Welcome to the February issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

Size of transaction threshold to remain at C$93-million for 2022.

The thresholds for pre-merger review under the Investment Canada Act for 2022 have been released.

The number of completed reviews in January 2022 (nine) is 40 per cent lower than the number of completed reviews from January 2021 (15) and 47 per cent lower than the number of completed reviews from January 2020 (17).

The federal government to undertake a review of Canadian competition laws.

Submissions received by Senator Howard Wetston’s competition consultation have been published.

The federal government proposes new voluntary filing regime under the Investment Canada Act.

Investment Canada Act 2020-2021 Annual Report was released on February 2, 2022.

Merger Monitor

January 2022 Highlights

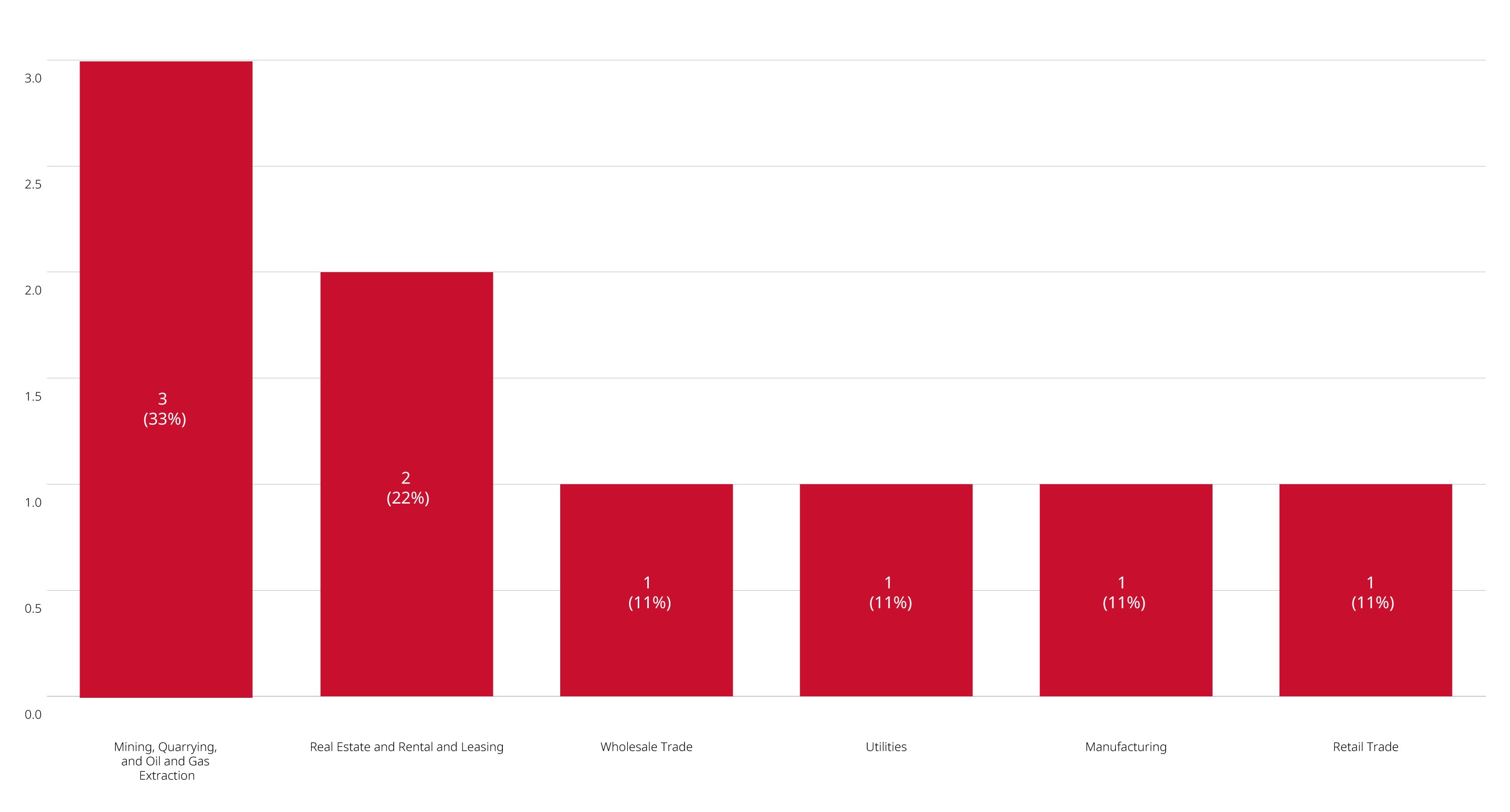

Nine merger reviews completed

Primary industries mining, quarrying, and oil and gas extraction (33 per cent); real estate and rental and leasing (22 per cent); wholesale trade (11 per cent); utilities (11 per cent); manufacturing (11 per cent); and retail trade (11 per cent)

Zero consent agreements (remedies) filed

Four transactions received an Advance Ruling Certificate (44 per cent), five transactions received a No Action Letter (56 per cent)

Other Enforcement Activity

Other Enforcement Activity

CPL Interiors pleads guilty in GTA condo refurbishment bid rigging scheme

On January 17, 2022, the Competition Bureau announced that CPL Interiors Ltd., a construction company operating in the Greater Toronto Area, was fined C$761,967 after pleading guilty before the Ontario Superior Court for its role in a criminal bid rigging conspiracy. In its guilty plea, the company admitted to conspiring with competitors to allocate customers and fix prices on 31 refurbishment contracts issued by private condominium corporations between 2009 and 2014. CPL Interiors received leniency in sentencing for its full cooperation with the Competition Bureau’s investigation.

Competition Bureau approves sale of crop input facility to ProSoils Inc.

On January 28, 2022, the Competition Bureau announced its approval of Blair’s Family of Companies’ sale of a retail crop input facility in Lipton, Saskatchewan to ProSoils Inc. The sale of this facility, required under the Bureau’s consent agreement with Blair’s and Federated Co-operatives Limited, concludes the Bureau’s review of the Blair’s/FCL joint venture.

Non-Enforcement Activity

Senator Wetston publishes submissions received in Competition Consultation

Senator Wetston has published the submissions received in response to his October 27, 2021 consultation invitation on potential reform for Canadian competition law. Included in the invitation was a discussion paper by Professor Iacobucci of the University of Toronto, titled “Examining the Canadian Competition Act in the Digital Era”, which concludes that the Competition Act is generally well-suited to address economic harms in digital markets, and suggests some incremental amendments to address pre-existing shortcomings. A wide range of interested parties participated in the consultation, ranging from economists and academics to members of the competition bar and government agencies, including the Competition Bureau. In its submission, the Bureau proposes a wide range of changes to Canadian competition law and policy, including eliminating the efficiencies defence, enacting structural presumptions that would require merging parties to prove that a concentrative merger would not substantially lessen or prevent competition, extending the time in which the Competition Bureau can challenge a completed merger and allowing private access to the Competition Tribunal for abuse of dominance and competitor collaboration cases.

Minister Champagne announces review of Canada’s competition laws and maintains pre-merger notification transaction-size threshold

On February 7, 2022, the Minister of Innovation, Science and Industry, François-Phillipe Champagne, announced that the government would examine potential ways to improve the operation of the Competition Act, including more clearly addressing drip pricing, tackling wage fixing agreements and modernizing the penalty regime to ensure it serves as a genuine deterrent against harmful business conduct. In addition, the Minister’s announcement also clarified that the pre-merger notification transaction-size threshold would remain at C$93-million.

Section 36 Remedies under the Competition Act

Class action certification ruling rejects umbrella damages and limits parent liability

In David v Loblaw, 2021 ONSC 7331, the Ontario Superior Court of Justice (Court) certified a class action against Weston Bakeries, Loblaw and certain other retailers and producers of packaged bread. The plaintiff alleges that the defendants participated in a price fixing agreement relating to bread products over a number of years. The Court authorized the proceeding but refused to certify it as against a number of the defendants’ parent companies and refused to include “umbrella” claims that the alleged conspiracy also increased the price of other products.

Investment Canada Act

Investment Canada Act 2020-2021 Annual Report now available

The Investment Canada Act 2020-2021 Annual Report was released on February 2, 2022, by the Minister of Innovation, Science and Industry. The report provides information and statistics on the administration of the Investment Canada Act (ICA) during the government’s 2020-2021 fiscal year (from April 1, 2020, to March 31, 2021). Highlights include:

A total of 826 investment filings were certified during the 2020-2021 fiscal year, a 20 per cent decrease from 1,032 filings in 2019-2020. The 826 filings consisted of three applications for review (compared to nine in each of the three previous fiscal years) and 823 notifications (577 notifications for the acquisition of control of an existing Canadian business and 246 notifications for the establishment of a new Canadian business).

The most common countries of origin for investors were the United States (448 investments) and the European Union (146). The top five source countries or regions of origin of investment accounted for 720 total investments (87.2 per cent of all investments in 2020-2021).

The leading sector for the number of investments was Business and Services Industries (338 investments), followed by Other Services (199), and Manufacturing (145) while top sectors for the enterprise value of investments were Business and Services Industries (C$10,068-million), Manufacturing (C$9,759-million) and Other Services (C$9,477-million).

With respect to the national security review of investments, all 826 filings were reviewed for potential injury to national security with one investment proceeding directly to a national security review and 23 investments receiving a section 25.2 notice for further review. The 23 section 25.2 notices issued in 2020-2021 account for nearly 50 per cent of all section 25.2 notices (50 notices) issued over the past five years. Of the investments receiving a section 25.2 notice, 11 received section 25.3 notices for a full national security review, representing 35 per cent of all section 25.3 notices (32 notices) issued over the past five years; the remaining 12 investments were allowed to proceed with no further action. Of the 11 investments subject to a full national security review, four were permitted to proceed with no further action, four were withdrawn by the investor, two resulted in orders for the investor to divest or wind-up its investment and one resulted in and order blocking the proposed investment.

Non-Cultural Investments

December 2022 Highlights

Zero reviewable investment approvals and 106 notifications filed (93 for acquisitions and 13 for establishment of a new Canadian business)

Country of origin of investor (non-cultural): U.S. (58 per cent); UK (five per cent); Luxembourg (four per cent); Austria (four per cent) and Australia (four per cent)

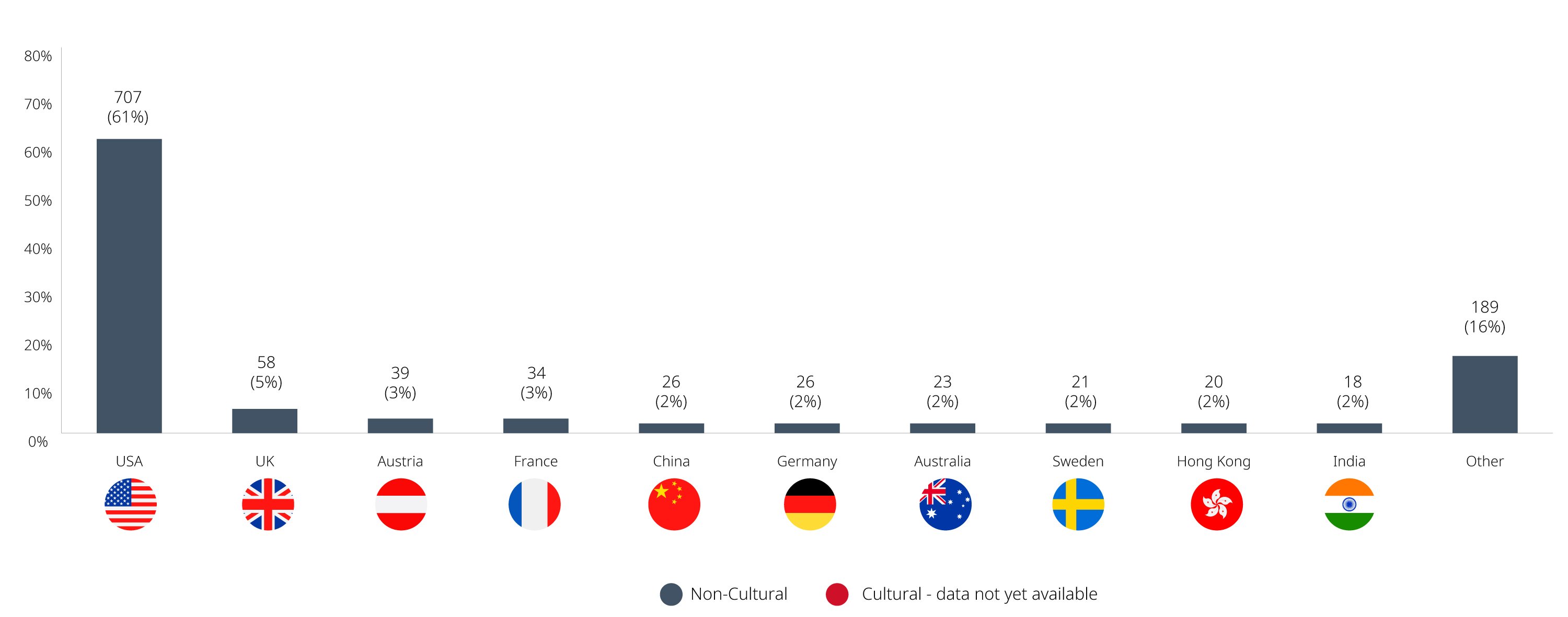

Annual 2022 Highlights

One reviewable investment approval and 1,160 notifications filed (902 for acquisitions and 258 for establishment of a new Canadian business)

Country of origin of investor (non-cultural): U.S. (61 per cent); UK (five per cent); Austria (three per cent) and France (three per cent)

Government of Canada publishes updated thresholds for Investment Canada Act reviews

The Government of Canada has released the 2022 thresholds that will determine whether investments by foreign investors will be required to go through a pre-merger “net benefit” review, subject to publication in the Canada Gazette:

The threshold for investors that are not state-owned enterprises based in countries with a trade agreement with Canada increased to C$1.711-billion in enterprise value (from C$1.565-billion).

The threshold for investors that are not state-owned enterprises based in other World Trade Organization countries increased to C$1.141 in enterprise value (from C$1.043-billion).

The threshold for state-owned enterprise investors from World Trade Organization countries increased to C$454-million in book value of assets of the Canadian business being acquired (C$415-million).

Government of Canada proposes amendments to national security regulations to introduce voluntary filing mechanism

On February 12, 2022, the Government of Canada proposed changes to the national security regulations under the Investment Canada Act to provide for a voluntary filing mechanism for investments by non-Canadians that do not require a filing. The proposed changes also significantly extend the time period the government has to review such an investment where a voluntary filing is not made. Currently, the applicable period for the government to begin the national security review process starts on the day on which the investment first comes to the Minister’s attention and ends 45 days after the investment is implemented. Under the proposed changes, the government would have 45 days from filing to begin the national security review process where the non-Canadian investor makes a voluntary filing, and up to five years after implementation of the investment where no filing is made.

Blakes Notes

To read more thought leadership insights from the Competition, Antitrust & Foreign Investment group, please click here.

For the latest legal and business updates regarding COVID-19, visit our Resource Centre.

Contact Us

If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Related Insights

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2026 Blake, Cassels & Graydon LLP