Welcome to the September issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition and foreign investment law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- Merger review activity in 2025 has increased compared to the last two years, with the Bureau completing 142 merger reviews through the end of August, an 8% increase from the 131 completed through August 2024 and a 14% increase from the 125 completed through August 2023. The average duration of a merger review in August 2025 was 24 calendar days, a 14% decrease from the 28-calendar-day average in August 2024 and a 25% decrease from the 32-calendar-day average in August 2023.

- Apple, Google and the Commissioner of Competition respond to a proposed private action at the Competition Tribunal.

- The Bureau launches a public consultation for the upcoming small and medium-sized enterprise lending sector market study.

- Under the Investment Canada Act, the United States remains the most common investor country of ultimate control for non-cultural investments, representing 58% of all notifications and approved net-benefit applications through July 2025. France has the second-highest proportion of notifications and approved net-benefit applications through July 2025 at 7%.

- The Government of Canada provides an update on the implementation of amendments to the Investment Canada Act.

Competition Act

Merger Monitor

August 1 – August 31, 2025 Highlights

- 16 merger reviews announced, 16 merger reviews completed

- Primary industries of completed reviews: manufacturing (25%); information and cultural industries (25%); finance and insurance (19%); mining, quarrying, and oil and gas extraction (6%); retail trade (6%)

- Seven transactions received an Advanced Ruling Certificate (44%); nine transactions received a No Action Letter (56%)

January – August 31, 2025 Highlights

- 147 merger reviews announced, 142 merger reviews completed

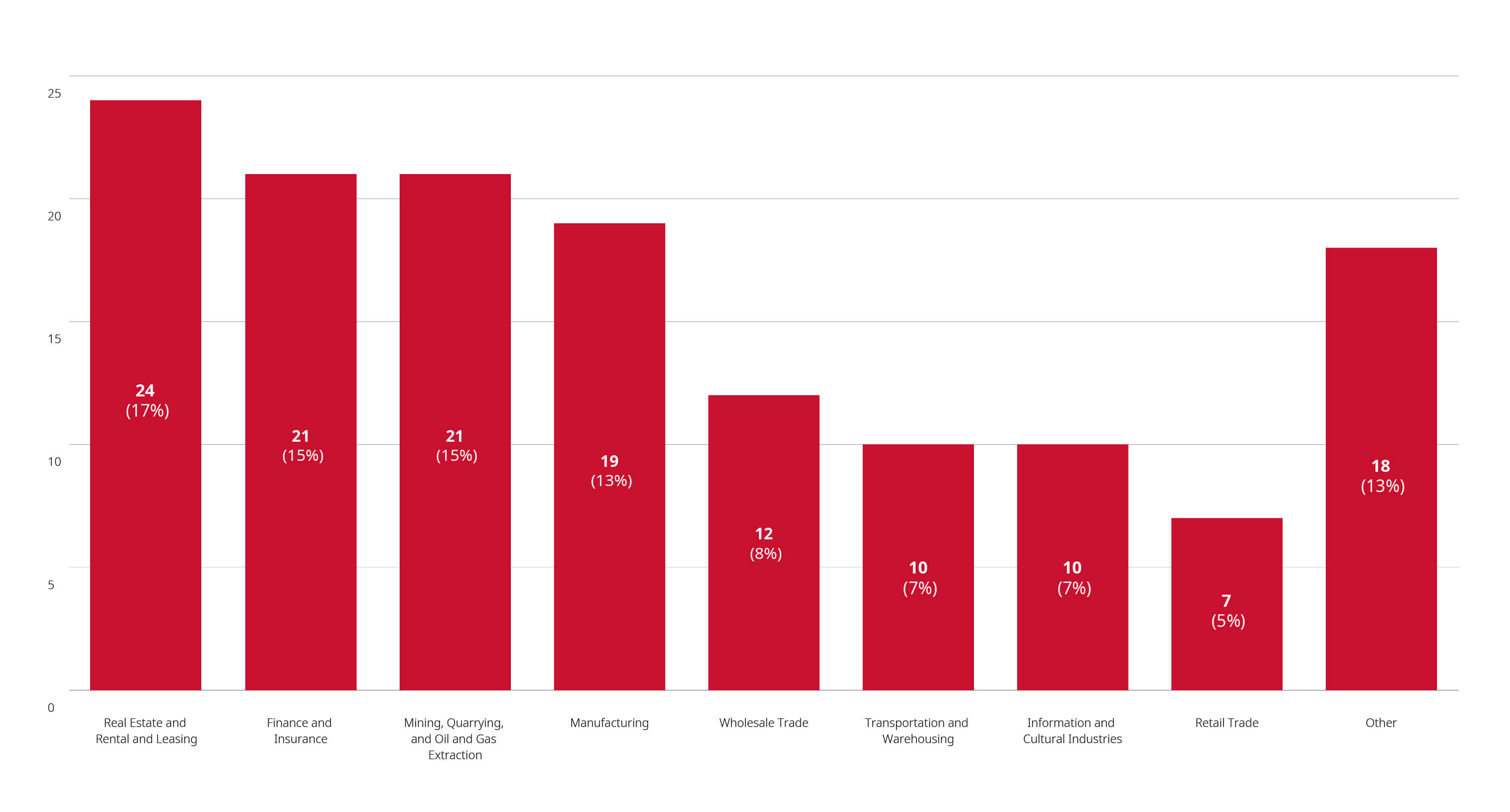

- Primary industries of completed reviews: real estate and rental and leasing (17%); finance and insurance (15%); mining, quarrying, and oil and gas extraction (15%); manufacturing (13%); wholesale trade (8%); transportation and warehousing (7%)

- 82 transactions received a No Action Letter (58%); 53 transactions received an Advance Ruling Certificate (37%); four transactions were resolved through other means; two transactions were resolved via consent agreement; and one transaction was abandoned by the merging parties

Merger Reviews Completed Year to Date Through August 31, 2025, by Primary Industry

Enforcement Activity

Apple, Google and the Commissioner of Competition Respond to Proposed Private Action at Competition Tribunal

- On September 2, 2025, Apple Inc. and Apple Canada Corporation (Apple) and Alphabet Inc., Google LLC and Google Canada Corporation (Google) filed memoranda of fact and law to the Competition Tribunal (Tribunal) in response to a June 20, 2025, leave application where a private applicant had alleged that Google’s revenue-sharing agreements (including with Apple) breached the abuse of dominance and civil agreement provisions of the Competition Act (Act). In its representations, Apple argued that (1) the applicant failed to present cogent evidence to suggest that the civil agreement provisions of the Act had been breached by the revenue-sharing agreements, (2) the applicant’s primary public interest concern of privacy falls beyond the scope of the Act, (3) the proposed proceeding engaged the “double jeopardy” rules found in section 90.1(10) of the Act, which prohibits parallel proceedings from being commenced under section 90.1 where a proceeding based on section 45 has already commenced on substantially the same facts, (4) the subject matter of the proceeding was already covered by a position statement issued by the Bureau, and (5) the applicant had failed to demonstrate an ability to litigate the proposed action in the public interest. In its representations, Google took similar positions to Apple and also posited that the Tribunal should consider the following non-exhaustive factors when determining if the “public interest” criterion for granting leave under section 103.1 would be met: (1) whether the proposed application furthers the public interest with regard to the purposes and scope of the Act and the statutory provisions at issue, (2) whether there is sufficient credible, cogent and objective evidence to establish each element of the reviewable practice(s) on a prima facie basis, (3) whether the applicant is a suitable representative to prosecute the proposed application in the public interest, and (4) whether there is a more suitable forum for adjudicating the claims and allegations. Google argued that the applicant failed to meet any of these factors.

- This follows the August 22, 2025 submission of written representations by the Commissioner, in which the Commissioner proposed that the Tribunal should consider the following factors in its assessment of public interest: (1) whether the application raises a serious justiciable issue (i.e., far from frivolous), (2) whether the applicant has a genuine interest in the matter, that need not be direct or substantial, and (3) whether the proposed application is a reasonable and effective means of bringing the case to court. The Commissioner stated that these factors should be applied in a “‘flexible and generous manner’ that takes into account the underlying purposes of the public interest standing that justify limiting or granting standing.” More information on the private action against Google and Apple can be found in the Blakes Competitive Edge™: July 2025 Update.

Google Defends Its Constitutional Challenge in Abuse of Dominance Proceedings

- On August 22, 2025, Google Canada Corporation and Google LLC (Google) submitted a memorandum of fact and law to the Tribunal in response to the Commissioner’s June 4, 2025, motion to strike Google’s constitutional challenge against section 79(3.1)(b) of the Act, which authorizes the Tribunal to impose administrative monetary penalties (AMPs) for abuse of dominance. This challenge stems from a November 28, 2024, notice of application filed by the Commissioner, which alleged that Google abused its dominant position through anti-competitive practices relating to its advertising technology tools. The Commissioner sought an AMP in an amount equal to three times the value of the benefit allegedly derived from Google’s purported anti-competitive practices or, if that amount cannot be reasonably determined, 3% of Google’s worldwide gross revenues or such other relief as the Tribunal may consider appropriate. In response, Google filed a notice of constitutional question challenging the validity of the power to issue AMPs, which the Commissioner subsequently sought to strike. In its response to the Commissioner’s motion to strike, Google (1) reasserted its claims that the provision allows the Tribunal to impose a “true penal consequence” reserved for criminal conduct, (2) alleged that the document production requirements and seizures it has been subject to pursuant to section 11 of the Act and Rule 60 of the Competition Tribunal Rules were in breach of its rights under section 8 of the Charter of Rights and Freedoms, and (3) claimed that the proceedings initiated by the Commissioner were ultimately unconstitutional. For more information on the abuse of dominance proceedings against Google, see the Blakes Competitive Edge™: June 2025 Update.

Non-Enforcement Activity

Bureau Launches Consultation for Upcoming Small and Medium-Sized Enterprise Lending Sector Market Study

- On September 4, 2025, the Bureau launched a public consultation and issued a corresponding consultation paper regarding the proposed terms of reference for a market study on competition within the lending sector for small and medium-sized enterprises (SMEs). In its consultation paper, the Bureau indicated that its proposed market study would focus on financing provided to SMEs through term loans and would examine three topics: (1) competitive dynamics in the SME financing sector, (2) barriers to entry or expansion in providing financing to SMEs, and (3) barriers to switching lenders. Interested parties can share their views on the proposed terms of reference for the market study through a public consultation feedback form until October 3, 2025. For more information about the Bureau’s market study powers, see the Blakes Competitive Edge™: June 2025 Update.

Investment Canada Act

Foreign Investment Monitor

Cultural Investments

Q2 Highlights

- One reviewable investment approval and three notifications filed (all for acquisitions)

- Country of ultimate control: United States (50%); China (25%); Japan (25%)

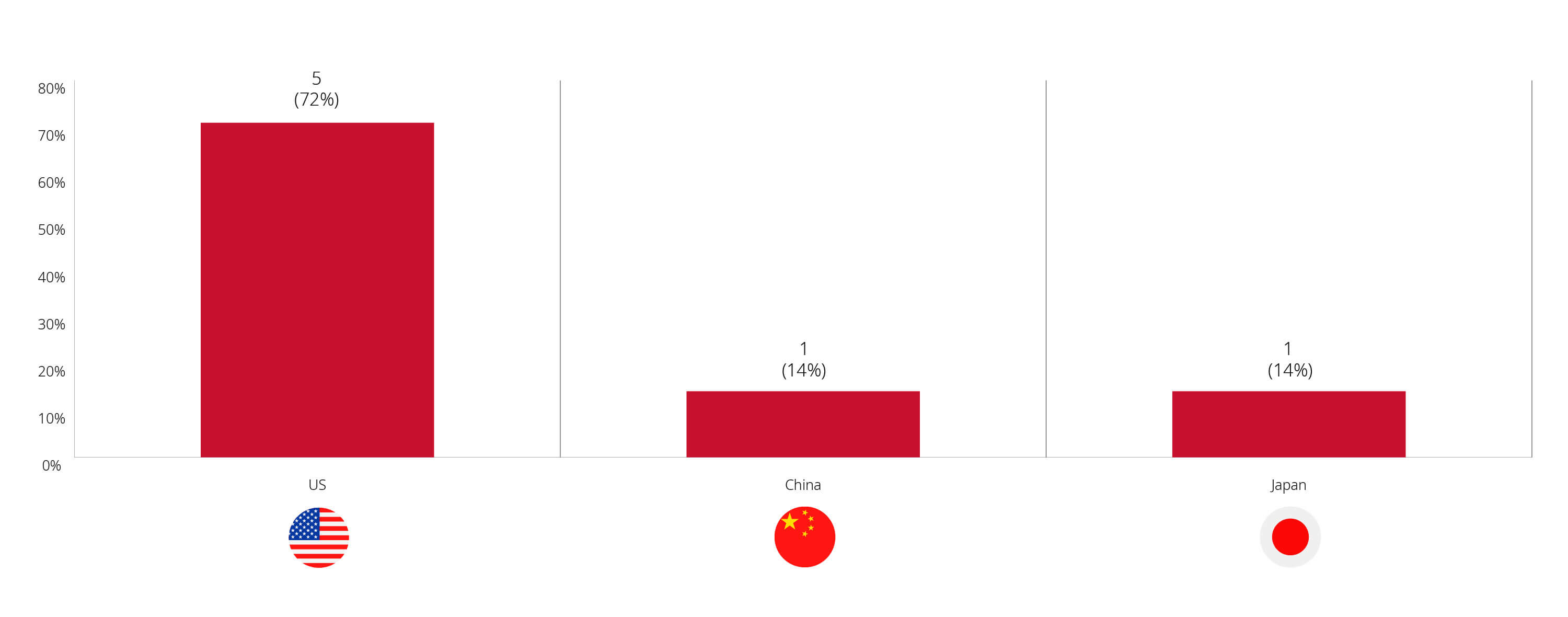

Q1 – Q2 Highlights

- Two reviewable investment approvals and five notifications filed (four filed for an acquisition, one for the establishment of a new Canadian business)

- Country of ultimate control: United States (72%); China (14%); Japan (14%)

Investment Canada Act Cultural Investment Filings and Approvals, January – July 2025

Non-Cultural Investments

July 2025 Highlights

- One reviewable investment approval and 98 notifications filed (88 filed for an acquisition, 10 for the establishment of a new Canadian business)

- Country of ultimate control: United States (62%); France (7%); Germany (5%); Japan (4%); United Kingdom (4%); India (3%)

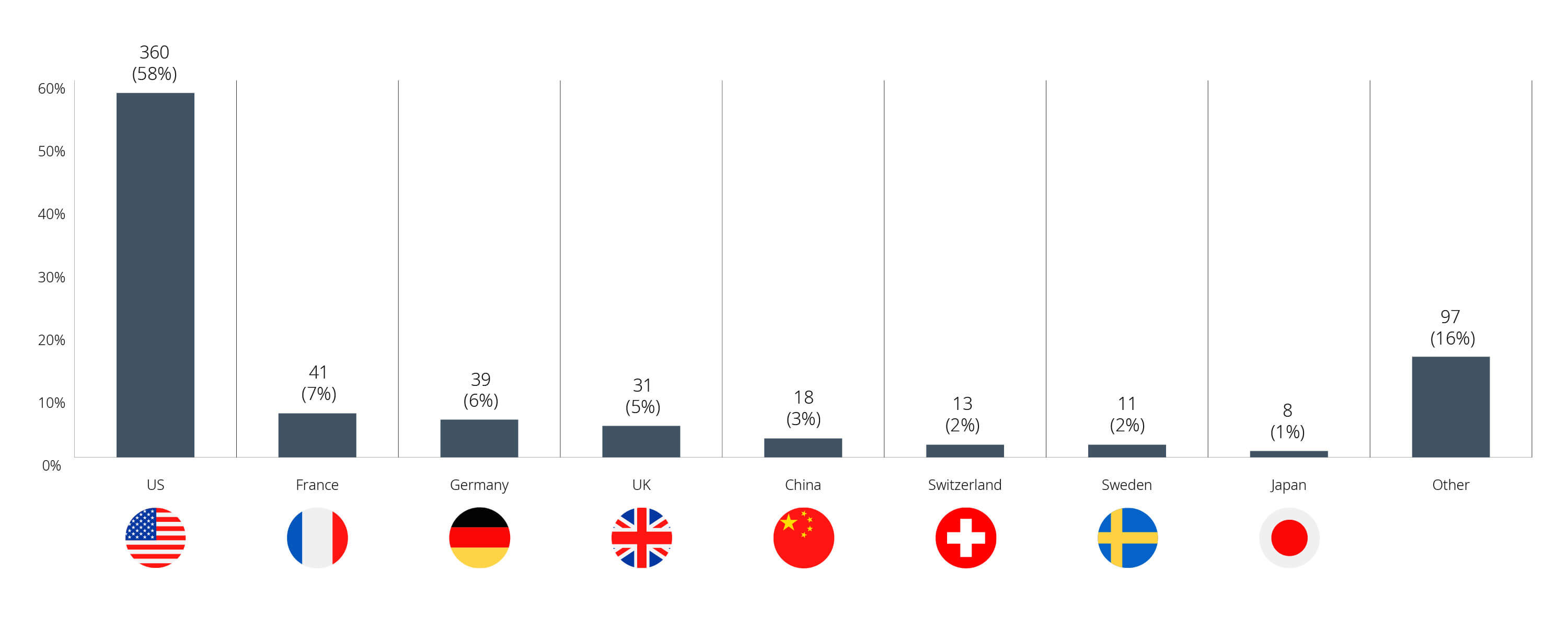

January – July 2025 Highlights

- Two reviewable investment approvals and 616 notifications filed (478 filed for an acquisition, 138 for the establishment of a new Canadian business)

- Country of ultimate control: United States (58%); France (7%); Germany (6%); United Kingdom (5%); China (3%)

Investment Canada Act Non-Cultural Investment Filings and Approvals, January – July 2025

Non-Enforcement Activity

Government of Canada Confirms Summer 2026 Timeline for Implementation of Pre-Closing Investment Canada Act Regime

- On September 8, 2025, the Government of Canada released an update regarding its plan for the implementation of recent amendments to the Investment Canada Act (ICA). For the amendments that have been passed but are not yet in force, the draft regulations for the pre-closing filing requirement for investments in sensitive sectors are anticipated to be published in final form in Summer 2026, with draft regulations to be published in Winter 2025 for a 75-day public comment period. For more information on the amendments and the evolving Investment Canada Act landscape, see Blakes Bulletins: Investment Canada Act: A New Era for Foreign Investment Reviews and Foreign Investment in Canada: Recent Trends and Future Outlook.

Blakes Notes

- Browse our thought-leadership insights from the Competition, Antitrust & Foreign Investment group to learn more.

Contact Us

- If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Related Insights

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2026 Blake, Cassels & Graydon LLP