Welcome to the June issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition and foreign investment law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- Merger review activity in 2025 is slightly up compared to the last two years, with the Bureau completing 82 merger reviews through the end of May, a 9% increase from the 75 completed through each of May 2024 and April 2023. Merger reviews resulting in No Action Letters have also risen to 61%, compared to 55% through May 2024 and 53% through December 2024.

- The United States remains the most common investor country of ultimate control for non-cultural investments, representing 55% of all Investment Canada Act notifications and approved net benefit applications through April 2025, which is a three-percentage point decrease from 58% through April 2024, and is consistent with 55% through April 2023. Germany has the second-highest proportion of notifications and approved net benefit applications through April 2025 (8%).

- The Commissioner of Competition (Commissioner) files a motion to strike Google’s constitutional challenge.

- The Bureau publishes greenwashing and competitor property control guidelines.

- The Bureau publishes an updated Market Studies Information Bulletin.

- New members of cabinet are appointed following Canada’s federal election.

Competition Act

Merger Monitor

May 1 – May 31, 2025 Highlights

- 19 merger reviews announced, 10 merger reviews completed

- Primary industries of completed reviews: finance and insurance (30%); mining, quarrying, and oil and gas extraction (20%); transportation and warehousing (20%); agriculture, forestry, fishing and hunting (10%); wholesale trade (10%); real estate and rental and leasing (10%)

- Five transactions received a No Action Letter (50%), four transactions received an Advanced Ruling Certificate (40%), one transaction was resolved through other means

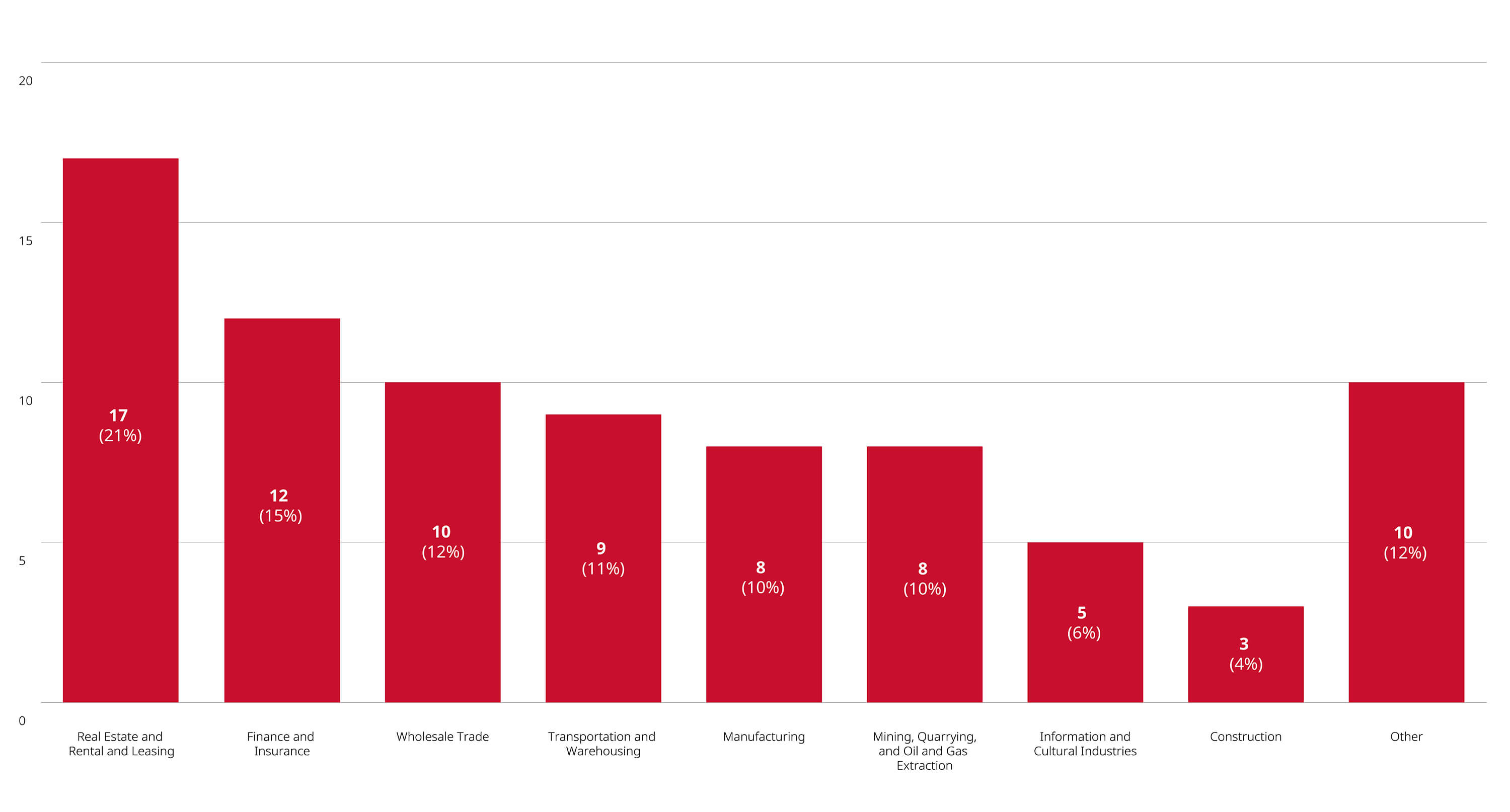

January – May 31, 2025 Highlights

- 83 merger reviews announced, 82 merger reviews completed

- Primary industries of completed reviews: real estate and rental and leasing (21%); finance and insurance (15%); wholesale trade (12%); transportation and warehousing (11%); manufacturing (10%); mining, quarrying, and oil and gas extraction (10%)

- 50 transactions received a No Action Letter (61%); 28 transactions received an Advance Ruling Certificate (34%); three transactions were resolved through other means; one transaction was abandoned by the merging parties

Merger Reviews Completed Year to Date Through May 31, 2025, by Primary Industry

Enforcement Activity

Commissioner Files Motion to Strike Google’s Proposed Constitutional Challenge

- On June 4, 2025, the Commissioner filed a notice of motion and supporting factum to the Competition Tribunal (Tribunal) in response to Google Canada Corporation and Google LLC (Google)’s proposed constitutional challenge. On November 28, 2024, the Commissioner filed a notice of application against Google, which alleged that Google abused its dominant position through anti-competitive practices relating to its advertising technology tools. The Commissioner is seeking an administrative monetary penalty (AMP) in an amount equal to three times the value of the benefit allegedly derived from Google’s purported anti-competitive practices or, if that amount cannot be reasonably determined, 3% of Google’s worldwide gross revenues. In response, Google filed a notice of constitutional question, which challenged the validity of the provision that allows for such an AMP to be sought. In its notice of motion and factum, the Commissioner states that there is no legal basis for the proposed constitutional challenge to proceed and argues, among other things, that (1) a general claim for relief in a pleading cannot give rise to a breach of rights; (2) the constitutional challenge ignores the legislative scheme that provides discretion to the Tribunal to order payment of, and the amount of an AMP; and (3) the constitutional challenge is purely speculative because no actual AMP amount has been considered or awarded. For more information on the abuse of dominance proceedings against Google, see the Blakes Competitive Edge™: May 2025 Update.

Non-Enforcement Activity

New Competition Act Private Access Regime Begins June 20, 2025

- On June 20, 2025, significant amendments to the Competition Act's (Act) private access regime will come into effect. These changes include: (1) a new right for private parties to make an application to the Tribunal (with leave) concerning violations of the civil deceptive marketing and collaboration provisions of the Act; (2) a lowered threshold for leave requiring that private parties only show either (i) that their application is in the public interest or, for applications brought concerning the Act’s refusal to deal, exclusive dealing, market restriction, tied selling, abuse of dominance and collaboration provisions, (ii) that their business is substantially affected in part, rather than in whole; and (3) a new disgorgement remedy for successful private parties in an amount up to the benefit derived from the refusal to deal, price maintenance, exclusive dealing, market restriction, tied selling, abuse of dominance and collaboration conduct. These amendments were adopted in June 2024 with implementation delayed by one year; for more information regarding the June 2024 amendments to the Act, see our June 2024 bulletin Canadian Competition Law Changes Now in Force.

Bureau Releases Discussion Paper on Algorithmic Pricing

- On June 10, 2025, the Bureau released a discussion paper about algorithmic pricing in connection with a related public consultation. Algorithmic pricing refers to the practice of using algorithms to set prices for products or services. The discussion paper does not include policy recommendations or enforcement guidelines; rather, it is part of the Bureau’s process of building an understanding of algorithmic pricing so that the Bureau can respond to the growing practice. The first section of the discussion paper explains (1) what algorithmic pricing is, (2) how it works, (3) what type of data is used, and (4) where the data comes from. The second section of the discussion paper identifies potential issues under the Act that can be created by algorithmic pricing, including (1) algorithmic price-fixing and competitor collaborations, (2) enabling the practice of anti-competitive acts, and (3) deceptive marketing practices. The second section also considers how algorithmic pricing can affect competitive market entry, personalized prices, consumer switching, innovation and market efficiency. Interested parties are invited to submit responses to the Bureau’s consultation online until July 22, 2025.

Bureau Publishes Final Greenwashing Guidelines

- On June 5, 2025, the Bureau published final guidelines and a corresponding backgrounder on how it will handle matters under the Act’s provisions that relate to environmental claims. The guidelines outline the relevant civil provisions of the Act and their implications for environmental claims. They also include suggested principles for businesses to keep in mind when assessing whether their environmental claims are contrary to the Act. These principles include: (1) environmental claims should be truthful, and not false or misleading; (2) environmental benefits of a product and performance claims should be adequately and properly tested; (3) comparative environmental claims should be specific about what is being compared; (4) environmental claims should avoid exaggeration; (5) environmental claims should be clear and specific, not vague; and (6) environmental claims about the future should be supported by substantiation and a clear plan. In its backgrounder, the Bureau sets out responses on recurring themes that are not reflected in the final guidelines, including (1) whether the Bureau should specify the exact types of environmental claims that can be made; (2) whether the Bureau should act beyond its scope of authority in relation to greenwashing practices; and (3) whether the deceptive marketing provisions of the Act should be interpreted in the same manner as security laws. For more information about the final greenwashing guidelines, see our bulletin Competition Bureau Releases Guidelines on Environmental Claims.

Bureau Publishes Final Guidelines on Real Estate Property Controls

- On June 4, 2025, the Bureau announced that it had published final guidelines on competitor property controls, following a public consultation on its draft guidelines that closed in October 2024. The guidelines follow changes to the Act’s civil competitor collaboration provisions to include agreements that are not between competitors (e.g., vertical agreements between landlords and tenants) if a significant purpose of all or part of the agreement is to prevent or lessen competition. The guidance focuses on two types of competitor property controls: (1) exclusivity clauses in commercial leases, which limit the extent to which the property can be used by a tenant’s competitor; and (2) restrictive covenants, which are restrictions attached to land that prevent purchasers or owners of commercial property from certain uses. In its guidelines, the Bureau identifies three factors that it will use to assess whether a competitor property control is justified: (1) timeframe: whether the property control will only last as long as is necessary to incentivize entry or investment; (2) geographic area: whether the property control covers the smallest geographic area necessary; and (3) products and services: whether the property control unnecessarily limits the products or services that a competitor can offer. The guidelines also outline the Bureau's enforcement approach to property controls under the abuse of dominance and competitor collaboration provisions of the Act. For more information about the final guidelines on real estate property controls, see our bulletin Competition Bureau Issues Final Guidelines on Real Estate Property Controls.

Bureau Publishes Updated Market Studies Information Bulletin

- On May 20, 2025, the Bureau published an updated Market Studies Information Bulletin, which replaces the 2018 edition. Amendments to the Act that took effect in December 2023 gave the Bureau wide-ranging market study powers to investigate industries or specific market participants and seek court orders compelling relevant businesses to produce documents, data and written submissions, or participate in oral examinations. The findings of market studies are published on the Bureau’s website. The Market Studies Information Bulletin sets forth: (1) the steps taken before launching a market study; (2) how a market study is launched and how long it will take; (3) how the Bureau obtains and uses information collected during a market study, including confidential information; (4) the potential outcomes of a market study; and (5) how the impact of a market study is monitored. For more information about the Bureau’s market study powers, see the Blakes Market Studies Toolkit. Details of the Bureau’s use of its expanded market study powers to examine the airline industry can be found in the Blakes Competitive Edge™: May 2024 Update.

Bureau Releases 2025-2026 Annual Plan

- On May 15, 2025, the Bureau published its 2025-2026 Annual Plan. The plan sets forth the three pillars of the Bureau’s strategic vision — enforcement, promoting competition and investing in the Bureau as an organization — and the steps it intends to take to achieve these aims. Among other priorities, the Bureau expressed a desire to (1) use its enforcement tools to address anti-competitive activity in sectors of focus, including online marketing, artificial intelligence, telecommunications, financial services, health, and infrastructure; (2) prioritize investigations of conduct and mergers that increase the cost of living, as well as crack down on greenwashing and drip pricing; (3) champion a whole-of-government approach to competition; (4) launch a consultation and initiate research on algorithmic pricing; and (5) launch a new market study.

Investment Canada Act

Foreign Investment Monitor

Cultural Investments

Q4 Highlights

- Four reviewable investment approvals and four notifications filed (two filed for acquisitions, two for the establishment of a new Canadian business)

- Country of ultimate control: United States (50%); Turkey (13%); Hungary (13%); Sweden (13%); France (13%)

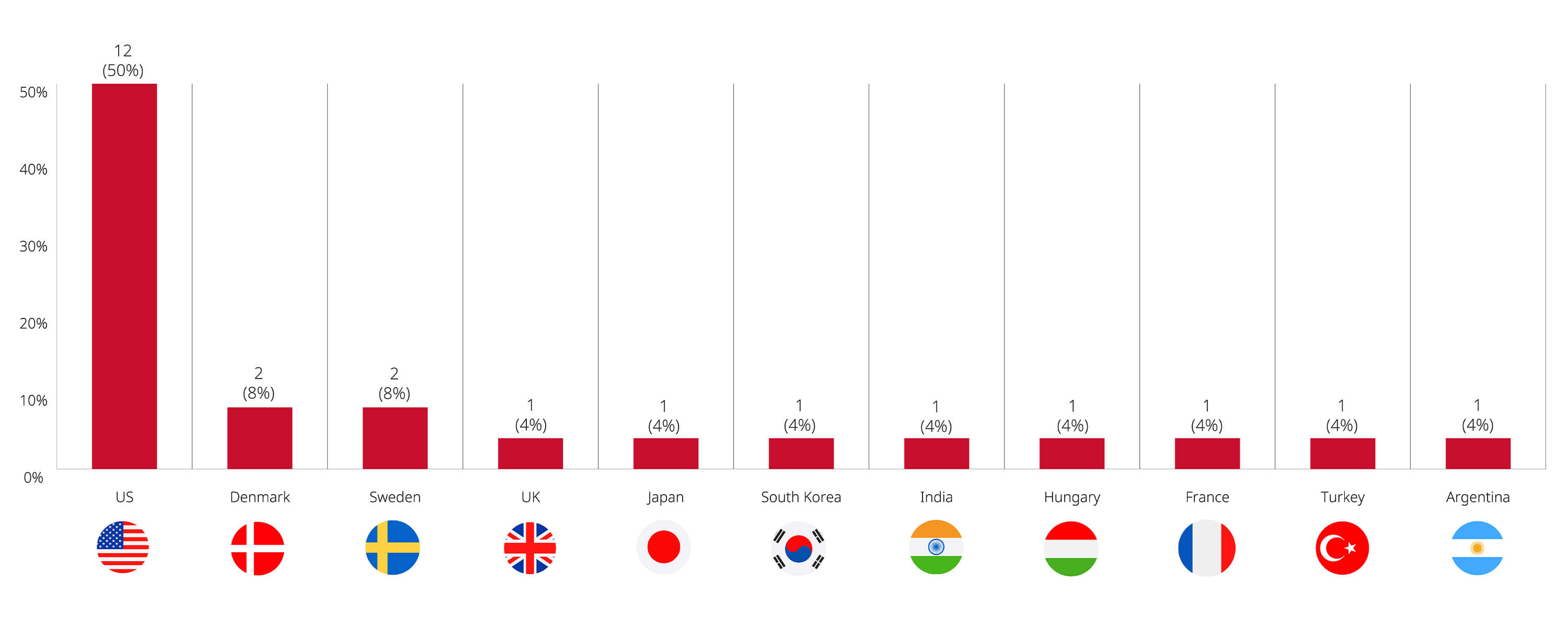

Q1 – Q4 Highlights

- Nine reviewable investment approvals and 15 notifications filed (eight filed for acquisitions, seven for the establishment of a new Canadian business)

- Country of ultimate control: United States (50%); Denmark (8%); Sweden (8%); Japan (4%); United Kingdom (4%); Argentina (4%); Hungary (4%); South Korea (4%); Turkey (4%); India (4%); France (4%)

Investment Canada Act Cultural Investment Filings and Approvals, January – April 2025

Non-Cultural Investments

April 2025 Highlights

- 90 notifications filed (59 filed for an acquisition, 31 for the establishment of a new Canadian business)

- Country of ultimate control: United States (54%); Germany (10%); France (7%); Switzerland (3%); United Kingdom (3%); Australia (2%); China (2%); Denmark (2%); Singapore (2%); Sweden (2%)

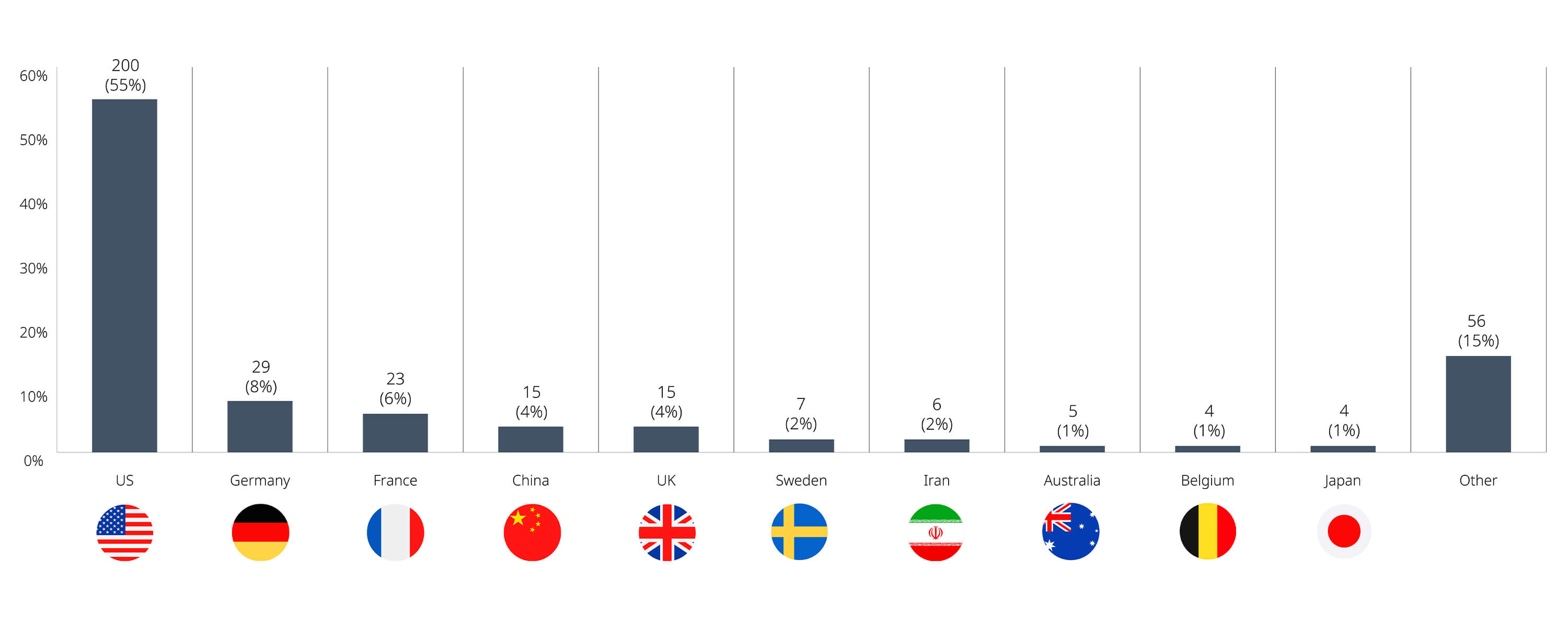

January – April 2025 Highlights

- One reviewable investment approval and 363 notifications filed (272 filed for an acquisition, 91 for the establishment of a new Canadian business)

- Country of ultimate control: United States (55%); Germany (8%); France (6%); China (4%); United Kingdom (4%); Iran (2%); Sweden (2%)

Investment Canada Act Non-Cultural Investment Filings and Approvals, January – April 2025

Non-Enforcement Activity

New Cabinet Appointments Announced

- On May 13, 2025, Prime Minister Mark Carney introduced the new federal cabinet, including new ministers responsible for enforcing the Investment Canada Act (ICA). The new cabinet includes Mélanie Joly as Minister of Industry, replacing Anita Anand as the primary minister responsible for enforcing the ICA. In addition, as an independent agency within Innovation, Science and Economic Development Canada, the Bureau also falls under the ultimate jurisdiction of Minister Joly. Steven Guilbeault will stay on as Minister of Canadian Identity and Culture, a role he has held since the last cabinet shuffle in March 2025. Minister Guilbeault is responsible for assessing investments in “cultural businesses” that fall under the ICA’s jurisdiction. Finally, Gary Anandasangaree has been appointed as the new Minister of Public Safety. Minister Anandasangaree will be involved in national security reviews alongside Minister Joly.

Blakes Notes

- Blakes Partner and Co-Chair of the Competition, Antitrust & Foreign Investment group Julie Soloway and Blakes Partner Cassie Brown were recognized in Global Competition Review’s Women in Antitrust 2025, which spotlights top competition professionals worldwide.

- On June 4, 2025, Blakes Partner Julia Potter and several partners from the Commercial Real Estate group hosted a webinar titled “Five Critical Things Not to Be Overlooked in Real Estate Purchase Agreements.”

- On June 19, 2025, Blakes Partners Cassie Brown, Jeff Bakker, Olga Kary, and Blakes Associate Robel Sahlu are hosting a seminar about the Act's new greenwashing provisions at our Calgary office.

- Blakes Partner and Co-Chair of the Competition, Antitrust & Foreign Investment group Julie Soloway recently moderated a webinar hosted by Wolters Kluwer titled “Global Trends in Merger Control.” Learn more about the webinar, including how to access the recording.

- The CBA Competition Law and Foreign Investment Review Section’s Young Lawyers Committee hosted its annual Half-Day Symposium at our Ottawa office on May 23, 2025.

- Browse our thought-leadership insights from the Competition, Antitrust & Foreign Investment group to learn more.

Contact Us

If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Related Insights

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2026 Blake, Cassels & Graydon LLP