Welcome to the February issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition and foreign investment law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- The Bureau cautions businesses about liability under the Competition Act (Act) for employees posting false or misleading online reviews.

- A settlement agreement between Construction DJL Inc. and the Public Prosecution Service of Canada brings the Bureau’s bid-rigging investigation to a conclusion.

- The thresholds for “net benefit to Canada” review under the Investment Canada Act for 2024 are released.

Merger Monitor

January 1 – January 28, 2024, Highlights

- 16 merger reviews started, 21 merger reviews completed

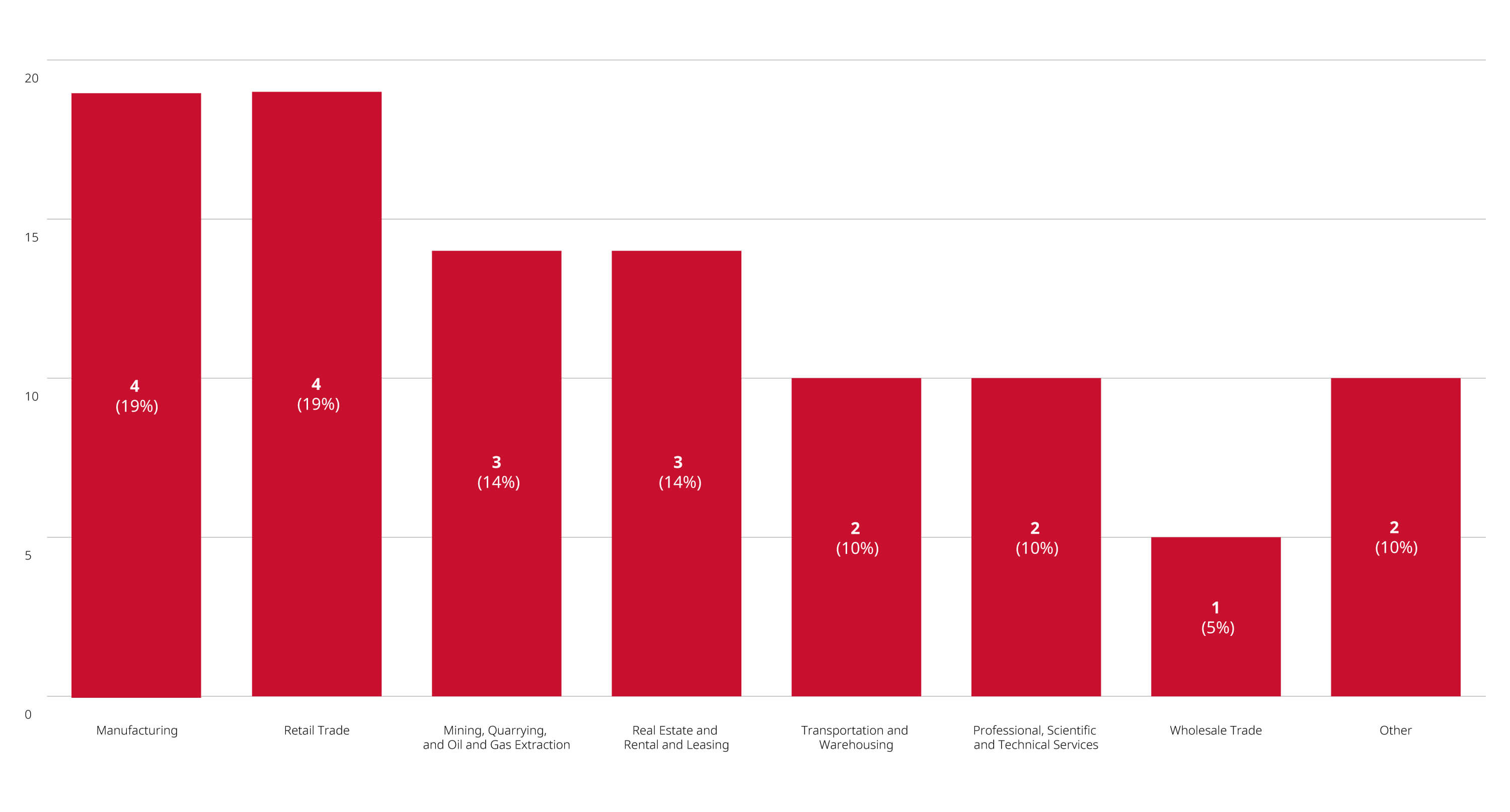

- Primary Industries: manufacturing (19%); retail trade (19%); real estate and rental and leasing (14%); mining, quarrying, and oil and gas extraction (14%)

- 12 transactions received an Advance Ruling Certificate (57%), eight transactions received a No Action Letter (38%), and one transaction was resolved through other means (5%)

- Zero consent agreements (remedies) filed

- Zero judicial decisions filed

Merger Reviews Completed Through January 28, 2024, by Primary Industry

Enforcement Activity

Construction DJL Inc. to pay C$1.5-million in bid-rigging settlement

- On January 15, 2024, the Bureau announced that road construction company Construction DJL Inc. (DJL) had entered into a settlement agreement with the Public Prosecution Service of Canada for bid-rigging related to the ministère des Transports du Québec paving contracts in Quebec’s Granby region. As part of this settlement, DJL has agreed to pay a C$1.5-million fine and follow its corporate compliance program. The settlement agreement brings the Bureau’s investigation into DJL’s role in the 2008–2009 bid-rigging scheme to an end.

Non-Enforcement Activity

Bureau encourages businesses to provide employee training regarding posting online reviews

- On January 18, 2024, the Bureau warned businesses against posting or permitting their employees to post false or misleading online reviews about their respective company or its competitors. Under the misleading advertising provisions of the Act, businesses can become liable for writing or permitting the writing of online reviews that give a false or misleading impression to consumers. In addition to a robust compliance program, the Bureau encourages businesses to train employees to provide truthful and transparent reviews about their company or its competitors, and to provide full disclosure about the connections they have with the business, product, or service they are promoting — even when providing their honest opinions.

Bureau launches new Compliance Hub

- On January 17, 2024, the Bureau launched its new Compliance Hub, incorporating feedback received from the Bureau’s Consultation on the New Compliance Portal. The Compliance Hub introduces a more user-friendly format for businesses to learn about the competition laws (and related laws) that the Bureau enforces, how the laws apply to their respective businesses, and how to create and implement effective compliance programs.

Bureau revises Merger Review Process Guidelines

- On January 16, 2024, the Bureau revised its Merger Review Process Guidelines, to reflect amendments made to the Act under Bill C-56. Specifically, the Bureau removed all references to the efficiencies defence. The efficiencies defence, which allowed mergers that resulted in economic efficiency gains to proceed if those gains outweighed any anti-competitive effects resulting from the merger, was repealed effective December 15, 2023.

Legislation Watch

House of Commons resumes second reading of Bill C-59

- On January 29, 2024, Parliamentary debate in the House of Commons on Bill C-59 resumed. Bill C-59 includes proposed amendments to the Act previewed in the government’s Fall Economic Statement. Among other things, the proposed amendments will (1) significantly expand the scope of conduct subject to private access and potential remedies available to private parties, (2) introduce administrative monetary penalties and the potential for divestiture orders with respect to joint ventures and other non-merger agreements, (3) expand the scope of the merger notification requirements, (4) establish a right to repair, and (5) address misleading environmental claims (known as greenwashing). For more information on the amendments, please see our November 30, 2023 Blakes Bulletin: Revamping the Rules: Canadian Competition Act Update and our November 23, 2023 Blakes Bulletin: Competition Law Update: Further Changes Coming to the Competition Act.

Canadian Senate’s Banking, Commerce and Economy Standing Committee to debate Bill C-34

- The Canadian Senate’s Standing Committee on Banking, Commerce and the Economy is scheduled to debate Bill C-34 on February 8, 2024. Bill C-34 proposes to introduce a new mandatory pre-closing filing requirement for specified investments by non-Canadians in certain business sectors (which will be identified in regulations), provide the relevant minister authority to accept undertakings during a national security review, and remove the threshold for review of investments by state-owned enterprises from countries without trade agreements with Canada. For more information on Bill C-34, please see our December 7, 2022 Blakes Bulletin: Canadian Government Proposes Important Changes to Expand National Security Review Powers Under the Investment Canada Act and our April 4, 2023 Blakes Seminar: Sweeping Changes to Canada's Competition and Foreign Investment Rules.

Investment Canada Act

Non-Cultural Investments

December 2023 Highlights

- One reviewable investment approval, 81 notifications filed (65 filed for acquisitions and 16 for the establishment of a new Canadian business)

- Country of ultimate control: United States (53%); United Kingdom (9%); France (6%)

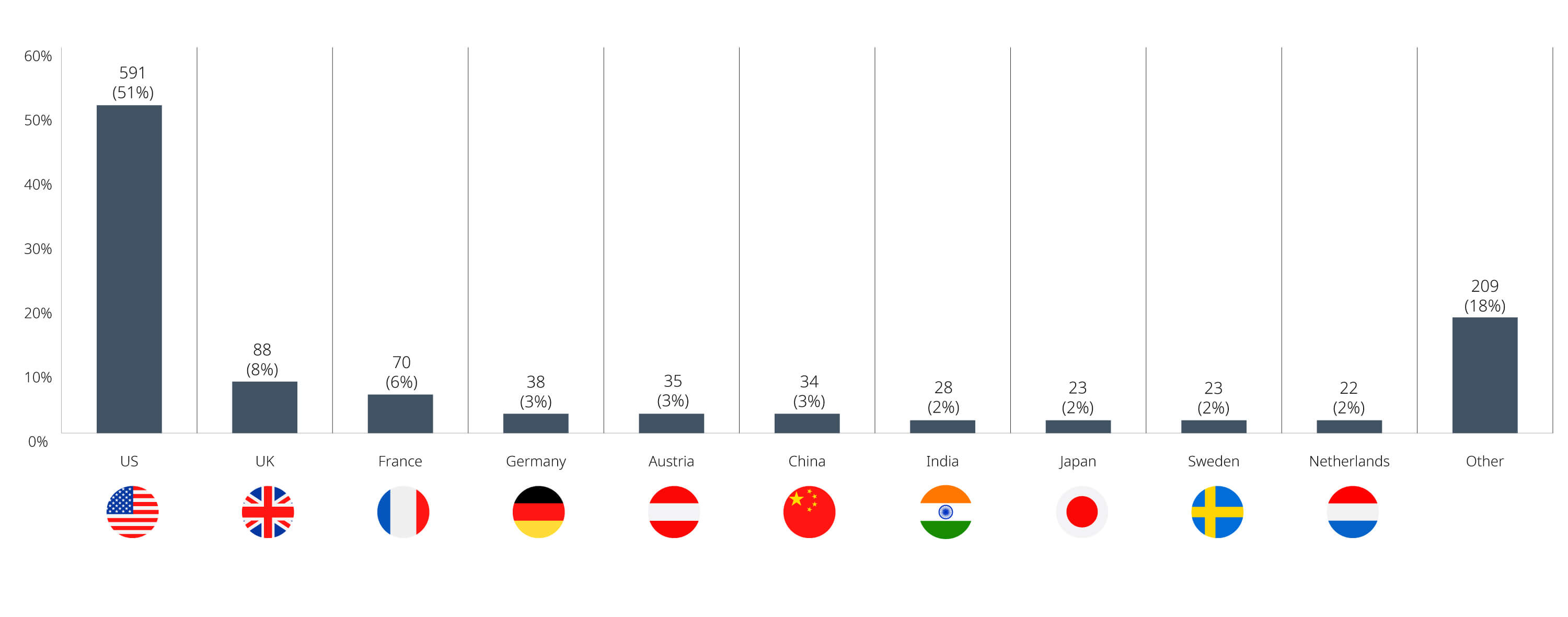

2023 Highlights

- Seven reviewable investment approvals and 1,154 notifications filed (872 for acquisitions and 282 for the establishment of a new Canadian business)

- Country of ultimate control: U.S. (51%); U.K. (8%); France (6%); Austria (3%); China (3%); Germany (3%)

Government of Canada publishes updated thresholds for Investment Canada Act “net benefit to Canada” reviews

- The Government of Canada has released the 2024 thresholds that will determine whether investments by foreign investors will be subject to a pre-closing “net benefit to Canada” review, subject to publication in the Canada Gazette:

- The threshold for investors that are not state-owned enterprises based in countries party to a trade agreement with Canada increased to C$1.989-billion in enterprise value (from C$1.931-billion). This threshold applies to investors based in countries party to the following trade agreements:

- Canada-United States-Mexico Agreement (CUSMA)

- Canada-UK Trade Continuity Agreement (Canada-UK TCA)

- Canada-European Union: Comprehensive Economic and Trade Agreement (CETA)

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

- Canada-Chile Free Trade Agreement

- Canada-Peru Free Trade Agreement

- Canada-Colombia Free Trade Agreement

- Canada–Panama Free Trade Agreement

- Canada-Honduras Free Trade Agreement

- Canada-Korea Free Trade Agreement (CKFTA)

- The threshold for investors that are not state-owned enterprises based in other World Trade Organization countries increased to C$1.326-billion in enterprise value (from C$1.287-billion).

- The threshold for state-owned enterprise investors from World Trade Organization countries increased to C$528-million in book value of assets of the Canadian business being acquired (from C$512-million).

- The threshold for all investors in a cultural business and all investors that are not World Trade Organization countries remained at C$5-million in book value of assets of the Canadian business being acquired.

- The threshold for investors that are not state-owned enterprises based in countries party to a trade agreement with Canada increased to C$1.989-billion in enterprise value (from C$1.931-billion). This threshold applies to investors based in countries party to the following trade agreements:

Cultural Investments

January – March 2023 Highlights

- One reviewable investment approval and three notifications filed (two for acquisitions and one for the establishment of a new Canadian business)

- Country of origin of investor: U.S. (75%); India (25%)

Cultural Sector Investment Review clarifies the applicability of the Related Business Guidelines to foreign investments in Canada’s cultural sector

- The Cultural Sector Investment Review (CSIR) has published an interpretation note confirming the applicability of the Related Business Guidelines to foreign investments in Canada’s cultural sector. Specifically, CSIR clarified that the establishment of a new Canadian business related to an existing Canadian business already controlled by a foreign investor will be subject to mandatory notification under section 11 of the Investment Canada Act. This will apply even where the new Canadian Business is related to the business of a foreign investor that has previously notified or been subject to review by the Minister of Canadian Heritage. Additionally, CSIR confirmed that the continuation of an existing business (primarily through reorganizations or expansion) due to new personnel, new premises, or internal reorganization, will not constitute the establishment of a new business.

Blakes Notes

- On February 12, 2024, Blakes published Canadian Competition Law Outlook: Continued Expansion and Increased Enforcement as Reforms Continue to Take Shape in 2024. The trends piece looks at the key trends in Canadian competition law and the practical implications for businesses in Canada.

- On January 22, 2024, Blakes published the latest edition of Competition Law Investigations and Compliance: A Toolkit for Managing Risk. The toolkit outlines the types of Competition Bureau investigations a company may face and offers practical guidance on what to do if an investigation is initiated.

- Browse our thought-leadership insights from the Competition, Antitrust & Foreign Investment group to learn more.

Contact Us

If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Related Insights

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2026 Blake, Cassels & Graydon LLP