Welcome to the November issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

Merger review activity in 2022 continues to slow, with 168 mergers completed through the end of August. This is a 7.6% decrease over the number of reviews completed in the same period in 2021 (182).

Competition Tribunal releases decision rejecting the Bureau’s challenge of Parrish & Heimbecker, Limited’s acquisition of a grain elevator in Virden, Manitoba.

Minister Champagne denies a request for the wholesale transfer of spectrum licences from Shaw to Rogers.

Ministry of Innovation, Science and Industry publishes its annual Investment Canada Act report.

Government of Canada issues new policy regarding Foreign Investments from State-Owned Enterprises in Critical Minerals and orders divestiture of investments by three Chinese companies in Canadian critical minerals businesses.

Merger Monitor

October 2022 Highlights

Fifteen merger reviews completed

Primary industries: wholesale trade (20%); manufacturing (20%); utilities (13%); finance and insurance (13%)

Zero consent agreements (remedies) filed

One judicial decision filed

Six transactions received an Advance Ruling Certificate (40%); eight transactions received a No Action Letter (53%)

January – October 2022 Highlights

168 merger reviews completed

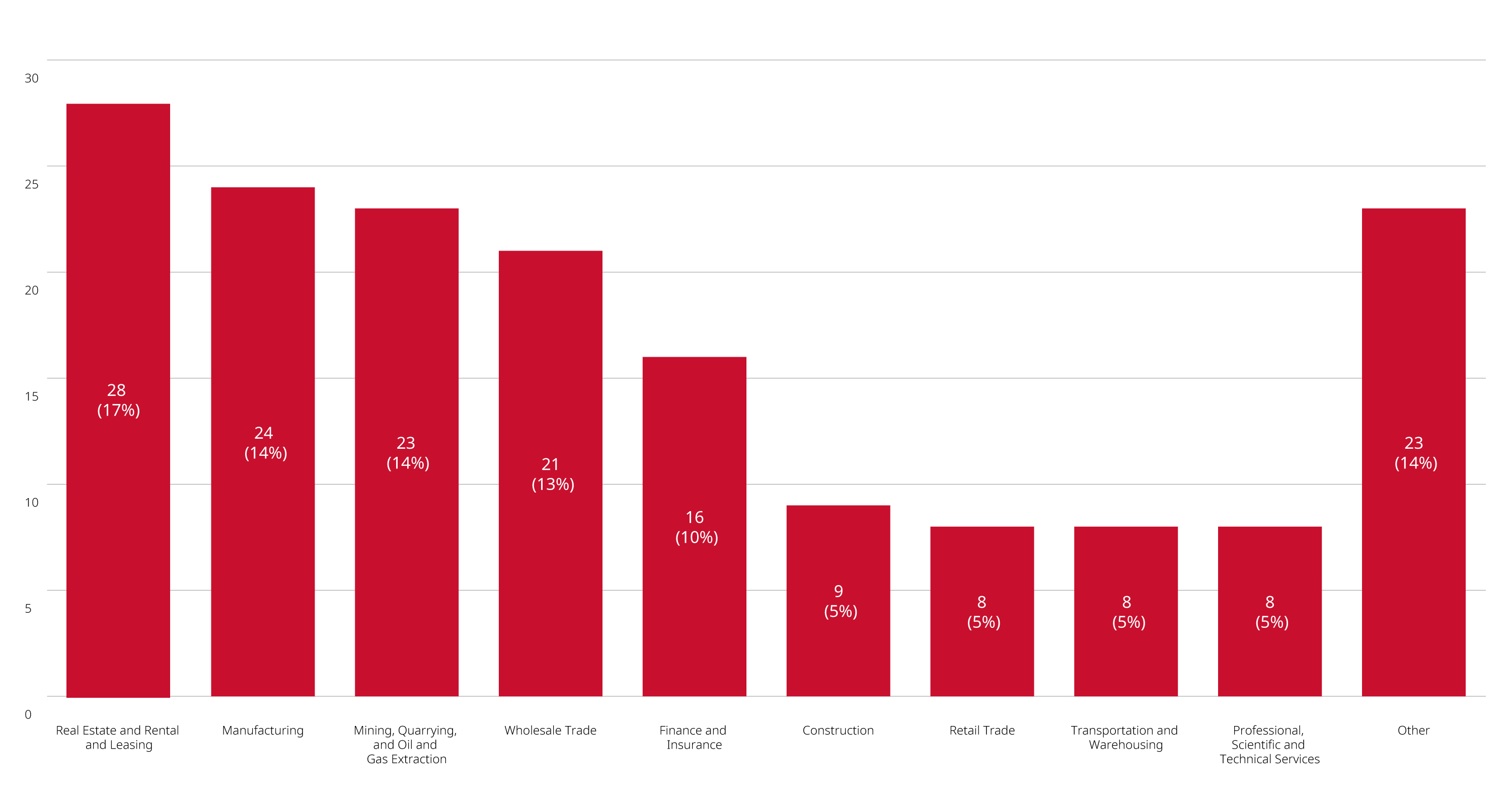

Primary industries: real estate and rental and leasing (17%); manufacturing (14%); mining, quarrying, and oil and gas extraction (14%); wholesale trade (13%); finance and insurance (10%)

Six consent agreements (remedies) filed

One judicial decision filed

88 transactions received an Advance Ruling Certificate (52%); 73 transactions received a No Action Letter (43%)

Merger Enforcement Activity

Competition Tribunal issues summary of its decision in Parrish & Heimbecker, Limited

On November 16, 2022, the Competition Tribunal (Tribunal) released its decision in Canada (Commissioner of Competition) v. Parrish & Heimbecker, Limited. The Tribunal concluded the Commissioner did not prove that the acquisition by Parrish & Heimbecker, Limited of one grain elevator in Virden, Manitoba, from Louis Dreyfus Company Canada ULC would substantially lessen price or non-price competition for the purchase of wheat and canola in the geographic area surrounding the elevator. The Tribunal found that the Commissioner’s proposed product market was not grounded in commercial reality or in the evidence and that their “value-added” approach to defining the product market failed on the facts, from both a legal standpoint and an economic perspective. The Tribunal determined that the transaction’s price effects for the purchase of both wheat and canola were immaterial, that there remained several effective competitors post-acquisition and that the combined shares were below the 35% safe-harbour threshold. The Bureau has announced that it is reviewing the Tribunal’s decision and may take additional steps to challenge the acquisition. For more discussion on the case, refer to the January 2021 and February 2021 editions of Blakes Competitive Edge.

Minister Champagne denies request for wholesale transfer of spectrum licences from Shaw to Rogers

On October 25, 2022, the Minister of Innovation, Science and Industry (Minister) released a statement officially denying the parties’ request to approve the wholesale transfer of wireless spectrum licences from Shaw to Rogers in connection with Rogers’ proposed acquisition of Shaw. Moreover, in respect of Shaw’s proposal to sell Freedom Mobile to Vidéotron, the Minister stated that he would approve the requisite transfer of spectrum licences only if the licences remained in Vidéotron’s possession for at least 10 years. The Minister also stated that he would expect to see prices for wireless services in Ontario and Western Canada following the transaction comparable to the current Vidéotron prices in Quebec.

Hearing begins in the Commissioner’s challenge of the Rogers/Shaw merger

The hearing in the Bureau’s challenge of the Rogers/Shaw merger began before the Tribunal on November 7, 2022, and is expected to last until December 8, 2022, at the latest. The Tribunal is streaming the hearing on Zoom, and any filings made in connection with the hearing will be uploaded to the Tribunal’s website in due course. Following the hearing, written arguments are currently scheduled to be filed on December 8, with oral arguments to follow on December 13 and 14.

Bureau releases report to the Minister of Transportation regarding WestJet’s acquisition of Sunwing

On October 25, 2022, the Bureau released its report to the Minister of Transport regarding the competitive effects of WestJet Airlines Ltd.’s acquisition of Sunwing Vacations and Sunwing Airlines. The Bureau concluded the proposed acquisition is likely to result in a substantial lessening or prevention of competition in the sale of vacation packages in 31 “sun destination” markets. Transport Canada has until December 5, 2022, to complete its public interest assessment of the acquisition, after which the Minister of Transport will issue its recommendation to the Governor in Council, who will make the final decision regarding the transaction.

Non-Enforcement Activity

Minister Champagne launches Competition Act review

As discussed in our November 2022 Blakes Bulletin, the Minister of Innovation, Science and Industry (Minister) has launched a review of the Competition Act (Act), as well as a public consultation “on broader changes to the [Act] and its enforcement framework, including changes that will help the Competition Bureau better protect consumers and the integrity of the marketplace.” The review is the next step in realizing the Minister’s intention to “improve and reinforce” the Act, following the amendments to the Act passed in June 2022. As set out in greater detail in a discussion paper and briefing note regarding the consultation, the review will examine Canada’s competition framework, including the scope of the Act, the enforcement methods and corrective measures set out in the Act, and competition policy in increasingly digital and data-driven markets. Canadians are invited to submit feedback by February 27, 2023.

Competition Bureau announces grocery-sector market study

On October 24, 2022, the Bureau announced that it is launching a market study of grocery store competition in response to increasing grocery store prices in Canada. The study will assess the competitive dynamics in the grocery industry to determine whether there are any market features that restrict or may restrict competition, including the behaviour of firms and individuals, laws, regulations, policies, or structural barriers. Specifically, the Bureau will examine (i) the extent to which higher grocery prices are a result of changing competitive dynamics, (ii) steps that other countries have taken to increase competition in the sector, and (iii) how governments can lower barriers to entry and expansion to stimulate competition for consumers. Interested stakeholders may make submissions to the Bureau in writing through the Bureau’s web portal or via oral interviews with the Bureau before December 16, 2022. The Bureau anticipates that it will release the final report in June 2023.

Competition Bureau publishes a new Information Bulletin on Transparency

On October 25, 2022, the Bureau published the Information Bulletin on Transparency. As described in the March edition of Blakes Competitive Edge, this bulletin replaces the Bureau’s Information Bulletin on Communication during Inquiries, which was published in 2014 and is intended to reflect the evolution in the Bureau’s practices since that time. Key differences include that the new bulletin is written in more accessible language, it removes some statements that could be taken as fettering the Bureau’s discretion with respect to investigation timelines, and it indicates that the Bureau may publish public statements about active cases on a case-by-case basis.

Commissioner delivers speech to the Canadian Bar Association

On October 20, 2022, Commissioner of Competition Matthew Boswell delivered a speech to the Canadian Bar Association Competition Law Fall Conference titled “Seizing the Moment to Build a More Competitive Canada.” In his remarks, Commissioner Boswell highlighted (i) the Bureau’s continuing work to build its investigation and litigation capacity, (ii) the June amendments to the Act, and (iii) the Bureau’s plans to issue updated guidance on abuse of dominance and drip pricing and to publish new guidance on no-poach and wage-fixing agreements to reflect these amendments. The Commissioner also suggested that further reforms to competition law are necessary, including substantive reform to merger review tests and standards, increased timeliness in the administration of the Act and expanded Bureau powers when conducting market studies.

Bureau publishes new bulletin on the choice of the criminal or civil track for misleading representations and deceptive-marketing-practices offences

On October 25, 2022, the Bureau published a bulletin outlining the Commissioner’s approach when choosing whether to rely on the criminal or civil track of the Act to address misleading representations and deceptive marketing practices. The bulletin indicates that the Bureau will proceed with criminal charges only if there is clear and compelling evidence suggesting the accused knowingly or recklessly made a false or misleading representation to the public and if the Bureau is satisfied that criminal prosecution would be in the public interest, considering the seriousness of the alleged offence and any mitigating factors.

Bureau rescinds guidance on competitor collaborations issued to support COVID-19 pandemic crisis-response efforts

- On November 7, 2022, the Bureau rescinded the statement they had previously issued on April 8, 2020, on competitor collaborations during the COVID-19 pandemic. The statement confirmed that the Bureau would not exercise scrutiny against short-term collaborations between companies undertaken and executed in good faith to respond to the COVID-19 crisis. The Bureau determined the exceptional conditions that led to the statement are no longer applicable and has thereby rescinded this guidance. To read more about the now-rescinded statement, please see our April 2020 Blakes Bulletin.

Section 36 Remedies Under the Competition Act

In Cheung v. NHK Spring Co., Ltd., 2022 BCSC 1738, the Supreme Court of British Columbia (BCSC) certified a national class action under the British Columbia Class Proceedings Act against a group of defendants for the alleged price-fixing of suspension assemblies, which make up a small component of computer hard drives. The defendants challenged both the BCSC’s jurisdiction and the plaintiff’s motion to certify its claim for breaches of section 45 of the Competition Act (Act) on the basis that the alleged price-fixing agreements were made and implemented entirely outside of Canada and that the defendants did not make any direct sales of suspension assemblies to Canada. The BCSC held that the plaintiffs’ allegations that the defendants engaged in a price-fixing conspiracy that intentionally and foreseeably caused economic harm to purchasers in British Columbia was sufficient to create a real and substantial connection to British Columbia. As such, the BCSC had jurisdiction to hear the claim and the plaintiff’s claim based on section 45 of the Act was not bound to fail.

In Valeant Canada LP/Valeant Canada S.E.C. v. British Columbia, 2022 BCCA 366, the British Columbia Court of Appeal (BCCA) was asked to consider a motion to strike claims made by the Province of British Columbia (Province) against a group of defendant pharmaceutical manufacturers to recover the Province’s opioid-related health-care costs. The Province’s claims are based on alleged false and misleading representations made by the manufacturers in breach of section 52 of the Act, along with a variety of other statutory and common law causes of action. In the course of its decision, the BCCA considered whether a plaintiff alleging a breach of section 52 of the Act in a claim brought under section 36 is required to show their detrimental reliance on the allegedly false and misleading representations. The BCCA held that while a plaintiff must show they suffered damages as a result of the defendant’s breach of section 52 in order to claim damages under section 36, it was not plain and obvious that the plaintiff must prove detrimental reliance on the alleged misrepresentations. On this basis, the BCCA refused to strike the Province’s Competition Act claims, leaving the question to be resolved at trial.

Investment Canada Act

Non-Cultural Investments

Highlights

Information regarding Investment Canada Act (ICA) decisions since August 2022 have not yet been published and will be addressed in a subsequent edition of Blakes Competitive Edge.

Minister publishes annual Investment Canada Act report

The Minister released the 2021-2022 ICA Annual Report in October 2022. The report provides fiscal-year statistics on the administration of the ICA, including net benefit and national security reviews. Some highlights of the report include:

The fiscal year 2021-2022 saw a record high of 1,255 investment filings, a 51.9% increase from 2020-2021 and 21.6% higher than 2019-2020. The filings consisted of eight applications for review approved as being of likely net benefit to Canada and 1,247 certified notifications, 278 of which were notifications in respect of the establishment of a new Canadian business by a non-Canadian.

The greatest number of investments was in the category of Business and Services Industries (543 investments, or 43.3% of total filings). However, these investments represented a relatively smaller portion of the total value invested (20.3% of total asset value of all notified investments and 37.1% of total enterprise value of all notified investments). Comparatively, the second greatest number of investments was in Other Services (308 filings, 24.5%), but these investments made up 40.9% of the total asset value and 24.1% of the total enterprise value. The remaining filings were in Manufacturing (216 investments, 17.2%), Wholesale and Retail Trades (155 investments, 12.4%) and Resources (33 investments, 2.6%).

The United States was by far the most significant foreign investor in Canadian businesses, with 731 investments originating from the U.S. (58.2%), accounting for 64.5% of the total asset value and 71.5% of the total enterprise value of investments. The next largest sources of investment were the European Union (209 investments, 16.7%) and the United Kingdom (88 investments, 7%). The proportion of investments from China (including Hong Kong) decreased to 4% of total investments (compared to 5.1% in the prior fiscal year).

The primary target for investments was Ontario (655 investments, 52.3%), followed by British Columbia (250 investments, 20%) and Quebec (172 investments, 13.7%). The total value of investments received by each of Ontario, B.C., Quebec and Alberta was above C$10-billion in combined asset and enterprise value.

Twenty-four investments were subject to an extended national security review. Sixteen of those investments were permitted to proceed, seven were withdrawn by the investor and one review remained ongoing at the end of the 2021-2022 fiscal year. The average length of the extended national security review process was 133 days.

Of particular note, 47 (70%) of the 70 extended national security reviews that have been conducted under the ICA in the last five fiscal years have occurred in the last two years.

Government of Canada issues Policy Regarding Foreign Investments from State-Owned Enterprises in Critical Minerals

On October 28, 2022, the federal government issued an updated policy on the application of the ICA to investments in the critical minerals sector by foreign state-owned enterprises (SOEs) or private investors closely tied to, subject to influence from or potentially compellable by foreign governments. Under the new policy, applications for net benefit review of acquisitions of control of a Canadian critical minerals business from foreign SOEs or private investors subject to the influence of foreign governments will only be approved “on an exceptional basis.” Moreover, an investment in critical minerals that involves a foreign SOE or a state-influenced investor will support a de facto finding that there are reasonable grounds to believe the investment could be injurious to Canada’s national security. This policy suggests that it applies regardless of the value, direct or indirect nature, controlling or non-controlling character, stage of the value chain of the investment, or country of origin of the investor.

Government orders divestiture of investments by three Chinese companies in Canadian critical minerals businesses

On November 2, 2022, further to the national security review provisions of the ICA, the Minister announced that the Canadian government had ordered three non-Canadian investors to completely divest their investments in Canadian critical minerals companies (specifically, lithium mining companies) under the ICA. The Chinese government has criticized the divestiture order as “unreasonably targeting Chinese companies.”

Blakes Notes

To read more thought-leadership insights from the Competition, Antitrust & Foreign Investment group, please click here.

Contact Us

If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Related Insights

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2026 Blake, Cassels & Graydon LLP