On January 29, 2026, the Canadian Department of Finance (Finance) released for consultation legislative proposals (Proposals) that would broaden the existing “hybrid mismatch” rules in the Income Tax Act (ITA) to apply to so-called hybrid entity arrangements.

These proposals are the second phase of the hybrid mismatch rules first announced in the 2021 Canadian federal budget, with the first phase of the hybrid mismatch rules applying to hybrid financial instruments. These proposals generally track the recommendations in the Organization for Economic Cooperation and Development’s Action 2 Final Report from the base erosion and profit shifting project, released in October of 2015, and so will be broadly familiar to multinationals that already deal with similar rules in other jurisdictions that have implemented anti-hybrid regimes based on that guidance.

The existing anti-hybrid rules in Canada became effective in 2024 and focus on “deduction/non-inclusion” mismatches that arise from the hybrid treatment of financial instruments and related arrangements in different jurisdictions. Where the rules apply in respect of a particular payment, if the payer is a Canadian resident the deduction for the payment will be denied (Primary Rule) whereas if the payer is a non-resident, the Canadian recipient will be subject to an income inclusion, in each case to the extent of the mismatch that would otherwise arise. In circumstances where the Primary Rule denies a deduction in respect of interest paid by a Canadian corporation, the amount of the payment for which the deduction is denied is deemed to be a dividend for Canadian withholding tax purposes. (The Proposals extend this withholding tax requirement to partnerships that have at least one Canadian corporate member.) For further information on the existing hybrid mismatch rules, see our December 2023 bulletin, Select Tax Measures in Canada’s Bill C-59.

The Proposals extend the scope of the current rules to also address deduction/non-inclusion mismatches that arise from hybrid treatment of legal entities in different jurisdictions, “double deduction” mismatches that arise from the hybrid treatment of legal entities and various other transactions. This is done through the creation of four new categories of hybrid arrangements that are caught by the rules: (i) reverse hybrid mismatch arrangements, (ii) disregarded payment arrangements, (iii) hybrid payer arrangements, and (iv) imported mismatch arrangements, each as described below.

Reverse Hybrid Mismatch Arrangements

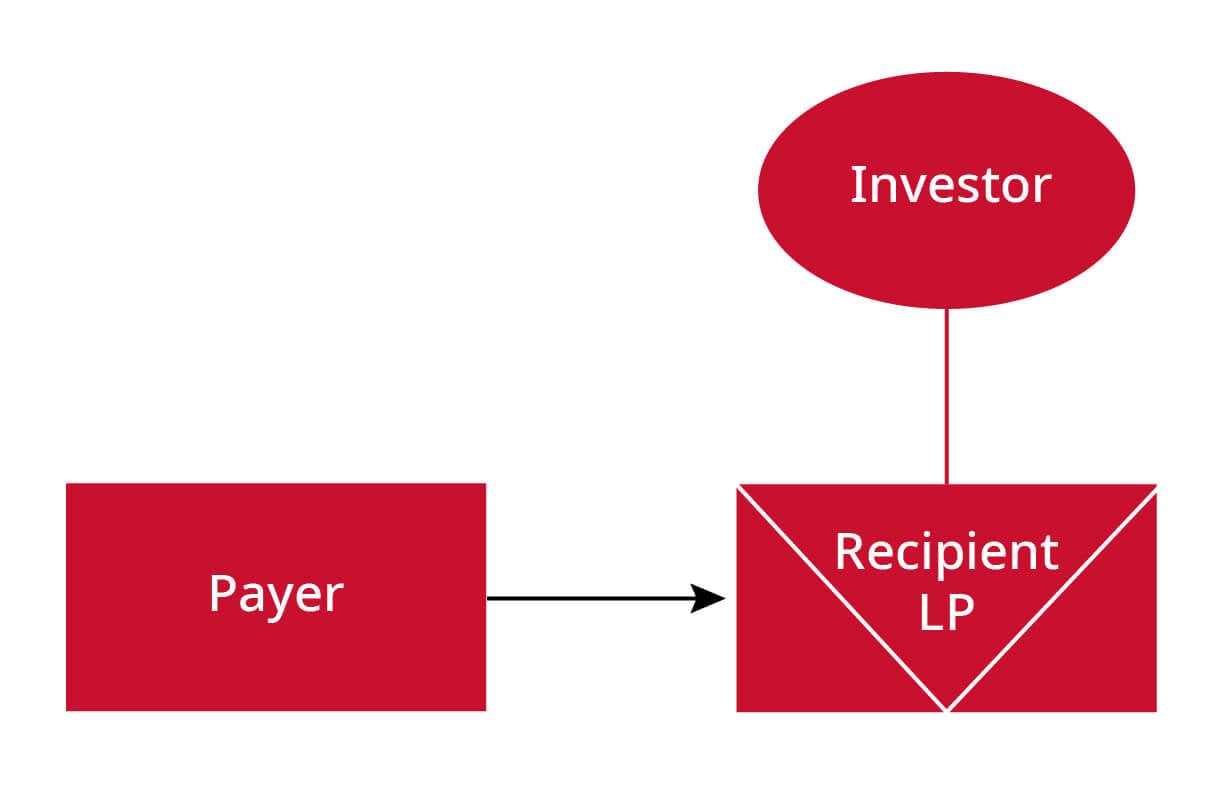

A “reverse hybrid” is an entity that is treated as fiscally transparent in its home jurisdiction but is treated as a taxable entity in the jurisdiction of one or more of its investors. An example of a reverse hybrid would be a partnership with a Canadian and United States member if the U.S. member has elected to treat the partnership as a corporation for U.S. tax purposes (see Figure 1). Payments to a reverse hybrid entity can give rise to a deduction/non-inclusion mismatch where a deductible payment is made to a reverse hybrid entity but not recognized as income by either the jurisdiction of the reverse hybrid entity (which regards it as fiscally transparent) or by the jurisdiction of the investors (which regard the income as belonging to the reverse hybrid entity and not to the investors).

The Proposals would deny a deduction to a Canadian taxpayer in respect of a payment made to a reverse hybrid if:

- The payer and the reverse hybrid do not deal at arm’s length, or the payment arises under or in connection with a “structured arrangement” (generally, an arrangement where it can reasonably be considered that the economic benefits of a mismatch are priced into the arrangement, or that the arrangement is otherwise intentionally designed to produce a mismatch)

- The payment gives rise to a deduction/non-inclusion mismatch

- The amount of the deduction non-inclusion mismatch exceeds the amount that, had the actual payment been made proportionately to the investors in the reverse hybrid entity, would not have been caught by a hybrid mismatch rule

The deduction of the above-described excess is the amount denied under the hybrid mismatch rules. Further, where the payment is interest, the amount for which a deduction is denied is deemed to be a dividend for withholding tax purposes.

Figure 1: Example of a reverse hybrid arrangement, with Recipient LP as the reverse hybrid entity.

Figure 1: Example of a reverse hybrid arrangement, with Recipient LP as the reverse hybrid entity.Disregarded Payment Arrangements

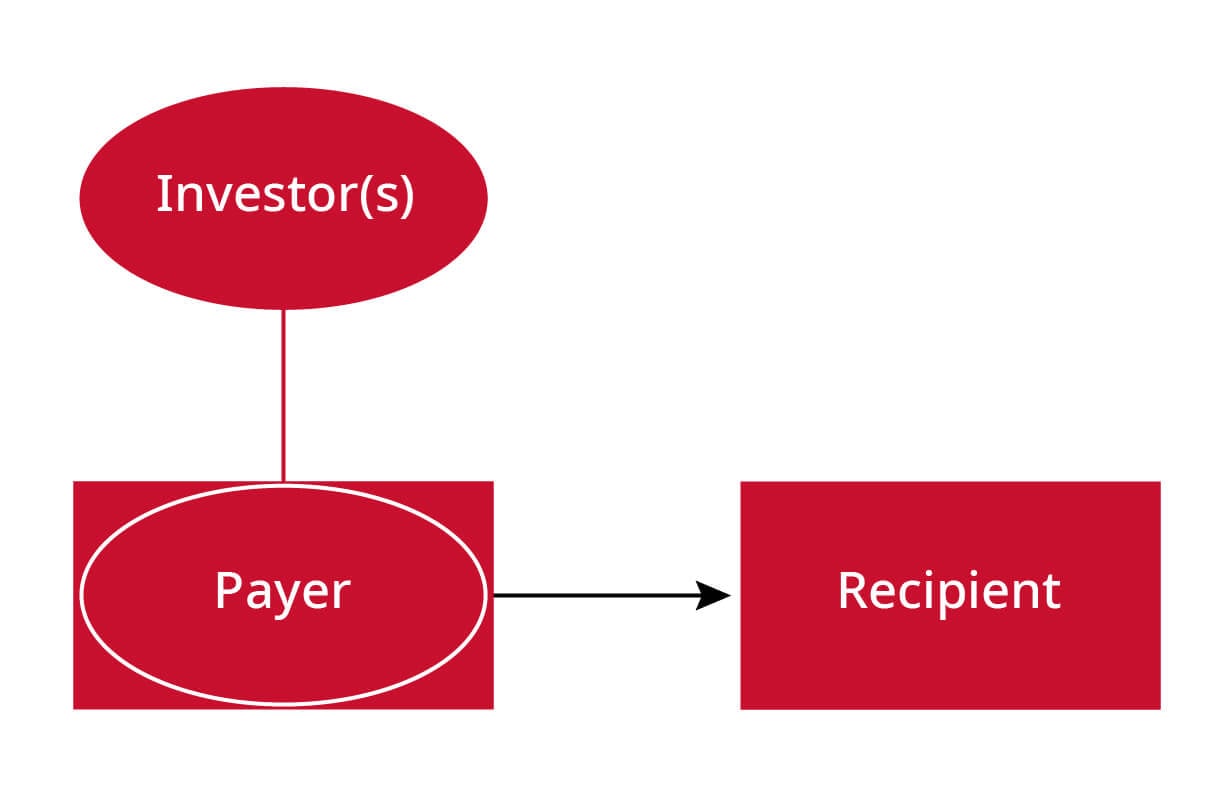

A “hybrid entity” is an entity that is taxable in its home jurisdiction but is treated as fiscally transparent in the jurisdiction of one or more of its investors. An example of a hybrid entity is a Canadian unlimited liability company that is treated as a corporation in Canada but as fiscally transparent under the laws of the U.S. (see Figure 2). A payment made by a hybrid entity to an investor may not be included in the income of an investor because the hybrid entity is not considered to be a separate legal entity in the jurisdiction of the investor, which can give rise to a deduction/non-inclusion mismatch.

The Proposals would generally deny a deduction to a hybrid entity in respect of a payment if:

- The hybrid entity and the recipient of the payment do not deal at arm’s length, or the payment arises under, or in connection with, a “structured arrangement”

- The payment gives rise to a deduction/non-inclusion mismatch

- The deduction/non-inclusion mismatch arises because the payment is disregarded under the laws of the recipient’s country of residence

It is also possible that payments received by a hybrid entity can be included in the income of both the hybrid entity in its jurisdiction and in the income of its investors (because the hybrid entity is fiscally transparent in that jurisdiction), giving rise to “dual inclusion income”. The Proposals do not include general relief for dual-inclusion income, but to the extent a hybrid entity has dual inclusion income, this can reduce the amount that would otherwise be caught by the disregarded payment rule (and excess amounts of dual-inclusion income in a year may be carried forward and applied against future payments that would otherwise be caught by the rule, subject to a no “double counting” rule).

Where the payment for which a deduction is denied is interest, that payment is deemed to be a dividend for withholding tax purposes.

Figure 2: An example of a disregarded payment arrangement, with a Canadian ULC as the hybrid entity making a payment to a US-based shareholder.

Figure 2: An example of a disregarded payment arrangement, with a Canadian ULC as the hybrid entity making a payment to a US-based shareholder. Hybrid Payer Arrangement

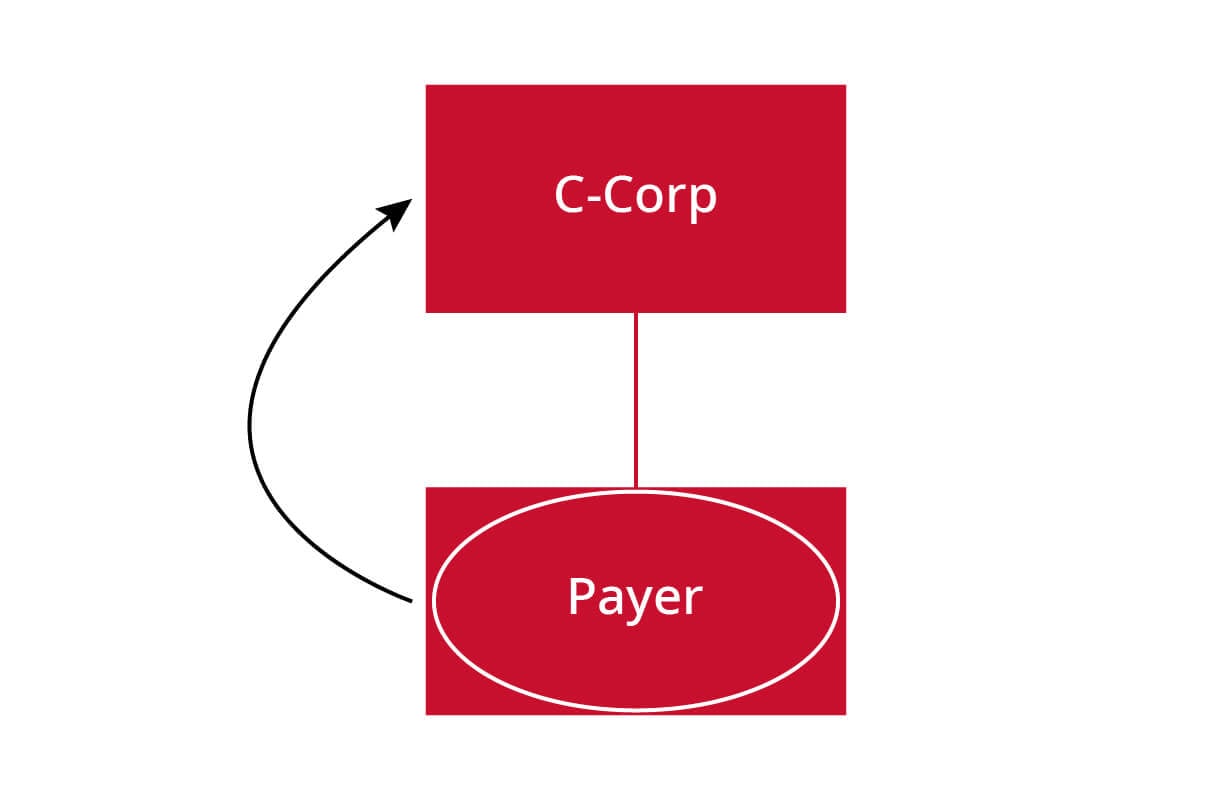

A “hybrid payer” is: (i) a hybrid entity, (ii) an entity resident in two countries, or (iii) an entity resident in one country and subject to tax in another country by virtue of carrying on business at a permanent establishment in that other country. An example of a hybrid payer is a Canadian unlimited liability company that is treated as a corporation in Canada but as fiscally transparent under the laws of the U.S. (see Figure 3). A payment by a hybrid payer can be deductible both to it, in its own jurisdiction, and to investors in their jurisdiction (because the hybrid entity is fiscally transparent in the investor jurisdiction), giving rise to a “double deduction” mismatch.

The Proposals would generally deny a deduction to a hybrid payer in respect of a payment if:

- In the case of a hybrid payer that is a hybrid entity resident in Canada, (i) the hybrid payer does not deal at arm’s length with an investor in the hybrid payer or the payment arises under, or in connection with a “structured arrangement” and (ii) in respect of at least one investor in the hybrid entity, no rule in their home country equivalent to the Canadian hybrid mismatch rules applies to the payment

- In the case of a “multinational entity” resident in a country other than Canada, no rule in that country equivalent to the Canadian hybrid mismatch rules applies to the payment

- In the absence of the Canadian hybrid mismatch rules and any equivalent non-Canadian rules, both the hybrid payer and an investor in the hybrid payer would both be entitled to a deduction in respect of the payment (being a “double deduction”)

The Proposals generally reduce the amount caught by the hybrid payer rule to the extent that the hybrid payer has any dual-inclusion income (without double-counting of amounts of dual-inclusion income used to reduce the impact of the disregarded payment rule or used in a prior year).

Unlike with reverse hybrid mismatch arrangements, disregarded payment arrangements, and imported mismatch arrangements, where the payment for which a deduction is denied pursuant to a hybrid payer arrangement is interest, that payment is deemed to be a dividend for withholding tax purposes only if it is paid to a person that does not deal at arm’s length with the hybrid payer or to a recipient that is party to a structured arrangement in respect of the amount.

Figure 3: An example of a hybrid payer arrangement, with a Canadian ULC as the hybrid payer.

Figure 3: An example of a hybrid payer arrangement, with a Canadian ULC as the hybrid payer.Imported Mismatch Arrangements

The Proposals also expand the hybrid mismatch rules by introducing complex “imported mismatch” rules, which, very generally, can deny a deduction of a Canadian taxpayer when a hybrid arrangement between non-Canadian taxpayers includes a payment by the Canadian taxpayer as part of the relevant series of transactions.

Conclusions

The Proposals, while expected, are very broad and have the potential to apply in many situations. Taxpayers, especially those with affiliates in the U.S. and those with legal entities carrying on business through branches, will want to review their structures to determine if the Proposals may impact any of their existing arrangements. For those with affiliates in the U.S., the “check the box” rules in the U.S. make it more likely for hybridity to arise (such as structures involving Canadian ULCs, U.S. LLCs or partnerships that have elected to be taxed as corporations for U.S. purposes), even if a hybrid mismatch was not the intent behind a particular structure. Revisiting these structures will be particularly important given the Canadian-specific rules by which a deduction that is denied is deemed to be a dividend for Canadian withholding tax purposes.

The Proposals generally apply to payments arising on or after July 1, 2026. Finance has invited comments on the Proposals until February 27, 2026.

For further information, please contact any member of our Tax group.

Related Insights

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2026 Blake, Cassels & Graydon LLP