Welcome to the May issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- The number of completed merger reviews through the end of April 2022 (71) is above historical averages – the Bureau completed more reviews in the same period in only two of the past ten years: 2014 (73) and 2021 (79).

- The Competition Bureau entered into a consent agreement with GFL Environmental Inc. to resolve litigation related to GFL’s purchase of Terrapure Environmental Ltd.

- The Government of Canada has proposed amendments that would significantly expand the scope of the Canadian Competition Act.

- The Competition Bureau has challenged the proposed Rogers/Shaw merger, and is seeking an order from the Competition Tribunal preventing the merger from proceeding.

Merger Monitor

April 2022 Highlights

- 20 merger reviews completed

- Primary industries: construction (20 per cent), real estate and rental and leasing (15 per cent); professional, scientific and technical services (10 per cent); wholesale trade (10 per cent); finance and insurance (10 per cent); and manufacturing (10 per cent)

- One consent agreement (remedy) filed

- Eight transactions received an Advance Ruling Certificate (40 per cent), 11 transactions received a No Action Letter (55 per cent)

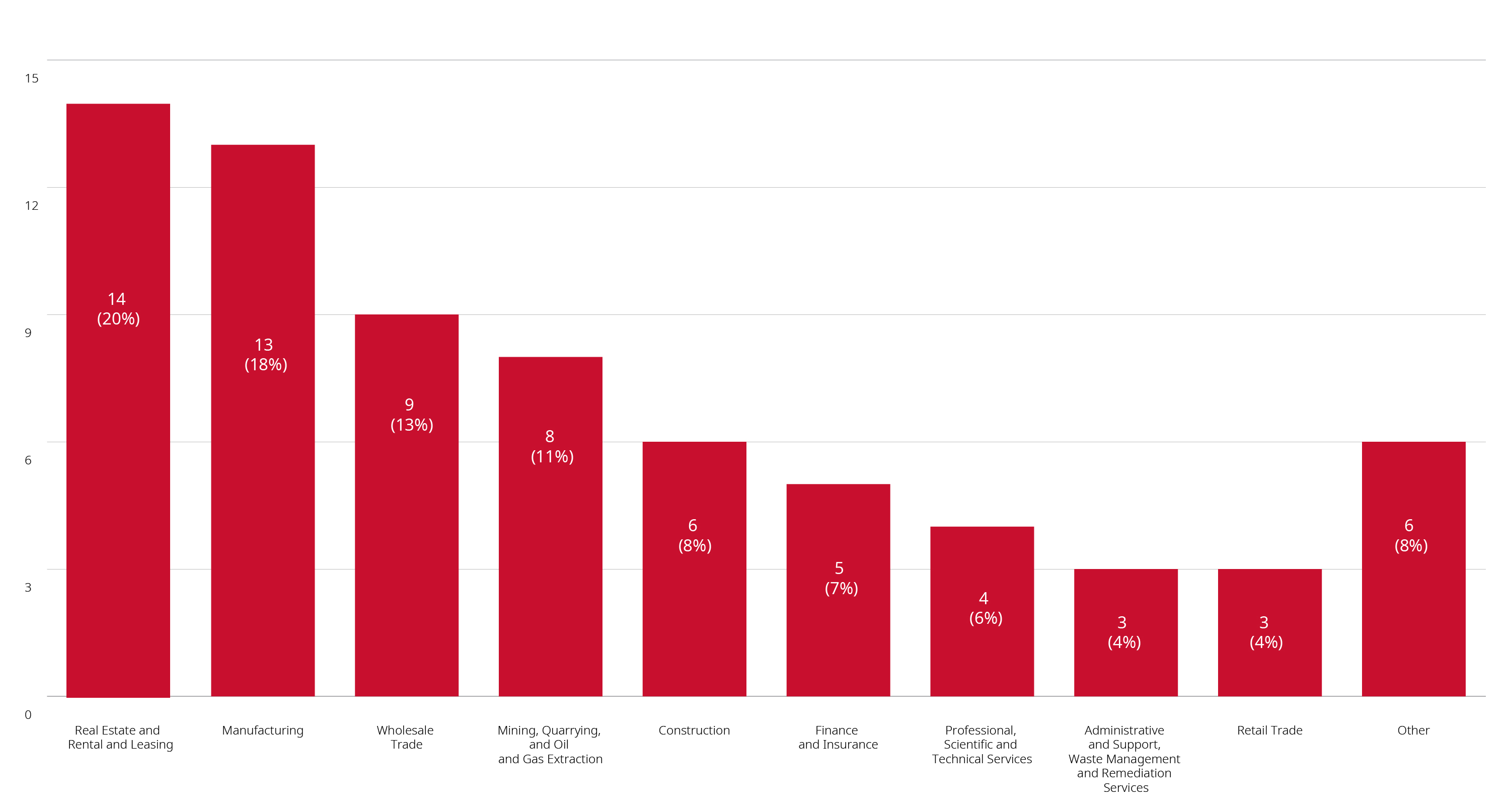

January – April 2022 Highlights

- 71 merger reviews completed

- Primary industries: real estate and rental and leasing (20 per cent); manufacturing (18 per cent); wholesale trade (13 per cent); mining, quarrying and oil and gas (11 per cent); and construction (eight per cent)

- One consent agreement (remedy) filed

- 40 transactions received an Advance Ruling Certificate (56 per cent) and 30 transactions received a No Action Letter (42 per cent)

Merger Enforcement

Competition Bureau seeks to block Rogers/Shaw merger

- In a press release dated May 9, 2022, the Bureau announced that it is seeking to block Rogers’ proposed acquisition of Shaw based on concerns that the potential merger would substantially prevent or lessen competition by (1) eliminating an established, independent and low-priced competitor, (2) preventing future competition for wireless services within and outside Shaw’s existing service area, and (3) preventing competition in wireless services for business customers in Ontario, Alberta and B.C. The Bureau further alleges that the potential merger has already led to a reduction of competition in the form of reduced investment by Shaw in its network and a reduction in Shaw’s marketing and promotional activity.

Competition Bureau reaches agreement with GFL Environmental Inc.

- On April 13, 2022, the Competition Bureau entered into a consent agreement with GFL Environmental Inc. to resolve concerns that GFL’s purchase of Terrapure Environmental Ltd. had substantially lessened competition in the markets for industrial waste services (IWS) and oil recycling services (ORS) in western Canada. Under the consent agreement, GFL has committed to sell seven of its IWS and ORS facilities to a buyer acceptable to the Commissioner. This agreement brings an end to the Bureau’s challenge of the transaction before the Competition Tribunal.

Other Enforcement Activity

Competition Bureau enters into consent agreement with NuvoCare Health Sciences Inc. and founder

- On April 27, 2022, the Competition Bureau entered into a consent agreement with NuvoCare Health Sciences Inc. and its founder to resolve allegations that the two made marketing claims that were not supported by adequate and proper testing. As part of the settlement, both NuvoCare and its founder have agreed to (1) pay C$100,000 in penalties, (2) change or remove all weight loss claims made about their products, and (3) establish and maintain a corporate compliance program to promote compliance with the law and prevent deceptive marketing issues in the future.

Non-Enforcement Activity

The Government of Canada has proposed amendments to the Competition Act

- In its Budget Implementation Act, 2022, the Government of Canada has proposed amendments that would significantly expand the scope of the Canadian Competition Act. These amendments are included in the Canadian Government’s budget legislation and are therefore likely to be enacted by the end of June. Key changes to the Competition Act include the introduction of criminal provisions to address agreements between employers to fix wages or to not hire or solicit each others’ employees (so-called “wage fixing” and “no-poach” agreements), an increase in the dollar amount of administrative monetary penalties available to address conduct such as deceptive marketing and abuse of dominance, and the introduction of a private right of action which would allow private parties (with leave) to bring abuse of dominance cases directly to the Competition Tribunal. For more information on the proposed amendments, please see our bulletin.

Senator Howard Wetston publishes commentary on the public consultation with respect to examining the Canadian Competition Act in the digital era

- Senator Howard Wetston has published commentary on a public consultation with respect to examining the Canadian Competition Act in the digital era that was launched in October 2021. Among other things, Senator Weston’s commentary identifies areas in which the consultation process attracted consensus on specific reforms to the Competition Act and recommends that the government move to implement these reforms, which include expanding the abuse of dominance provisions to prohibit conduct that harms competition but not competitors and increasing private parties’ access to the Competition Tribunal. The commentary also recommends that the government launch further consultation in areas that did not generate consensus, which include the goals the Competition Act should strive to achieve and the role of the efficiencies defence.

Investment Canada Act

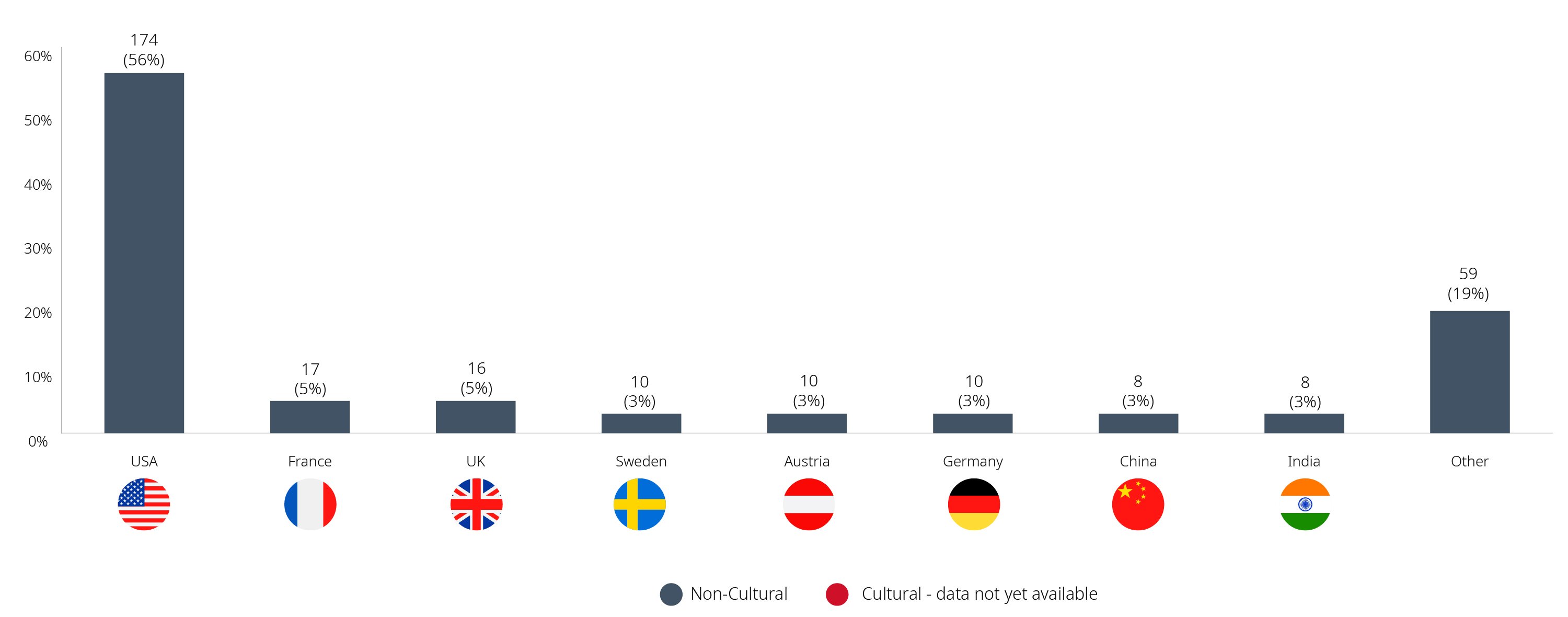

Non-Cultural Investments

March 2022 Highlights

- Zero reviewable investment approvals and 100 notifications filed (67 for acquisitions and 33 for the establishment of a new Canadian business)

- Country of origin of investor: U.S. (55 per cent); Germany (six per cent); India (five per cent); France (five per cent); China (four per cent); Hong Kong (four per cent)

January – March 2022 Highlights

- For non-cultural investments: zero reviewable investment approvals and 312 notifications filed (231 for acquisitions and 81 for the establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (56 per cent); France (five per cent); UK (five per cent); Sweden (three per cent); Austria (three per cent); Germany (three per cent); China (three per cent); India (three per cent)

Blakes Notes

Blakes Notes

- On Thursday, May 5, Blakes took home six awards at the 2022 Benchmark Litigation Canada Awards, including “Competition Law Firm of the Year”. Thank you to our clients and Benchmark Litigation for recognizing the strength of our work in this area. Read more here.

- For more information regarding the proposed changes to the Competition Act, please click here.

- To read more thought leadership insights from the Competition, Antitrust & Foreign Investment group, please click here.

- For the latest legal and business updates regarding COVID-19, visit our Resource Centre.

Contact Us

If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2024 Blake, Cassels & Graydon LLP