The Canadian public mergers & acquisitions (M&A) market saw a relative rarity in the first quarter of 2025 — an alleged “superior proposal” made by an alternative bidder during the interim period of an already announced negotiated transaction. While “superior proposals” remain rare in Canada, such proposals tend to receive significant publicity and can quickly turn contentious among the various parties involved.

The following highlights certain key considerations for bidders and target boards in considering “superior proposals.”

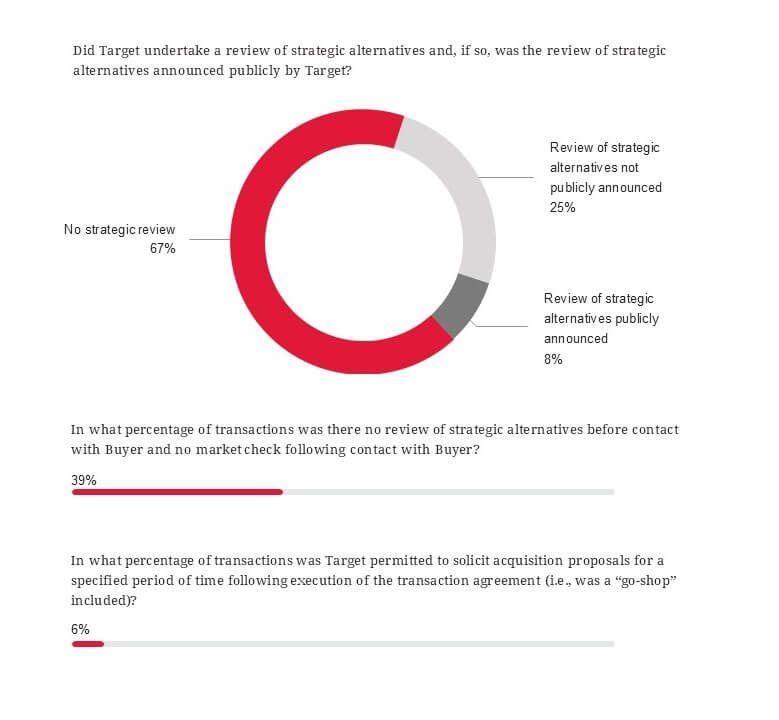

Strategic Reviews, Market Checks and Deal Protections

Canadian law provides target boards with broad discretion and flexibility in designing an appropriate sale process and in the negotiation of “deal protections” and other key provisions of the definitive agreement governing a supported transaction.

Generally speaking, there is no requirement for a target board to undertake a public review of strategic alternatives, perform a market check and/or include a “go-shop” provision permitting the solicitation of acquisition proposals for a specified period of time following execution of the original transaction agreement. The following shows the prevalence of each of these features in the surveyed deals from the most recent Blakes Public M&A Deal Study (please email us to receive a copy).

Figure From Blakes Public M&A Deal Study

In supported Canadian public M&A transactions, it is customary to include non-solicitation (or “no-shop”) provisions, which limit a target’s ability to solicit and respond to alternative transaction proposals. To balance these negotiated deal protections, Canadian target boards often insist on “fiduciary out” provisions, which provide a target board with the ability to consider, respond to and potentially enter into agreements in respect of unsolicited “superior proposals.”

These provisions are heavily negotiated, with detailed specifics on what a target board can and cannot do in the face of an alternative transaction proposal. For example, transaction agreements in Canada commonly contain strict requirements on what agreements the target is permitted to enter into with an alternative bidder (e.g., a substantially similar confidentiality agreement as was entered into with the original bidder) and the target is typically required to provide information regarding any proposal received (often including copies of any alternative definitive agreement) to the original bidder, with the original bidder being provided a corresponding match right for any “superior proposal” received. The target should carefully consider the fiduciary out provisions, including the key definition of a “superior proposal,” before signing a definitive agreement to ensure such provisions reflect the then current market practices and provide sufficient flexibility to the target board to respond to an acquisition proposal and evaluate an alternative transaction based on the particular circumstances of the target.

What Constitutes a “Superior Proposal”?

What constitutes a “superior proposal” is a matter of negotiation, but in Canadian public M&A transactions it generally means an unsolicited bona fide acquisition proposal that:

- Is determined by the target board to be more favourable, from a financial point of view, than the existing transaction

- Does not result from the breach of the non-solicitation provisions

- Is for all or substantially all of the shares or assets of the target

- Is not subject to any diligence or financing condition

- Is reasonably capable of being completed without undue delay

The “fiduciary out” provision will generally permit the target to terminate the agreement and enter into an agreement in respect of an alternative transaction if such alternative transaction constitutes a “superior proposal” (assuming that the original purchaser does not exercise any “right to match” and the target typically pays the break-fee). While rare in Canada, certain transactions may contain “force-the-vote” provisions that further limit the ability of the target to agree to a “superior proposal” unless the target shareholders have voted down the original transaction.

Knowing the Contract: Responding to a “Superior Proposal” and Navigating Deal Protection Provisions

Upon receipt of a proposal in respect of a potential alternative transaction, target boards, with the assistance of their legal and financial advisors, should carefully consider the negotiated language of the deal protection provisions of the transaction agreement to ensure the target does not inadvertently run afoul of any of the provisions the target has agreed to. The original bidder, having invested considerable time and resources to get to signing the definitive agreement and in fear of losing the deal (or being forced to match a higher purchase price), should be expected to strictly enforce the negotiated deal protections.

The importance was illustrated in a recent case when an original bidder brought a suit against a target company to enforce the negotiated deal protections on the basis that, among other things, the target had breached the non-solicitation covenants in the transaction agreement. The original bidder argued that such breach resulted by virtue of the target entering into both a confidentiality agreement and a separate “clean team” agreement (which is typically used in light of competition regulations concerns) with the new bidder.

While the transaction agreement contained the customary provision allowing the target to enter into a confidentiality agreement with similar terms to the confidentiality agreement entered into with the original bidder, the purchaser asserted breach on the basis that the entering into of the “clean team” agreement was not permitted under the terms of the transaction agreement (even though the target had also entered into a “clean team” agreement with the original bidder on the basis that the entering into of a separate “clean team” agreement was not permitted under the terms of the transaction agreement).

While public M&A is always a dynamic process requiring attention to detail and collaboration, dealing with approaches by another interested party after a definitive agreement has been entered into highlights the importance of a robust review and deliberation process, documenting that process and nimble legal and financial advice.

For more information, please contact the authors or any other member of our Public M&A group.

More insights

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2026 Blake, Cassels & Graydon LLP