Blakes has a long history of supporting emerging and growth-stage companies across Canada.

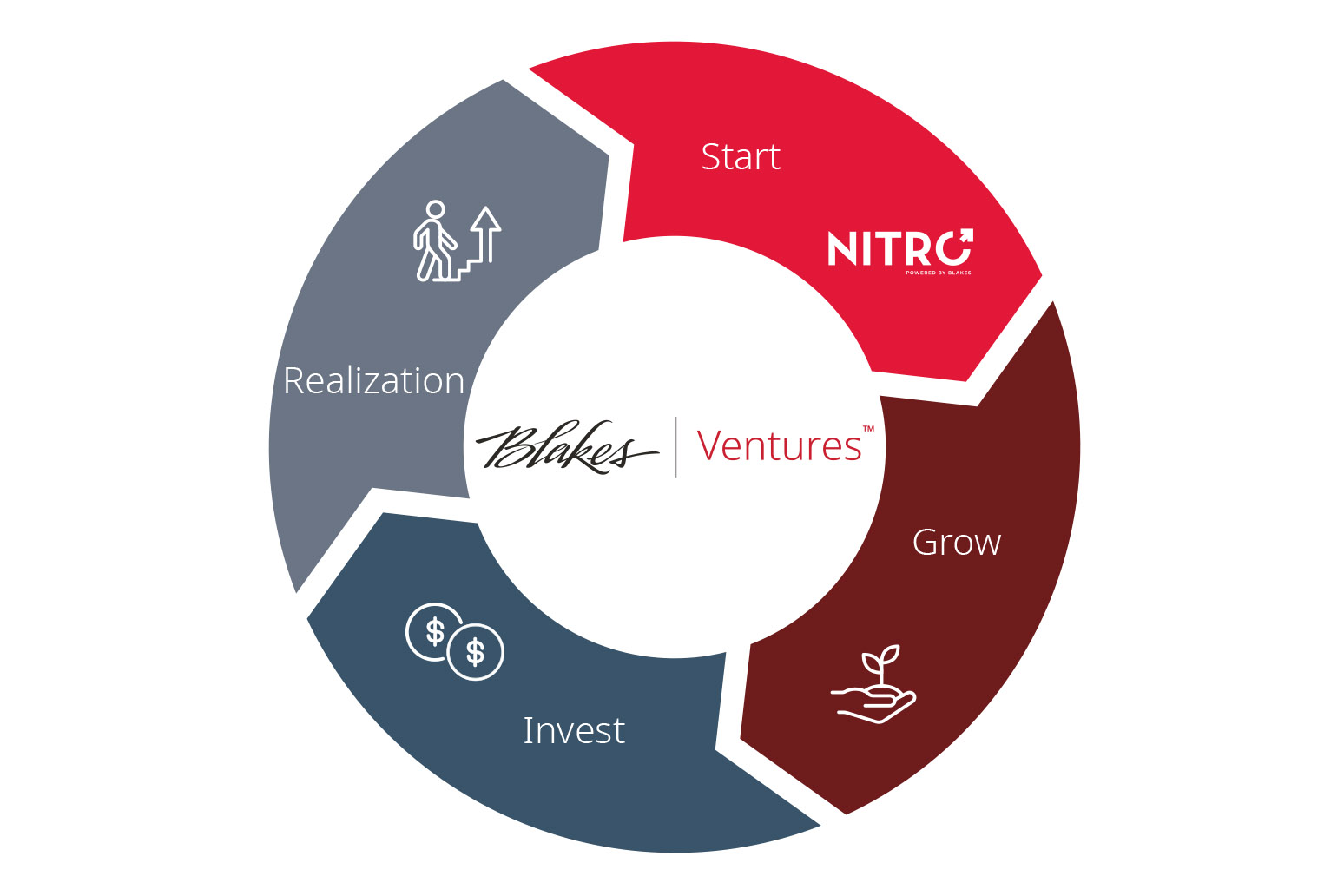

As one of Canada’s oldest law firms, we take great pride in working with Canadian entrepreneurs and international innovation leaders, supporting their businesses and strengthening their place in the global economy. Our Blakes Ventures services includes four areas of specific expertise:

Start

Emerging Companies

As a full-service business law firm, the Blakes Emerging Companies & Venture Capital group spans several specialty areas and provides strategic advice and legal counsel at each stage of a company’s lifecycle. This includes working with our clients on early- and idea-stage issues, intellectual property, incorporation, governance policies, management agreements, commercial agreements, employment advice and regulatory approvals.

In 2017, we launched Nitro powered by Blakes, an innovative platform that provides access to top-tier legal services for emerging technology companies in the pre-seed to growth stage. Nitro is designed to help guide and manage progress — and reduce cost and risk. As “fractional general counsel,” we provide Nitro clients with the same exceptional level of service and quality of work that we provide to our mature company clients, with custom service offerings that are unique to each client and their needs.

Grow

Financing Growth and Scaling Up

Growing businesses have growing legal needs, and our clients have unprecedented access to top talent, capital and other business resources. Our team has deep expertise to assist both growth-stage companies and investors with their growth strategies, including all stages of venture capital financial rounds and late-stage private financing that can rocket companies to the next level.

Invest

Sponsors and Investors

Raising funds can be challenging to navigate, but we can help. Our team draws on national experience working with fund sponsors on structuring and managing venture capital investment funds and other investment vehicles, including fund formation, management, shareholder and investment agreements, governance, regulatory compliance, and tax issues. We understand what a business needs to help it grow through venture capital opportunities.

We also work closely with investor clients, as both buyers and sellers, to provide advice when formulating an investment strategy and when sourcing, structuring and executing an investment-related transaction.

Realization

Exit Strategies and M&A

When a company is ready for take-off, we can help strategize the best way forward. Whether via an initial public offering (IPO), a sale transaction or a joint venture, we can help companies achieve their vision as they mature.

We regularly advise on IPOs, secondary offerings, rights issues, follow-on offerings and private placements, as well as equity-linked transactions. In addition, we draw on team members with specialized experience to counsel our clients on tax issues, corporate governance and regulatory compliance matters associated with equity offerings. Clients seek our representation in connection with listings on all Canadian stock exchanges and Canadian aspects of international listings and offerings, including those on the New York Stock Exchange, Nasdaq and the Hong Kong Stock Exchange, as well as transactions involving the London Stock Exchange's alternative investment market and offshore private placements.

Our Private M&A team leads the market in Canada with an industry-focused approach and multidisciplinary specialists. For our clients, this means we have a better understanding of their business, strategic objectives and challenges. It also means we work with the right partners in the right industries, especially those that are highly regulated such as financial services, life sciences, food and beverage, renewable power, gaming, insurance, among others.

Emerging Company Financings

-

Canada Growth Fund Inc. in respect of its C$90-million investment in Eavor Technologies Inc.’s Series B equity round

-

Autoleap Inc. on its C$40-million series B financing round.

-

Ostara Nutrient Recovery Technologies Inc. on its US$70-million series C equity funding.

-

Bolt Technologies Incorporated on its C$75-million in a preferred share financing co-led by Yaletown Venture Partners.

-

venBio Partners LLC on its C$23-million minority investment in 35Pharma Inc.

-

Centana Growth Partners, as lead investor, on the C$27-million series B financing of Plooto Inc.

-

Thentia on its C$10-million series B1 funding round led by private equity firms Spring Mountain Capital and BDC Capital.

-

KOHO Financial Inc., on its C$70-million series C investment from TTV Capital, Drive Capital and Portag3.

-

Notch Therapeutics Inc. on its US$85-million series A financing.

-

Diggs Inc. on its US$13-million series A investment round led by Venn Growth Partners with backing by Strand Equity.

-

AutoLeap Inc. on its C$18-million series A investment round led by Bain Capital Ventures.

-

Railz.ai on its US$12-million series A funding, led by Nyca Partners, with participation from Susa Ventures, Vestigo Ventures, Entrée Capital Global Founders Capital, Plug and Play Ventures, N49P, and Hack VC.

-

Svante Inc. on its US$75-million series D equity financing.

-

Grayhawk Investment Strategies Inc. on its C$13-million series B financing leg by Sagard Holdings Inc.

-

League, Inc. on its US$95-million series C financing investment from TDM Growth Partners and Workday Ventures.

-

Bolt Technologies Inc. (f.k.a. Second Closet) on its C$115-million series B financing round led by Yaletown Partners, with participation from Ingka Investments (the investment arm of IKEA) and existing investors, including Whitecap Venture Partners and Intact Ventures.

-

Cinchy Inc. on its C$10-million series A investment round led by Information Venture Partners.

-

Blueprint Software Systems Inc. on its series D preferred share financing.

-

Hi Mama Inc., on its C$70-million series B round led by Bain Capital Double Impact, including existing investors Round13 Capital and BDC Capital’s Women in Technology Venture Fund.

-

Knix Wear Inc. on its C$53-million series B round let by TZP Group.

-

Vena Medical on its C$6.5-million series A venture financing round.

-

Zymeworks Inc. on its private placement of class A preferred shares for aggregate gross proceeds of US$61-million.

-

Various emerging companies, including BitCine Technologies, IncWisedocs, Curv Labs Inc., PolicyMe Corp., Knockri Inc., Get Synapse, Inc., Senso.ai and Final Blueprint Inc. (doing business as Willful), on their seed financing rounds as well as general corporate and commercial matters.

Venture Capital and Sector Investments

-

GGV Capital in their investment in Arteria AI, a company that sells AI-powered software designed to help financial institutions generate, collaborate on, and analyze various documents

-

The Special Committee of the Board of Directors of IOU Financial Inc. in the sale of the Company to 9494-3677 Québec Inc., a corporation created by a group composed of funds managed by Neuberger Berman, Palos Capital and Fintech Ventures

-

Fonds de solidarité FTQ on its investment in NuChem Sciences Inc. in connection with NuChem’s acquisition of IniXium

-

McCain Foods Limited on the C$50-million investment round in Simulate Labs and related commercial matters.

-

An investor on its US$95-million investment in ApplyBoard Inc.'s series D financing.

-

The lead investor in Tenstorrent Inc.’s series C financing for over US$200-million, valuing Tenstorrent at US$1-billion.

-

Caisse de dépôt et placement du Québec, Investissement Québec and other participants on their investment in Inovia Capital’s C$450-million backing of domestic tech champions.

-

Koru, a groundbreaking venture foundry created by the Ontario Teachers’ Pension Plan, on various investments and other matters, including investments in Elovee and Fyld.

-

Entrepreneur First on its expansion into Canada and development of Canadian investment documents.

-

McCain Foods Ltd. on its investments in TruLeaf, a leading vertical farming venture, and NUGGS Labs, a plant-based chicken nugget producer.

-

Caisse de dépôt et placement du Québec on several investments in venture and technology enterprises.

-

Nutrien Ltd. on the formation of a partnership by entering into a limited partnership agreement with Radicle Growth Management, LLC, a San Diego-based acceleration fund focused on agtech and food tech.

-

The majority investor on various investments in Wealthsimple, one of Canada’s leading fintech companies.

-

Whitecap Venture Partners on its C$10-million series A investment in Nicoya Lifesciences Inc.

-

Mantella Venture Partners on numerous investments, including Ritual Technologies Inc. and Felix Health.

-

Cowen Healthcare Investments on its approximately US$82.5-million series B financing of Repare Therapeutics Inc.

-

Khosla Ventures on various investments, including in Meta Inc., Indigo Fair, Deep Genomics and Casca Designs Inc.

-

Perceptive Xontogeny Venture Fund, LP on its US$21-million series A venture capital investment in Zucara Therapeutics Inc.

-

BDC Capital on its co-investment with ACE Equity Partners in Preciseley Microtechnology Corporation, and ACE Equity Partners on related Canadian regulatory matters.

M&A and Exits

-

Canadian counsel to Elastic N.V. on its acquisition of CmdWatch Security Inc.

-

SecureWorks Corp. on its acquisition, through one of its wholly owned subsidiaries, of all outstanding and issued shares in the capital of Delve Laboratories Inc.

-

Kognitiv Corporation on its C$525-million acquisition of Aimia Inc.’s Loyalty Solutions business.

-

Great Hill Partners on the C$126-million acquisition of VersaPay Corporation.

-

FLIR Systems, Inc. on its US$200-million acquisition of Aeryon Labs Inc.

-

The Toronto-Dominion Bank on its acquisitions of artificial intelligence firm Layer 6 Inc. and asset management firm Greystone Capital Management.

-

Audax Group, Inc. on its acquisition of EIS, Inc.

-

Rover Parking Inc. on its acquisition by SpotHero, Inc.

-

Rank Software Inc. on its acquisition by Arctic Wolf Networks Inc.

-

Encycle Therapeutics and its investors on a sale process and their ultimate sale to Zealand Pharma

Practice Areas

People

-

Justin DrakePartner | Toronto

Justin DrakePartner | Toronto -

Robert FrazerPartner | Toronto

Robert FrazerPartner | Toronto -

Michael HickeyPartner | Toronto

Michael HickeyPartner | Toronto -

Christopher JonesPartner | Toronto

Christopher JonesPartner | Toronto -

Robert PercivalPartner | Toronto

Robert PercivalPartner | Toronto -

Brittany ShamessPartner | Toronto

Brittany ShamessPartner | Toronto -

Marko TrivunPartner | Toronto, Ottawa

Marko TrivunPartner | Toronto, Ottawa -

Joshua WhitfordPartner | Toronto

Joshua WhitfordPartner | Toronto -

Mark MohamedAssociate | Toronto

Mark MohamedAssociate | Toronto -

Karam PutrosAssociate | Toronto

Karam PutrosAssociate | Toronto -

Sondra RebenchukSenior Innovation Counsel | Toronto

Sondra RebenchukSenior Innovation Counsel | Toronto -

Laurie WrightPatent Agent/Trademark Agent | Toronto

Laurie WrightPatent Agent/Trademark Agent | Toronto

-

Chris HarrisPartner | Calgary

Chris HarrisPartner | Calgary -

Daniel McLeodPartner | Calgary

Daniel McLeodPartner | Calgary -

Christine MillikenPartner | Calgary

Christine MillikenPartner | Calgary -

Lindsay HoferAssociate | Calgary

Lindsay HoferAssociate | Calgary

-

Emma CostantePartner | Vancouver

Emma CostantePartner | Vancouver -

Evan StraightPartner | Vancouver

Evan StraightPartner | Vancouver -

Arik BroadbentCounsel | Vancouver

Arik BroadbentCounsel | Vancouver

-

François AugerPartner | Montréal

François AugerPartner | Montréal -

Sunny HandaPartner | Montréal

Sunny HandaPartner | Montréal -

Julien MichaudPartner | Montréal

Julien MichaudPartner | Montréal -

Alexe Corbeil-CourchesneAssociate | Montréal

Alexe Corbeil-CourchesneAssociate | Montréal -

Jordan FurfaroAssociate | Montréal

Jordan FurfaroAssociate | Montréal -

Connor MunroAssociate | Montréal

Connor MunroAssociate | Montréal -

Stefan VrinceanuAssociate | Montréal

Stefan VrinceanuAssociate | Montréal

-

Marko TrivunPartner | Toronto, Ottawa

Marko TrivunPartner | Toronto, Ottawa

-

François AugerPartner | Montréal

François AugerPartner | Montréal -

Emma CostantePartner | Vancouver

Emma CostantePartner | Vancouver -

Justin DrakePartner | Toronto

Justin DrakePartner | Toronto -

Robert FrazerPartner | Toronto

Robert FrazerPartner | Toronto -

Sunny HandaPartner | Montréal

Sunny HandaPartner | Montréal -

Chris HarrisPartner | Calgary

Chris HarrisPartner | Calgary -

Michael HickeyPartner | Toronto

Michael HickeyPartner | Toronto -

Christopher JonesPartner | Toronto

Christopher JonesPartner | Toronto -

Daniel McLeodPartner | Calgary

Daniel McLeodPartner | Calgary -

Julien MichaudPartner | Montréal

Julien MichaudPartner | Montréal -

Robert PercivalPartner | Toronto

Robert PercivalPartner | Toronto -

Brittany ShamessPartner | Toronto

Brittany ShamessPartner | Toronto -

Evan StraightPartner | Vancouver

Evan StraightPartner | Vancouver -

Marko TrivunPartner | Toronto, Ottawa

Marko TrivunPartner | Toronto, Ottawa -

Joshua WhitfordPartner | Toronto

Joshua WhitfordPartner | Toronto -

Arik BroadbentCounsel | Vancouver

Arik BroadbentCounsel | Vancouver -

Alexe Corbeil-CourchesneAssociate | Montréal

Alexe Corbeil-CourchesneAssociate | Montréal -

Jordan FurfaroAssociate | Montréal

Jordan FurfaroAssociate | Montréal -

Lindsay HoferAssociate | Calgary

Lindsay HoferAssociate | Calgary -

Mark MohamedAssociate | Toronto

Mark MohamedAssociate | Toronto -

Connor MunroAssociate | Montréal

Connor MunroAssociate | Montréal -

Karam PutrosAssociate | Toronto

Karam PutrosAssociate | Toronto -

Sondra RebenchukSenior Innovation Counsel | Toronto

Sondra RebenchukSenior Innovation Counsel | Toronto -

Stefan VrinceanuAssociate | Montréal

Stefan VrinceanuAssociate | Montréal -

Christine MillikenPartner | Calgary

Christine MillikenPartner | Calgary -

Laurie WrightPatent Agent/Trademark Agent | Toronto

Laurie WrightPatent Agent/Trademark Agent | Toronto

.jpg.aspx?width=1548&height=1032&ext=.jpg)