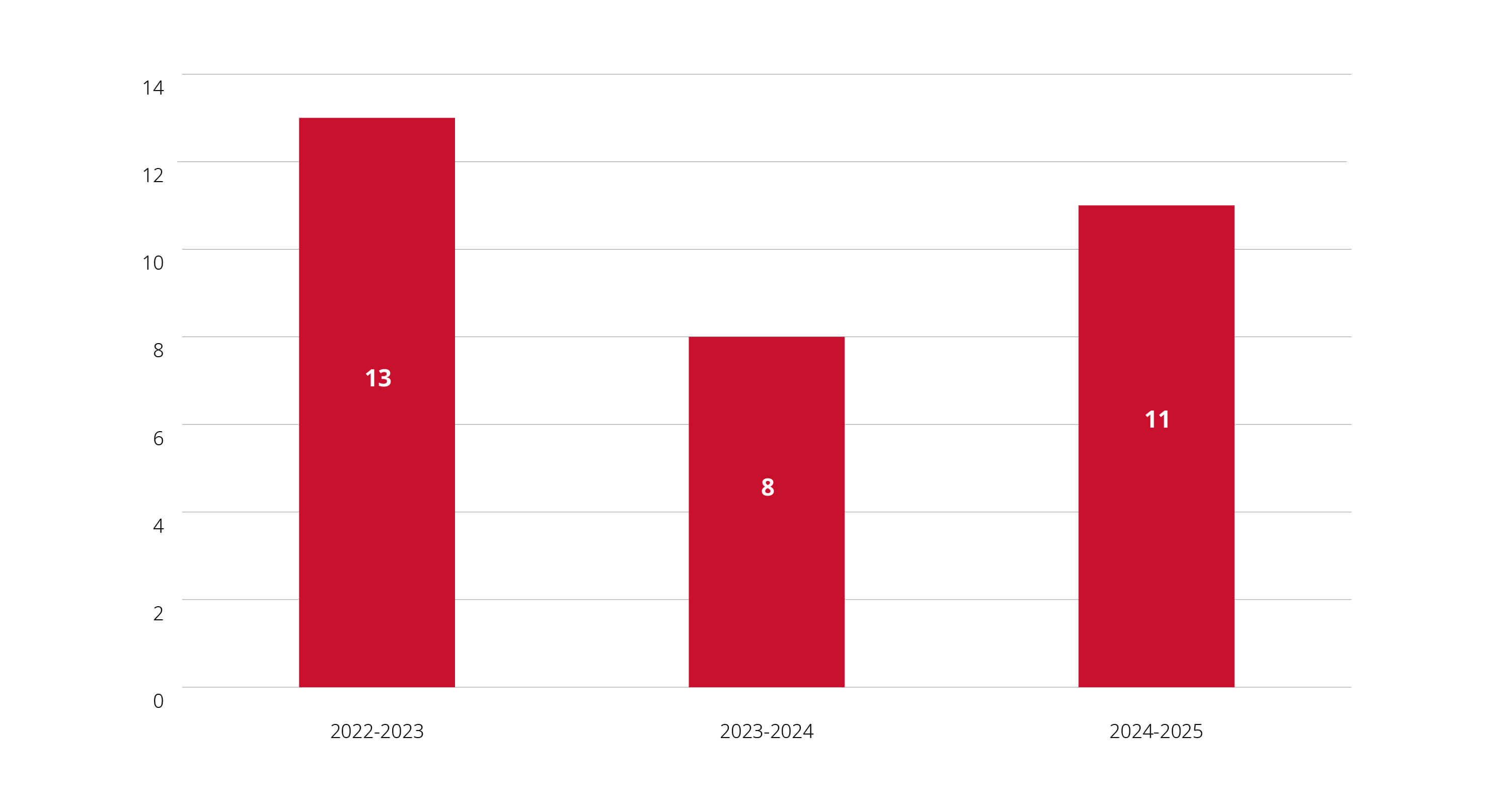

○ The Bureau commenced 253 merger reviews and concluded 237 in 2024-2025, an increase from the 200 reviews commenced and concluded 190 reviews concluded in 2023-2024. Similarly, the number of mergers filed with the Bureau, and the number of Supplementary Information Requests (SIRs) issued by the Bureau increased in 2024-2025:

Pre-Merger Notifications and ARC Requests

SIRS

SIRS

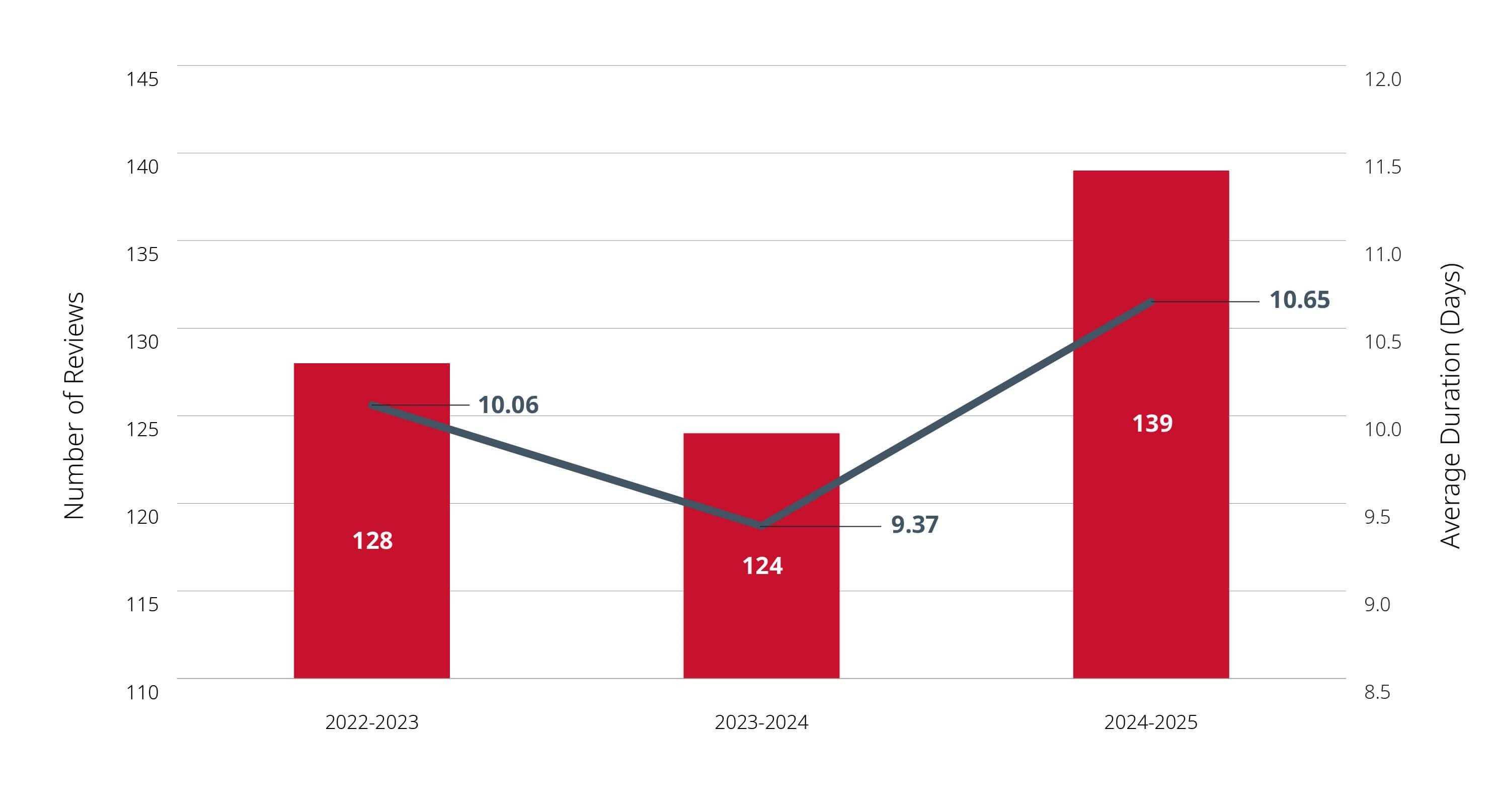

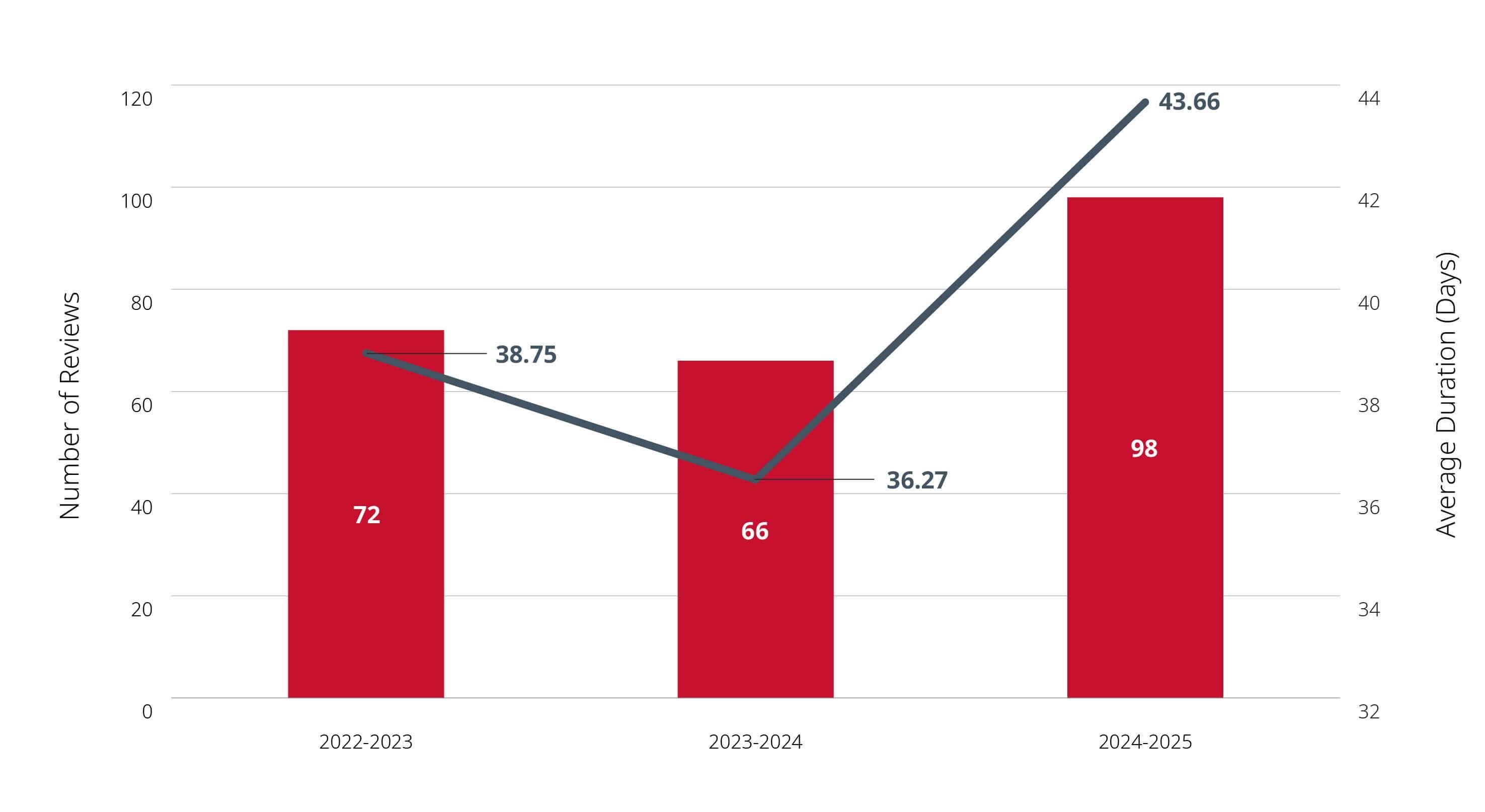

○ 100% of the 139 non-complex merger reviews were completed within the Bureau’s 14-day service standard, with the average review period being 10.65 days. For complex merger reviews, 92% (89) of the 98 complex merger reviews were completed within the Bureau’s service standard (45 days or, where a SIR is issued, 30 days after responses are provided), with the average review period being 43.66 days.

Non-Complex Reviews

Complex Reviews

○ The Bureau entered into three merger consent agreements, a decrease from four in 2023-2024.

○ With respect to non-merger enforcement activity, the Bureau commenced 81 investigations and closed 52, whereas in 2023–2024, 56 investigations were commenced and closed.

○ In 2024-2025, two non-merger matters were concluded with the registration of a consent agreement with the Tribunal, a decrease from four in 2023-2024.

Bureau Hosts G7 Competition Authorities and Policymakers’ Summit

- On October 2, 2025, the Bureau and the Department of Innovation, Science and Economic Development hosted the G7 Competition Authorities and Policymakers’ Summit. The summit focused on digital competition issues, with a particular emphasis on algorithmic pricing. Attendees included competition enforcement and government delegates from the G7 countries, as well as the OECD. The OECD prepared a background report examining emerging risks and enforcement challenges posed by algorithmic pricing across G7 jurisdictions. The G7 countries’ competition authorities also published an updated compendium of approaches to competition in digital markets, which included a submission from the Bureau on its guidance and enforcement activities. The Bureau’s submission also detailed its use of proprietary tools to assess competition, including “Eagle Eye,” a geospatial dashboard used for assessing local market competition, and the “COMPASS” project, a generative AI platform designed to equip the Bureau’s staff with AI tools for sensitive data analysis.

Bureau Hosts Canada’s Competition Summit 2025

- On October 1, 2025, the Bureau hosted “Canada’s Competition Summit 2025: Competition in a new economy.” The Commissioner made opening remarks at the summit, identifying three ways the Commissioner believes competition in Canada can be improved: (1) the breaking down of internal trade barriers; (2) the expansion of international trade opportunities; and (3) the creation of a regulatory environment at each level of government that promotes competition. In her remarks at the summit, Industry Minister Mélanie Joly indicated that Canada would take a whole-of-government approach to promoting competition moving forward.

Canadian Digital Regulators Forum Publishes Paper Exploring Impact of Synthetic Media

- On September 18, 2025, the Canadian Digital Regulators Forum published a paper titled “Synthetic Media in the Digital Landscape” that explores the impact of artificially generated images, video, text or audio content (synthetic media) on Canadians and businesses operating in Canada. The paper includes a contribution from the Bureau on how the use of deepfakes and other synthetic media may contravene the deceptive marketing practices provisions of the Act. The Bureau also provided commentary on the limitations of synthetic media labels in reducing the risk of misleading consumers, stating that: (1) a label’s wording and design may or may not be effective at communicating what is intended (e.g., truthfulness or origin); (2) synthetic media labelling could have the unintended effect of decreasing consumer trust of unlabelled content; and (3) repeated exposure to synthetic media may reduce the effectiveness of any accompanying labels.

Investment Canada Act

Foreign Investment Monitor

Cultural Investments

Q3 Highlights

- One reviewable investment approval and four notifications filed (three filed for an acquisition, one for the establishment of a new Canadian business)

- Country of ultimate control: United States (40%); United Kingdom (20%); India (20%); China (20%)

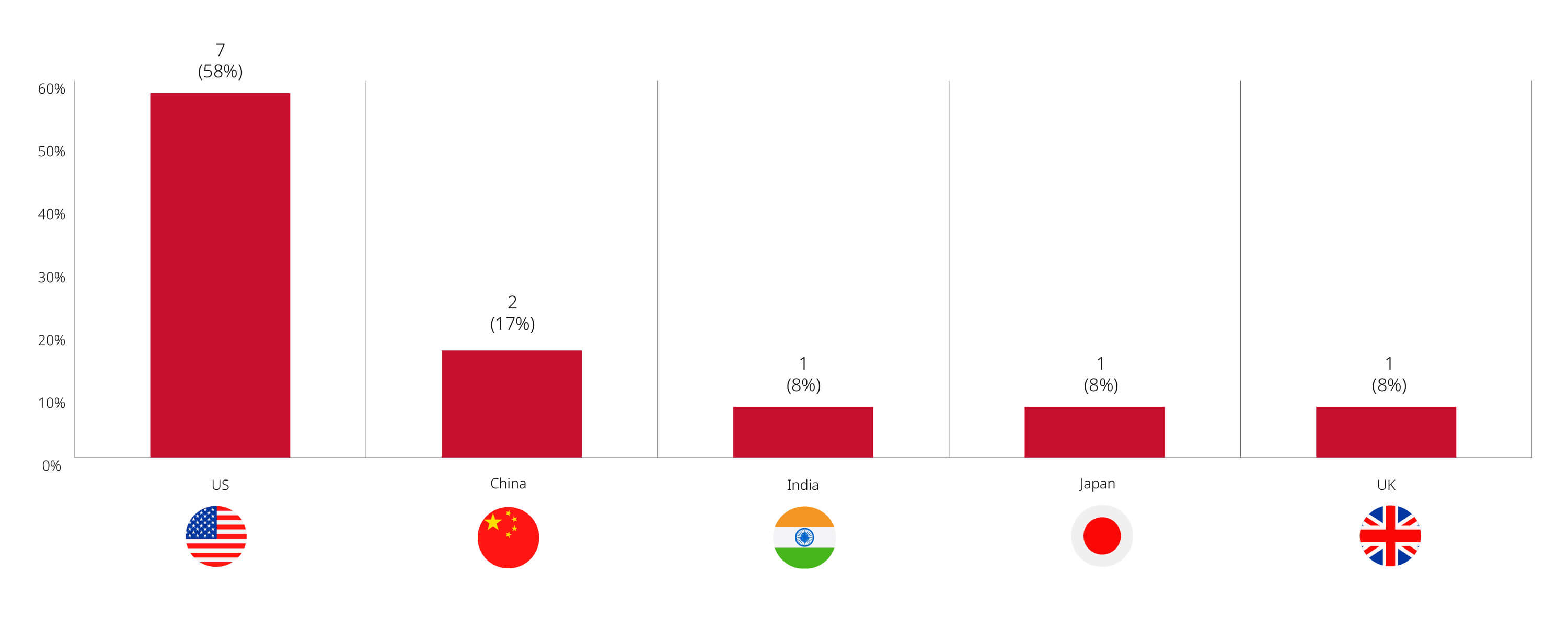

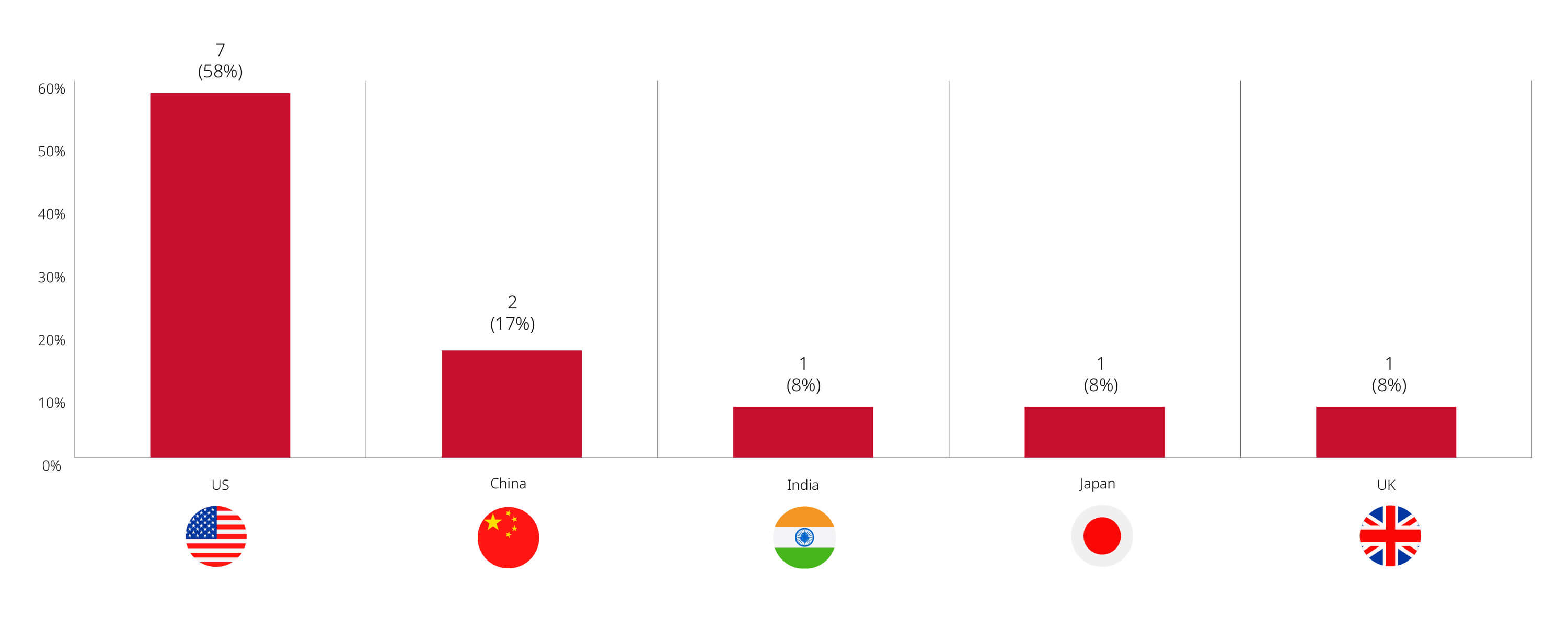

Q1 – Q3 Highlights

- Three reviewable investment approvals and nine notifications filed (six filed for an acquisition, three for the establishment of a new Canadian business)

- Country of ultimate control: United States (58%); China (17%); India (8%); Japan (8%); United Kingdom (8%)

Investment Canada Act Cultural Investment Filings and Approvals, January – September 2025

Non-Cultural Investments

Non-Cultural Investments

August 2025 Highlights

- 85 notifications filed (62 filed for an acquisition, 23 for the establishment of a new Canadian business)

- Country of ultimate control: United States (48%); France (14%); United Kingdom (7%); Australia (4%); Pakistan (4%)

January – August 2025 Highlights

- Two reviewable investment approvals and 701 notifications filed (540 filed for an acquisition, 161 for the establishment of a new Canadian business)

- Country of ultimate control: United States (57%); France (8%); Germany (6%); United Kingdom (5%); China (3%)

Investment Canada Act Non-Cultural Investment Filings and Approvals, January – August 2025

Blakes Notes

- The Competition, Antitrust & Foreign Investment group was once again recognized with a nationwide Band 1 practice ranking in Chambers Canada 2026. Seven partners from the group were recognized, including three ranked in Band 1.

- The Competition, Antitrust & Foreign Investment group was once again ranked #1 in The Globe and Mail’s Report on Business.

- On October 21, 2025, Blakes Partner Julia Potter hosted an episode of the Counterfactual Podcast titled “Barriers at Home: The Case for Interprovincial Free Trade,” featuring Ryan Manucha, an author and expert on interprovincial trade.

- Browse our thought-leadership insights from the Competition, Antitrust & Foreign Investment group to learn more.

Contact Us

- If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Related Insights

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2026 Blake, Cassels & Graydon LLP